USD/CAD Weekly Forecast: Slipping and sliding but not away

- Apparent failure of US Congressional talks propels USD/CAD on Thursday.

- Rising global viral diagnoses aid safety trade to USD.

- WTI remains below $42.00 resistance, flat on the week.

- Good September US Retail Sales have small impact.

- FXStreet Forecast Poll predicts a stall in USD/CAD

Seven months into the COVID-19 era markets are still trading the fallout from the near-universal global lockdowns in the spring.

The failure of the US Congress, caught up in a bitter presidential campaign, to enact a second economic stimulus package gave the US dollar its biggest rise in a month against the CAD on Thursday, proving that risk assessment remains the dominant emotion.

In keeping with that theme, a stellar September US Retail Sales on Friday did nothing to assist the Dollar which closed at 1.3189 two-thirds of a figure below the week’s high at 1.3260 on Thursday.

Over the past two weeks, markets have treated the three-way negotiations between the House Democrats, the Senate Republicans and the Trump White House as a safety-trade event.

When news reports or comments from participants were positive and a deal seemed possible, the dollar sold off with the logic that stimulus would improve the US economy, mitigating overall risk. When negotiations stalled or the sides were said to be far apart or when President Donald Trump temporarily withdrew from the talks, the US dollar gained ground as traders sought the supposed safety of US assets.

On Thursday the anticipated compromise between the House Democrats' $2.2 trillion package and the White House's $1.8 trillion offer was shot down in the upper chamber.

When Senate Republican Majority Leader Mitch McConnell was asked about the possibility for an agreement after President Trump said he was willing to increase his limit he said, “I don’t think so," "That’s where the administration's willing to go. My members think what we laid out, a half a trillion dollars, highly targeted, is the best way to go."

The sides are still in contact but Democratic House Speaker Nancy Pelosi has told her caucus there are still many differences. Treasury Secretary Stephen Mnuchin is heading to the Middle East in a few days and with less than three weeks before the election, and no new meeting scheduled, the possibility for a deal diminishes daily.

Rising numbers of COVID-19 cases and smaller increases in hospitalizations in Europe over the past two weeks, now higher than the US, gave the dollar a stable footing this week.

Technically, the USD/CAD remains in the wide descending channel that stems from the March market panic. A narrower interpretation of that same channel which was breached on September 21 has not produced a rising trend. The finish on Friday at 1.3189 is barely more than 10 points below the 1.3205 open on the 21st.

West Texas Intermediate (WTI), the North American crude oil pricing standard, opened the week at $40.78 and ended at $41.03. Resistance at $42.00 and $43.50 remain solid barriers to advancement.

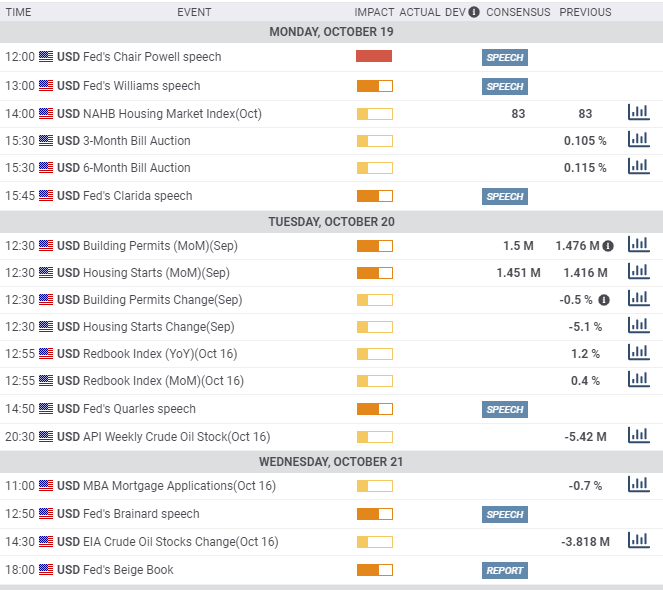

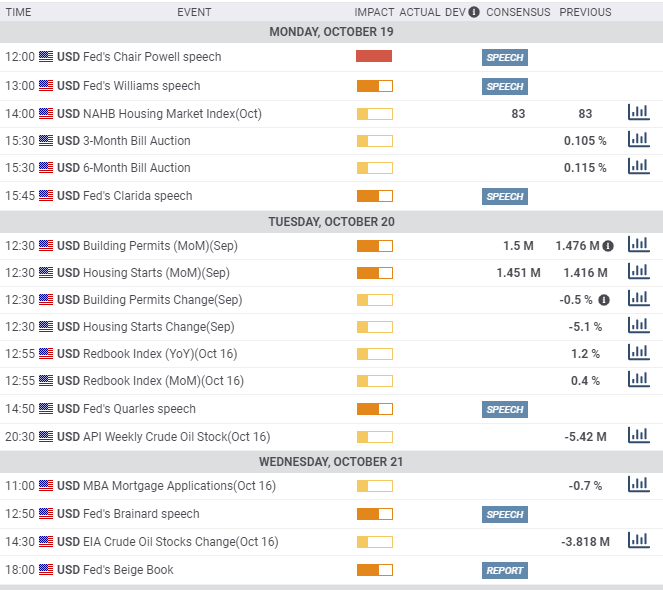

Canadian and US statistics October 12-October 16

Canadian statistics were of no importance this week.

