USD/CAD Weekly Forecast: US interest rates lose their positive influence

- Commodity prices close the week at a six-year high.

- May US payrolls restrict Fed taper options, drop Treasury yields and the dollar.

- WTI finishes at $69.25 on Friday, a three-year top.

- FXStreet Forecast Poll predicts a rebound for USD/CAD.

The USD/CAD was left out of the US dollar’s first quarter rise, because the resource rich Canadian economy and its dollar rode the rising tide of commodity and oil prices.

That dynamic was reinforced again this week. West Texas Intermediate, the North American crude standard, gained 4%, closing at a nearly three-year high and the Bloomberg Commodity Index jumped back to a six-year top after losing 3.2% in the middle two weeks of May.

FXStreet, Reuters

Movement in the USD/CAD was limited and easily contained within the 1.2030-1.2150 range of the last month. The USD/CAD opened Monday at 1.2078 and concluded Friday at 1.2090. Thursday’s 70 point gain to 1.2102 was on the back of an excellent US service sector Purchasing Managers’ Report for May. The gain was partially reversed on Friday after Nonfarm Payrolls.

That mediocre payroll result derailed the prospect of a change in Federal Reserve policy. The much anticipated taper of its bond purchase program is probably a dead letter until the fourth quarter.

Nationwide American payrolls expanded 559,000 in May, missing the 650,000 forecast. More tellingly for the labor market the revision to April’s 226,000 added a mere 12,000. The Unemployment Rate dropped to 5.8% from 6.1%.

Together the two months averaged just 394,000 new hires. With around eight million workers still unemployed from the lockdowns, the improvement is clearly inadequate for even the most tentative change in Fed policy.

Canada's Net Change in Employment for May was much worse than the US. The economy shed 68,000 jobs, the second negative month in a row. The Unemployment Rate rose to 8.2% from 8.1% and the Participation Rate dropped to 64.6% from 64.9%. First quarter annualized GDP was 5.6% rather than the 6.7% expected, and the fourth quarter of 2020 was revised to 9.3% from 9.6%.

American Treasury rates were lower on the week with most of the decline coming on Friday. The 10-year yield finished at 1.557%, 2.4 basis points from its open Monday at 1.581%, but 6.8 points below the Thursday close at 1.625%.

Rising US Inflation has been promoting market speculation that the Fed will be forced to consider tapering its bond purchases even though the bank has said the increases are a temporary base effect.

When the Biden administration supplemented and extended federal jobless benefits, it probably did not expect that workers would use the income to delay their return to employment, but that appears to be what has happened.

Employers are being forced to offer higher wages to attract workers. If that continues, the resulting wage pressures would be the first and most lasting step in changing inflation expectations. When rising wages are joined with the base effect on CPI, the carry-through from commodity price hikes and product shortages, there is an increasing possibility that the underlying inflation rate will be affected.

A change in inflation expectations is the Fed’s chief concern, but its emphasis on employment and its adoption of inflation-averaging last fall has effectively boxed policymakers in from a response until the labor market has returned to pre-pandemic levels.

That notion that inflation will drive US rates higher is mistaken.

The Consumer Price Index has tripled this year from 1.4% in January to 4.2% in April and is expected to rise to 4.6% when May’s figure is released on Thursday.

US CPI

FXStreet

West Texas Intermediate (WTI) finished at $69.25 for the week, up 3.7% and its highest since October 25, 2018.

USD/CAD outlook

The USD/CAD will continue to benefit from events on both sides of the border.

In Canada the surge in commodity and crude prices will aid its economy, 11% of whose GDP is based in the oil patch.

In the US the fast-receding pandemic is encouraging rapid growth. The Atlanta Fed GDPNow model estimates second quarter activity at a 10.3% annualized pace. Except for the curiosity of the labor market, the US economy appears headed for one of its strongest years on record.

The close ties of the US and Canadian economies ensure that American prosperity is shared with its northern neighbor. Federal Reserve monetary policy effectively supports Canadian business as financing is a fungible process.

Federal Reserve reluctance to begin tapering its bond purchases before a complete job recovery will keep US rates from rising sufficiently to reverse the Canadian dollar’s advantage.

The 15-month fall in the USD/CAD has generated an enormous amount of untapped profit, but a catalyst is needed for a reversal. Until traders can reasonably assume that the Fed is approaching a policy change, that spark will remain absent.

Further gains in commodities, or more likely oil, could send the USD/CAD lower; but for the week ahead, consolidation in the current 1.2030–1.2150 is most apparent.

Canada statistics May 31–June 4

FXStreet

US statistics May 31–June 4

FXStreet

Canada statistics June 7–June 11

The Bank of Canada policy decision and rate statement are the chief interest. No change is expected, but comments on the economy will be noted carefully.

