USD/CAD Price Forecast: Traders seem non-committed, look to Fed speaks for fresh impetus

- USD/CAD consolidates its recent losses to a one-week low touched earlier this Wednesday.

- Hotter Canadian CPI tempers expectations for a bigger BoC rate cut and underpins the CAD.

- Rebounding US bond yields revive the USD demand and offer support to the USD/CAD pair.

The USD/CAD pair struggles to gain any meaningful traction and trades just above mid-1.3900s, or a one-week low during the early European session on Wednesday amid mixed fundamental cues. Statistics Canada reported on Tuesday that the headline Consumer Price Index increased by 0.4% after two consecutive monthly declines and the annual inflation rate rose for the first time since May, to 2.0% in October. Adding to this, the Bank of Canada's (BOC) preferred measures of core inflation, CPI-median climbed to 2.5% from 2.3% in September, while CPI-trim edged higher to 2.6% from 2.4%. The data forced investors to scale back their bets for a bigger interest rate cut by the BoC in December. This, along with an uptick in Crude Oil prices, underpins the commodity-linked Loonie and acts as a headwind for the currency pair.

An escalation in the Russia-Ukraine conflict continues to fuel concerns about supply disruptions and assists Crude Oil prices to preserve this week's recovery gains from over a two-month low touched on Monday. That said, signs of a build in US stockpiles cap any meaningful upside for the black liquid. The American Petroleum Institute (API) reported that US inventories grew much more than expected, by 4.75 million barrels in the week to November 15, pointing to increased supply in the world’s biggest oil producer. Traders now look to the official inventory data, which will be published by the Energy Information Administration (EIA) later during the North American session this Wednesday. In the meantime, the emergence of some US Dollar (USD) dip-buying might continue to offer some support to the USD/CAD pair.

Following the overnight sharp decline in reaction to Russian President Vladimir Putin's approval to change the country's nuclear doctrine, the US Treasury bond yields rebounded swiftly amid expectations for a less dovish Federal Reserve (Fed). In fact, market participants now seem convinced that US President-elect Donald Trump's expansionary policies will boost inflation and limit the scope for the Fed to cut interest rates. This, in turn, triggers a fresh leg up in the US bond yields and revives the USD demand and helps limit the downside for the USD/CAD pair. Traders also seem reluctant and might opt to wait for speeches from influential FOMC members before placing directional bets. This, in turn, warrants caution before positioning for an extension of the pair's pullback from the highest level since May 2020 tested earlier this week.

Technical Outlook

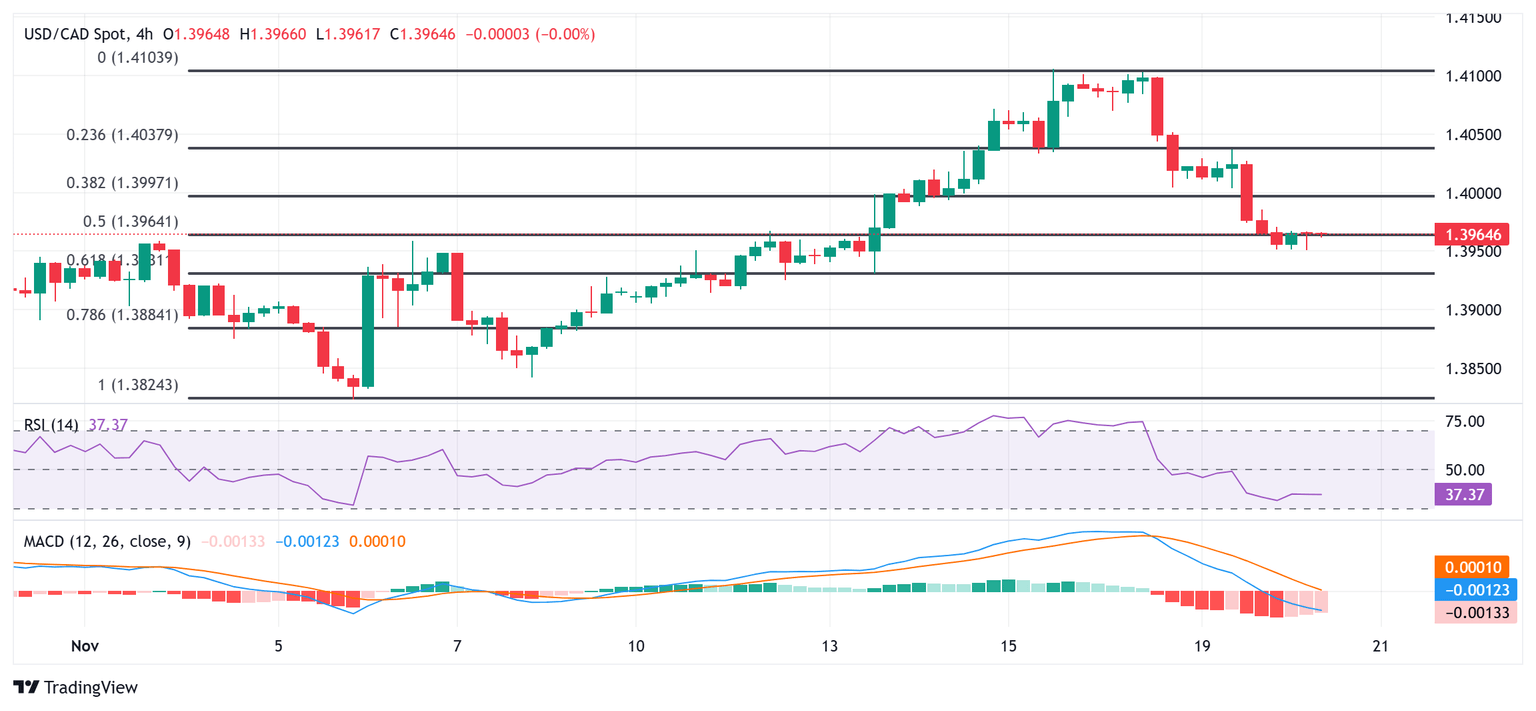

From a technical perspective, the USD/CAD pair is showing some resilience below the 50% retracement level of the recent rally from the monthly low. Moreover, oscillators on the daily chart – though they have been losing traction – are holding comfortably in positive territory. Hence, it will be prudent to wait for some follow-through selling below mid-1.3900s before positioning for deeper losses. Spot prices might then weaken further below the 61.8% Fibonacci level, around the 1.3920 area, and test the 1.3900 mark.

A convincing break below the latter could be seen as a fresh trigger for bearish traders and accelerate the fall towards the 1.3860-1.3855 intermediate support en route to the monthly low, around the 1.3820-1.3815 region. This is closely followed by the 1.3800 round figure, which if broken decisively will suggest a nearly two-month-old uptrend has run out of steam.

On the flip side, the 1.4000 psychological mark now seems to act as an immediate strong barrier ahead of the overnight swing high, around the 1.4035 region. A sustained strength beyond the latter should allow the USD/CAD pair to make a fresh attempt to conquer the 1.4100 round figure. The upward trajectory could extend further towards the 1.4170 area en route to the 1.4200 mark, mid-1.4200s, the 1.4300 round figure and the 1.4340 supply zone.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.