USD/CAD Price Annual Forecast: Battered Loonie unlikely to be saved by Fed rate cuts in 2025

- The Canadian Dollar had a rough run in 2024, falling to nearly five-year lows.

- A rapid pace of rate cuts from the Bank of Canada has widened the CAD’s rate divergence with the USD.

- As the Fed ponders slower moves on interest rates, the Loonie’s rate differential could widen further in 2025.

The Canadian Dollar (CAD) spent most of 2024 on the ropes, battling into a familiar midrange before giving up in the last quarter and backsliding into multi-year lows against the US Dollar (USD). Rumors of a broad-market downturn in the USD were wildly overblown, with the Greenback’s Q4 stellar performance further battering the Loonie.

Canadian Dollar in 2024: Bank of Canada aggressive easing weighs

USD/CAD rose into the 1.4400 handle at the tail end of the year, wrapping up 2024’s chart action around 9% higher than it started near 1.3230. The Bank of Canada (BoC) and the Federal Reserve (Fed) both kicked off a rate-cutting cycle in 2024, but the BoC’s faster and more furious pace of rate trims sent the Loonie tumbling as USD/CAD’s rate differential widened through the second half of the year.

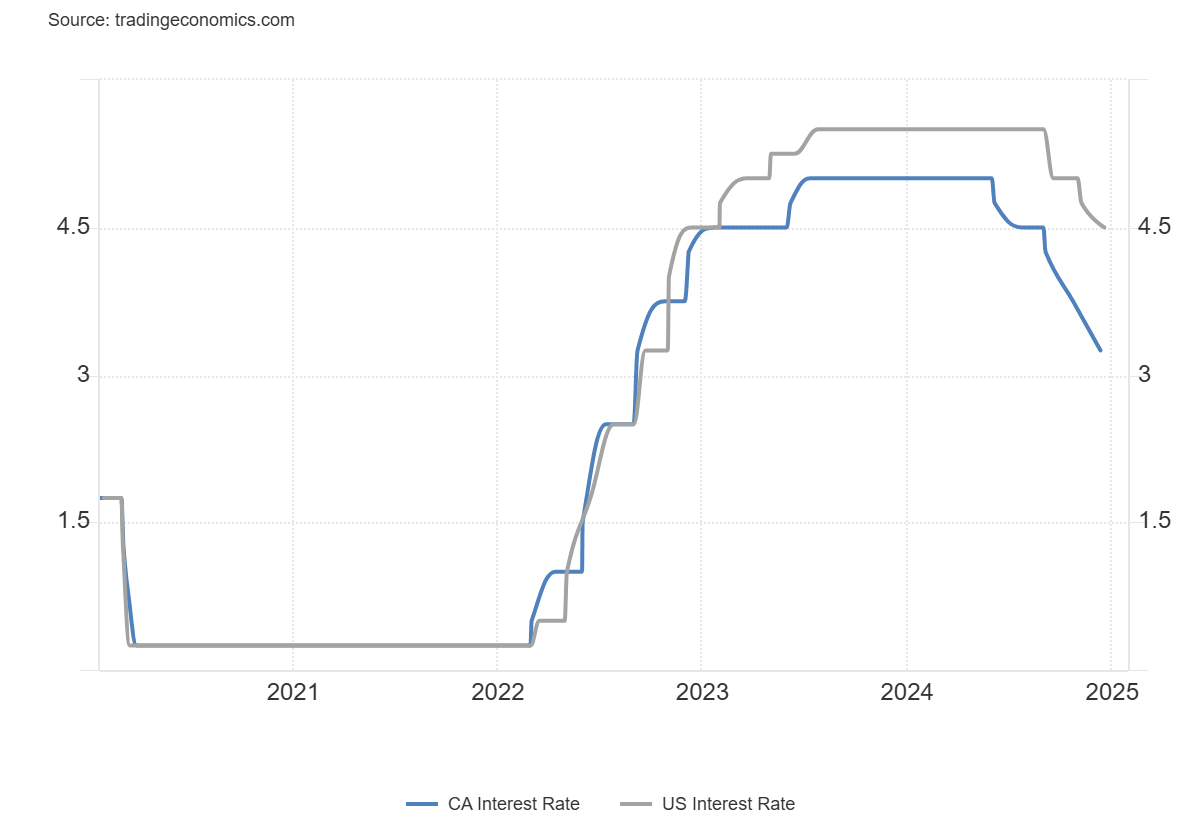

Evolution of interest rates in the US and Canada. Source: Trading Economics

The BoC’s main reference rate peaked at 5.0% in July 2023, and it took the better part of a year for the BoC to finally blink and start delivering rate cuts, opening with a 25 bps rate cut in June. The BoC followed up with four more cuts through the second half of the year, with the last two cuts accelerating to 50 bps each.