Private payrolls from Automatic Data Processing (ADP) for September at -240,800 were far from the official Net Change in Employment gain of 378,200. The August results were equally disparate with ADP registering -770,600 and the official figures adding 245,800. As has been true in the US, the ADP numbers have become a very unreliable guide to government employment numbers since the lockdowns.

Manufacturing sales for August fell 2% following July’s 7.2% increase. A drop of 1.4% had been predicted.

American data provided little market direction despite the Retail Sales beat on Friday.

Inflation for September came in as expected with the Consumer Price Index registering 1.4% on the year and the core rate reading 1.7%. Initial Jobless Claims rose unexpectedly to 898,000 in the week of October 9, ahead of the 825,000 forecast and the prior week's 845,000. Continuing Claims were lower than predicted in the October 2 week at 10.018 million, on a 10.7 million projection and 11.183 million prior.

Friday's Retail Sales figures supplied the only surprise and were much stronger than forecasts in all three categories. Overall sales rose 1.9% nearly triple the 0.7% forecast and exactly so the 0.6% August gain. The GDP component Control Group jumped 1.4% far more than the 0.2% consensus forecast and the revised -0.3% August result. Finally, Sales ex-Autos climbed 1.5%, thrice the 0.5% prediction and the identical August score.

As might be expected from such buoyant retail numbers, US consumers were happier than anticipated in October. The preliminary reading from the Michigan Survey reached 81.2 from 80.4 in September. The forecast from the Reuters Survey was 80.5.

USD/CAD outlook

The September 21 break was stymied when six straight sessions from September 23 to September 30 were unable to penetrate 1.3400. The shift down on the 30th and the low on that day of 1.3318 provided the next barrier. When five sessions were unable to close above 1.3318, the market again ratcheted down to 1.3250 which has held as resistance since.

The upper border of the original channel is around 1.3000 and will not attract trading. Support lines at 1.3150 and then 1.3050 are substantial with resistance at 1.3250 and 1.3315. The drift lower is the product of two forces. First, the long-running retreat of the US dollar in the wake of the March panic has not been replaced by a new scenario. Given the lack of competing ideas, the decline continues. Second, the main support of the dollar, aside from the occasional technical intervention, is still the risk-off trade.

Until the markets reassume some degree of economic comparison, the USD/CAD is likely to continue sliding.

Canada and US statistics October 19-October 23

Canada's Consumer Price Index (YoY) for September forecast at 0.7% after August's 0.8% for the core rate and 0.4% following 0.1% for the headline rate will not affect markets. August's monthly GDP is out on Friday, July gained 3%.

The main even in the US is the second and final Presidential debate on Friday at 9:00 pm EST. Markets disregarded the first debate between President Donald Trump and former Vice-President Joe Biden while it was occurring and the various post-mortem analyses had no greater impact. The policy arguments, charges, countercharges and rhetoric in this meeting will be ignored as well. The one possibility for market effect is a breakdown by either candidate, a noticeable mental lapse by Biden or an aggressive tirade from Trump. The odds for either are low.

Housing Starts and Building Permits on Tuesday and Existing Home Sales on Thursday, all for September, track the booming US home market. Starts are forecast to be 1.451 million annualized following August's 1.416 million and permits are expected to be 1.5 million, after 1.476 million prior. Existing Home Sales are predicted to climb to 6.16 million annualized from 6 million in August. All three figures would be among the highest numbers since the housing bubble of over a decade ago.

Federal Reserve Chairman Jerome Powell will speak at the International Monetary Fund meeting on Monday. The bank issues its Beige Book of economic anecdotes for the November 4-5 FOMC meeting on Wednesday. With the Fed on self-declared hold until the end of 2023, neither will overly concern traders.

Friday brings the Markit preliminary PMIs for October. Little change is expected, 53.3 from 53.2 in manufacturing and 54.5 from 54.6 in services

USD/CAD technical outlook

USD/CAD technical outlook

The Relative Strength Index at 45.75 is a weak negative indicator. The moving averages are all above the current level but only the 21-day at 1.3265, backing up resistance at 1.3250, is appositive. The 100-day at 1.3355 is mid-way between resistance at 1.3400 and 1.3500. The 200-day at 1.3540 is out of the current picture.

The inner and outer descending channels remain the prime formation for trading, though the strength of the trend is more discrete slippage than conviction. The USD/CAD will likely continue lower for lack of any competing idea not because of the compelling logic for a stronger Canadian Dollar.

Resistance: 1.3250; 1.3318; 1.3400; 1.3500

Support: 1.3150; 1.3050; 1.3100; 1.2960

USD/CAD Forecast Poll

The one-week and one-month outlooks in the FXStreet Forecast Poll state that support at 1.3150 will hold in the near and medium term while the forecasts stop at the 1.3250 resistance. This precisely describes the USD/CAD condition. The logic of decline is played-out, but between the lingering pandemic and the inability of the markets to credit the recovery yet, the pair drifts lower.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.