USD/CAD Price Forecast: Extends the range play ahead of the pivotal Fed decision

- USD/CAD ticks lower in a familiar trading range held over the past week or so.

- Bets for a 50 bps Fed rate cut keep the USD bulls on the defensive and cap gains.

- The downside remains limited amid dovish BoC expectations, ahead of the Fed.

The USD/CAD pair attracts some sellers following the previous day's failure to find acceptance above the 1.3600 mark, albeit it lacks follow-through and remains confined in a one-week-old range through the early European session on Wednesday. Traders opt to move on the sidelines and wait for the outcome of the pivotal two-day Federal Open Market Committee (FOMC) meeting before positioning for a firm near-term direction. In the meantime, expectations for a more aggressive policy easing by the Federal Reserve (Fed) cap the overnight US Dollar (USD) recovery from its lowest level since July 2023 and act as a headwind for the currency pair.

According to CME Group's FedWatch Tool, the markets are currently pricing in over a 6% chance that the US central bank will lower borrowing costs by a 50-basis point later today. The bets were lifted by the release of the US Consumer Price Index (CPI) and the Producer Price Index (PPI), which indicated that inflation was subsiding. This overshadows Tuesday's upbeat US Retail Sales data, which eased concerns about a broader economic slowdown and prompted some USD short-covering move. In fact, the US Census Bureau reported that Retail Sales rose 0.1% in August against a 0.2% fall expected, while sales excluding Autos missed estimates and expanded by 0.1%.

The yield on the benchmark 10-year US government bond bounced from a 16-month low after the data, though the immediate market reaction turned out to be short-lived amid dovish Fed expectations. The downside for the USD/CAD pair, however, seems limited in the wake of hopes for a larger, 50 bps interest rate cut by the Bank of Canada (BoC) next month, bolstered signs of cooling inflation. In fact, Canada's CPI posted its smallest rate of increase since February 2021 and the core measures also fell to the lowest level in 40 months. This, along with a modest downtick in Crude Oil prices, undermines the commodity-linked Loonie and lends support to the currency pair.

Technical Outlook

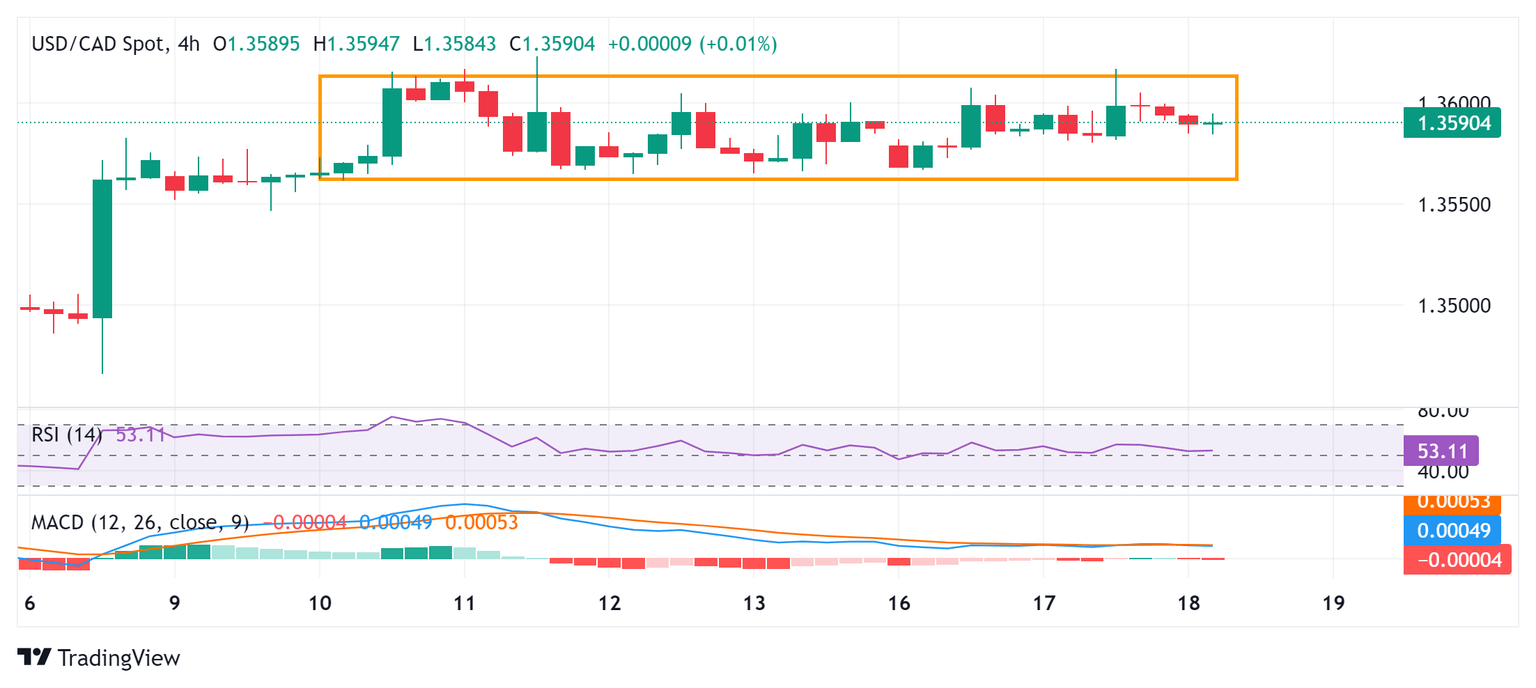

From a technical perspective, the recent range-bound price action around the very important 200-day Simple Moving Average (SMA) constitutes the formation of a rectangle and marks a consolidation phase. Furthermore, neutral oscillators on the daily chart make it prudent to wait for a sustained move in either direction before positioning for a firm near-term trajectory.

Meanwhile, movement beyond the 1.3600 mark is more likely to confront some resistance near the monthly peak, around the 1.3620-1.3625 region touched last week. Some follow-through buying will set the stage for an extension of the recent recovery from the multi-month low touched in August and allow the USD/CAD pair to reclaim the 1.3700 round figure, with some intermediate hurdle near the 1.3665-1.3670 area.

On the flip side, the 1.3565 zone, or the lower boundary of the trading range, might continue to act as an immediate support. A convincing breakthrough could drag the USD/CAD pair to the 1.3500 psychological mark, below which the downfall could extend towards the 1.3440 area or the multi-month low. Spot prices could eventually drop to the 1.3400 mark en route to the February swing low, around the 1.3365 region.

USD/CAD 4-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.