USD/CAD Price Forecast: Bulls have the upper hand; focus remains on US/Canadian jobs data

- USD/CAD attracts buyers for the fourth straight day amid a bullish US Dollar.

- The divergent Fed-BoC expectations further contribute to the positive move.

- Rising Crude Oil prices fail to benefit the Loonie and hinder the momentum.

- Traders look to the release of monthly jobs reports from the US and Canada.

The USD/CAD pair prolongs its uptrend for the fourth successive day on Friday and has now reverses a major part of its weekly losses amid sustained US Dollar (USD) buying. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, climbs back closer to a two-year peak touched last week on the back of the Federal Reserve's (Fed) hawkish outlook. Moreover, the Minutes of the December FOMC meeting, showed that policymakers viewed labor market conditions as gradually easing and were in favor of slowing the pace of rate cuts amid stalling disinflation. Furthermore, US President-elect Donald Trump's expansionary policies are expected to boost inflation, which in turn, keeps the US Treasury bond yields elevated and acts as a tailwind for the buck.

Apart from this, persistent geopolitical tensions stemming from the protracted Russia-Ukraine war and tensions in the Middle East, along with trade war fears, continue to support the safe-haven Greenback. Meanwhile, Trump's tariff threats cloud the economic outlook and offset the optimism around a likely change in government in Canada. Moreover, the markets are currently pricing in a greater chance of another 25-basis-point rate cut by the Bank of Canada (BoC) in January, which is seen undermining the Canadian Dollar (CAD) and lending additional support to the USD/CAD pair. Traders seem rather unaffected by bullish Crude Oil prices, which tend to underpin the commodity-linked Loonie, suggesting that the path of least resistance for spot prices remains to the upside.

Investors, however, might refrain from placing aggressive directional bets and opt to wait for the release of the crucial monthly employment details from the US and Canada, due later during the early North American session. The popularly known US Nonfarm Payrolls (NFP) report is expected to show that the world's largest economy added 160K jobs in December and the Unemployment Rate held steady at 4.2%. Meanwhile, the number of employed people in Canada is forecast to have risen by 25K during December and the Unemployment Rate is seen edging higher to 6.9% from 6.8% in November. A big divergence from the anticipated numbers is more likely to infuse volatility around the USD/CAD pair and produce short-term trading opportunities on the last day of the week.

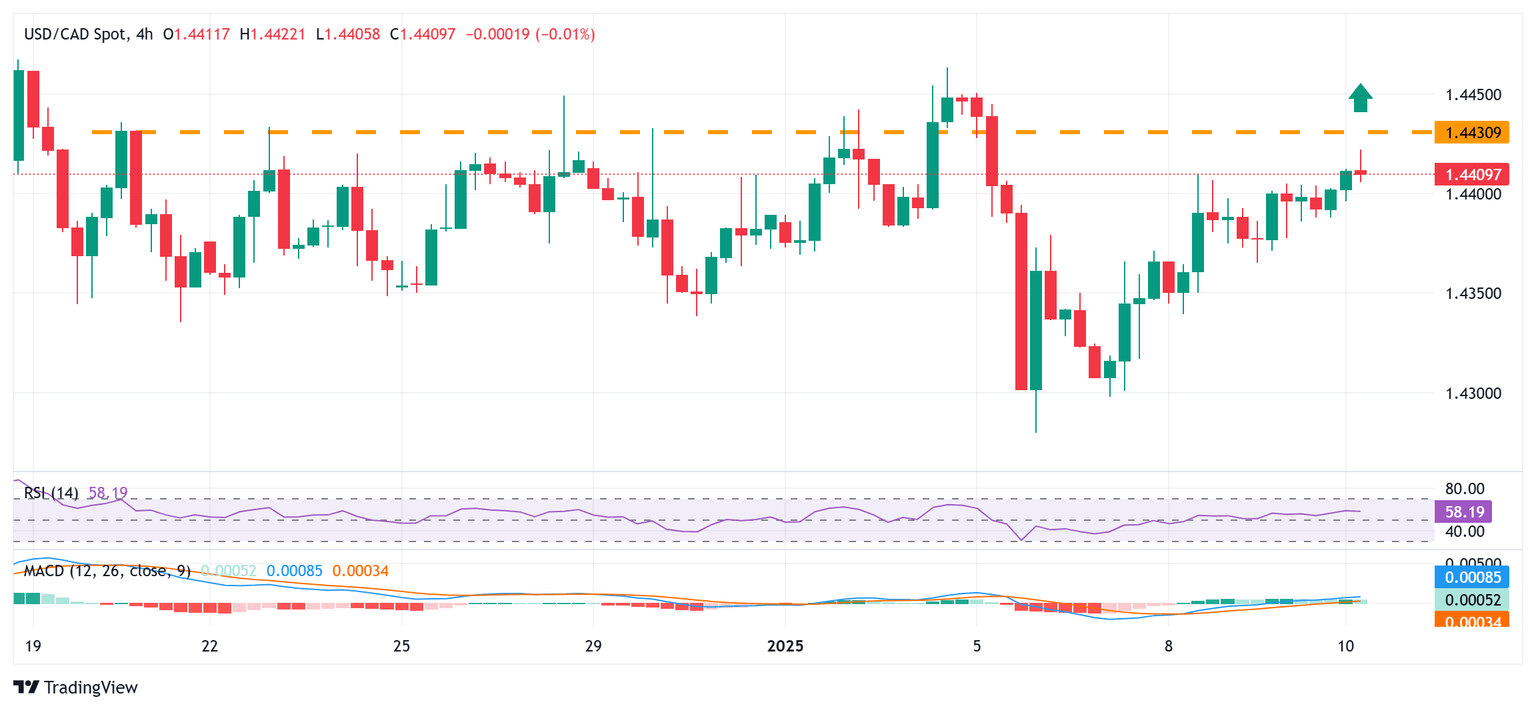

USD/CAD 4-hour chart

Technical Outlook

Any subsequent move up is likely to confront some resistance near the 1.4430-1.4435 supply zone, above which the USD/CAD pair could aim to retest the multi-year peak, around the 1.4465 region touched in December. Given that oscillators on the daily chart are holding comfortably in positive territory and are still away from being in the overbought zone, some follow-through buying will set the stage for a move towards the 1.4500 psychological mark.

On the flip side, any corrective pullback might now attract some dip-buying near the 1.4350-1.4345 region. This should help limit the downside near the 1.4300 mark, which is closely followed by the weekly swing low, around the 1.4280-1.4275 region. Some follow-through selling might shift the bias in favor of bearish traders and make the USD/CAD pair vulnerable to accelerate the slide towards the 1.4200 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.