FXStreet

US statistics June 7–June 11

The Consumer Price Index for May is the main attraction. Annual inflation is expected to rise to 4.6%. In January it was 1.4%. Though the Federal Reserve has repeatedly said the gain is a temporary base effect, and its policy is focused on the labor market, any greater increase will tend to support the dollar, however modestly.

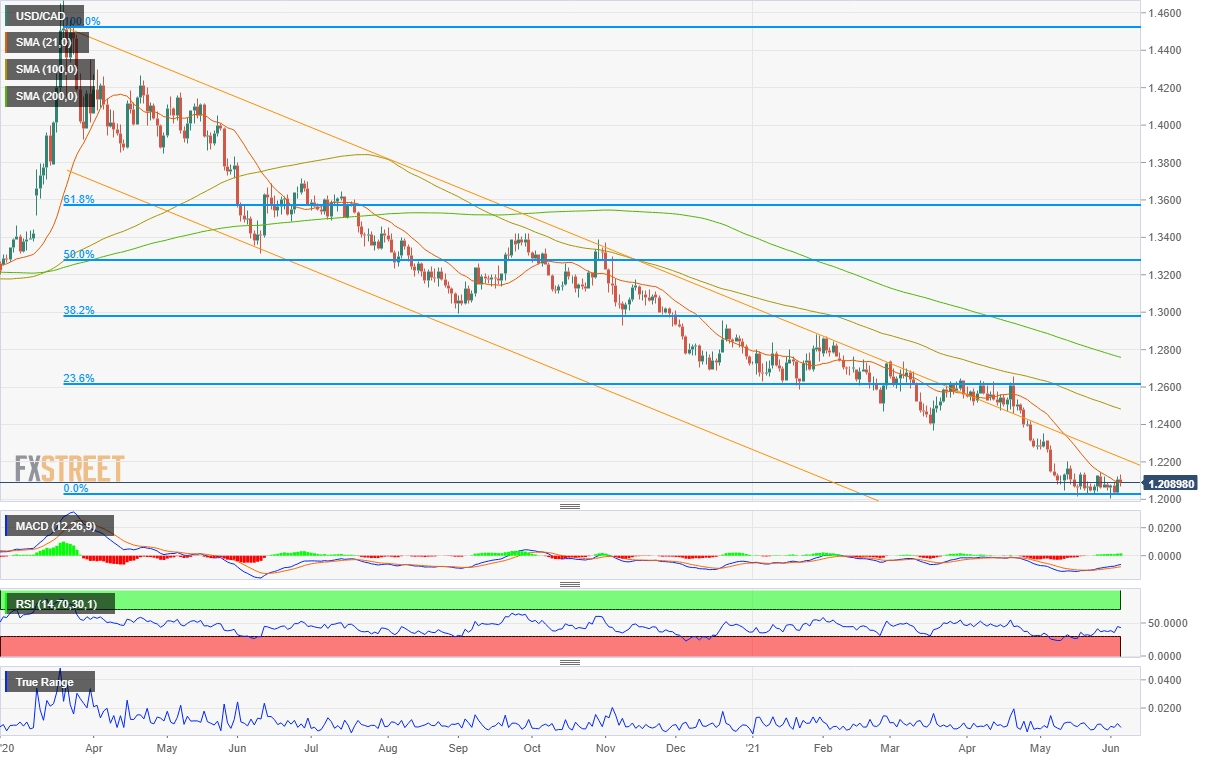

USD/CAD technical outlook

Overall bias in the USD/CAD is lower. Support lines based on price action from May 2015 are earlier and consequently weak. Resistance is recent and well traveled. The 15-month decline in the USD/CAD is probably the greatest inhibition to a casually lower USD/CAD. Any new short-term short positioning would wait for a rebound before entering.

The Relative Strength Index has left its oversold status with the three-week sideways movement in the USD/CAD, but when combined with the momentum based True Range indicator, the bias remains lower. There is simply no rising momentum generated from any price actions of the current range. The MACD suggests a minor buy signal, but more from the stability of the last three weeks than any positive movement. The 21-day moving average (MA) is resistance at 1.2089, while the 100-day MA at 1.2482 and 200-day MA at 1.2759 are too distant for immediate consideration.

Resistance: 1.2125, 1.2160, 1.2265, 1.2315, 1.2400

Support: 1.2040, 1.2000, 1.1960

USD/CAD FXStreet Forecast Poll

By all technical considerations, the USD/CAD is long overdue for a profit rally. The inability to do so has been a hallmark of the long decline. It is doubtful that mindset has changed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.