Canada’s interest rate now stands at 3.25%, still well above 2022’s rock bottom 0.25% but still far enough below the US’ fed funds rate, which only declined from 5.5% to 4.5% over the same period. The Fed held off on rate cuts much longer than the BoC, with the US central bank not delivering 2024’s first Fed rate cut until September.

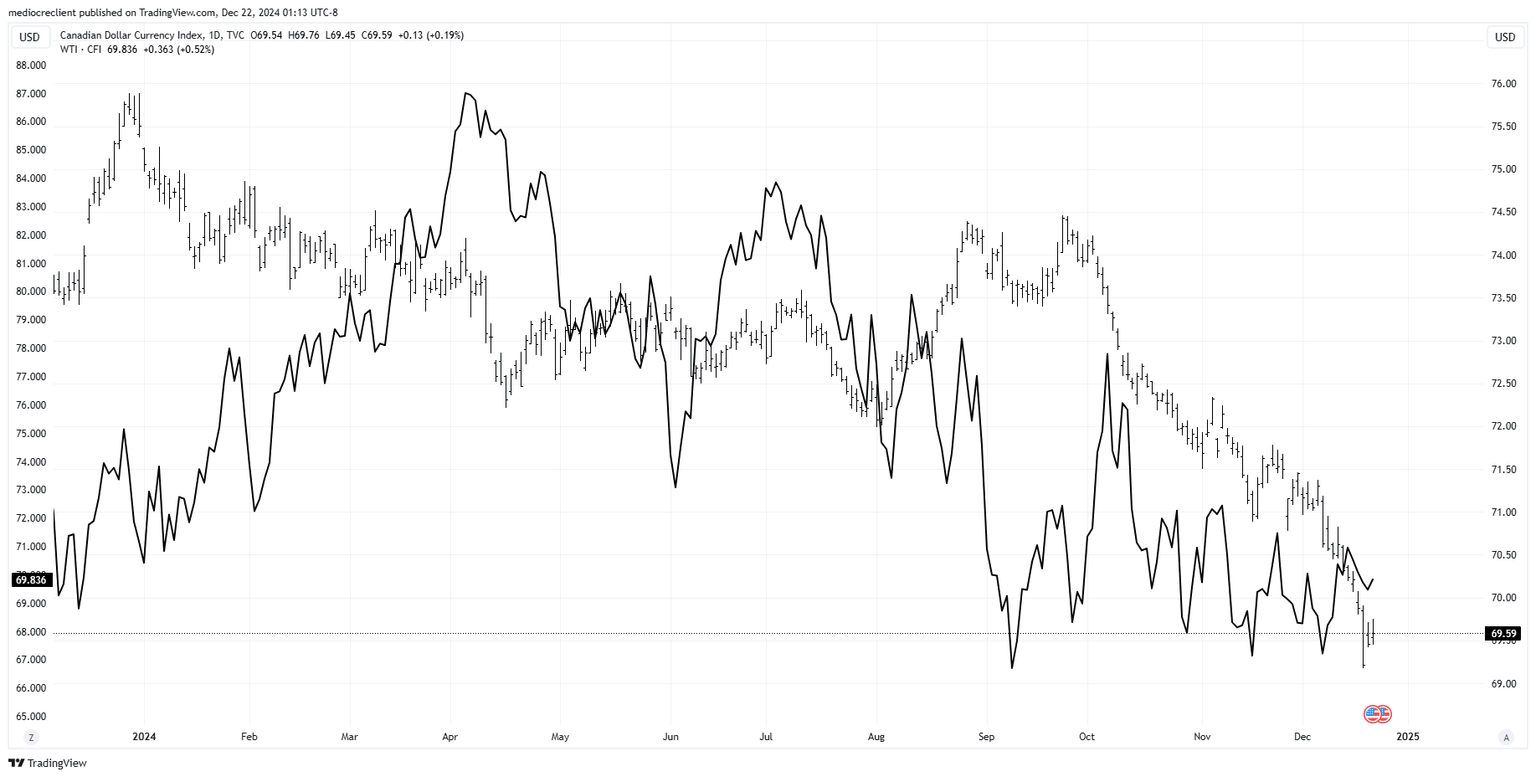

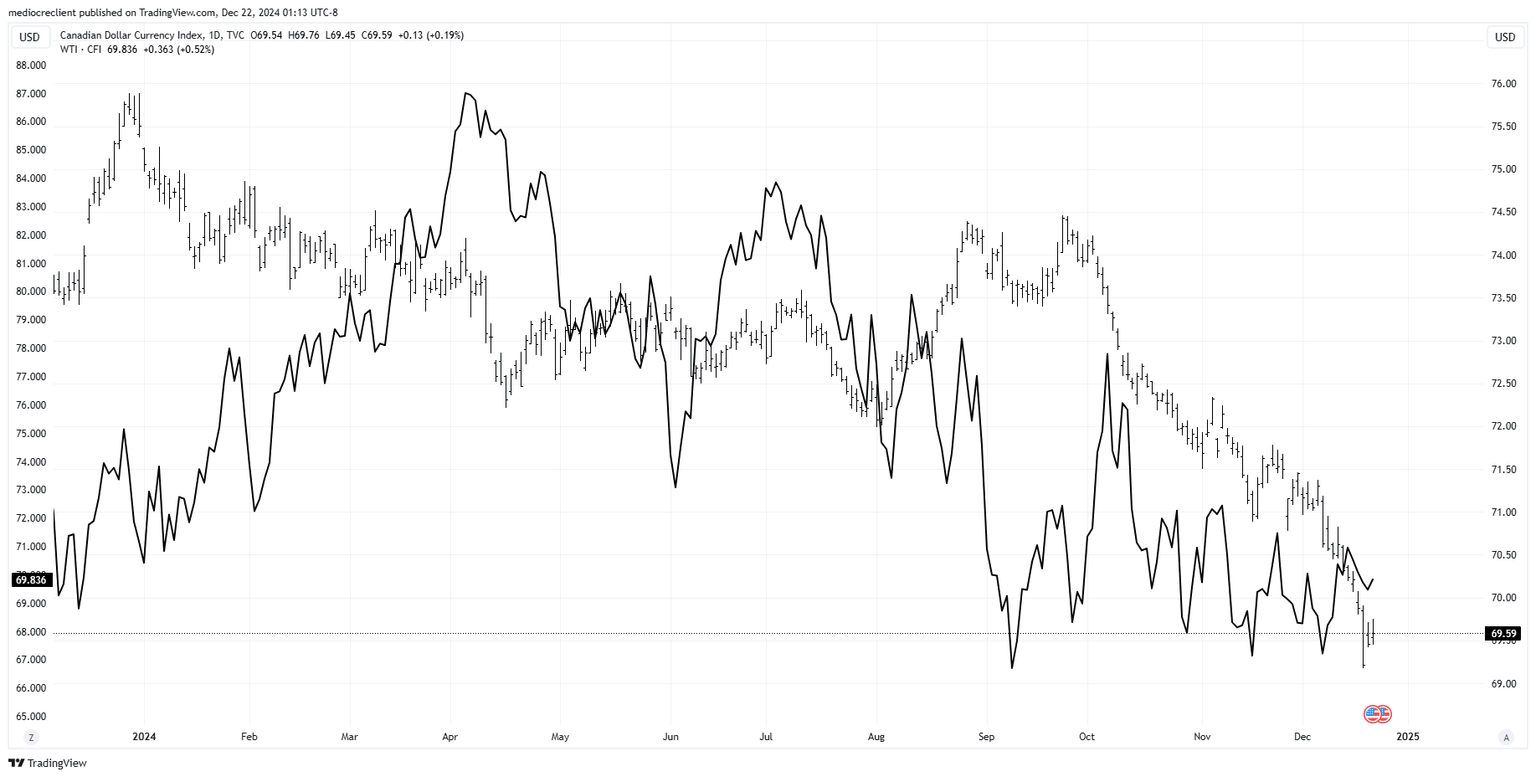

Global Crude Oil markets also provided little support for the Canadian Dollar in 2024. Despite kicking the year off with one-sided bullish momentum in the first quarter, Crude Oil prices were steady amid subdued global fossil fuel demand forecasts and as a constant stream of geopolitical concerns sprouting from multiple Middle East conflicts failed to materialize into any actual supply constraints. The Canadian Dollar’s correlation with Crude Oil prices has historically been a wobbly inference. However, a steady decline in barrel prices through the midpoint of 2024 crimped bullish potential in the Loonie.

Canadian Dollar Index (CXY), WTI Spot Price

Canadian Dollar in 2025: Where do we go from here?

Technicals drove the fundamentals in the USD/CAD price chart. Although the overall chart is poised nicely for a technical turnaround that should be an appealing play for momentum traders, significant headwinds lie ahead for the Loonie.

Canadian Prime Minister Justin Trudeau is having difficulty keeping his government on an even keel, culminating in Canadian Finance Minister and Deputy Prime Minister Chrystia Freeland publicly resigning from her federal post the same morning she was supposed to unveil the Canadian government’s most recent economic forecast.

Political turmoil at both home and abroad will threaten the Canadian Dollar heading into 2025. Incoming US President-elect Donald Trump has invested significant time on social media, threatening widespread tariffs on all of the US’ closest trading partners, including Canada.

Canada itself is likely headed for a federal election in 2025. While frontrunner Conservative Party opposition candidate Pierre Poilievre is unlikely to produce or create legislation that will be particularly supportive of the Loonie, risk-off conditions could remain elevated on the CAD’s outlook in the run-up to an election.

The BoC is likewise set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which will apply pressure on CAD’s already-rising rate differential. The BoC is under significant pressure to continue lowering interest rates, especially with such a large proportion of the Canadian economy meaningfully absorbed in the country’s top-heavy real estate industry and housing investors clamoring for funding relief.

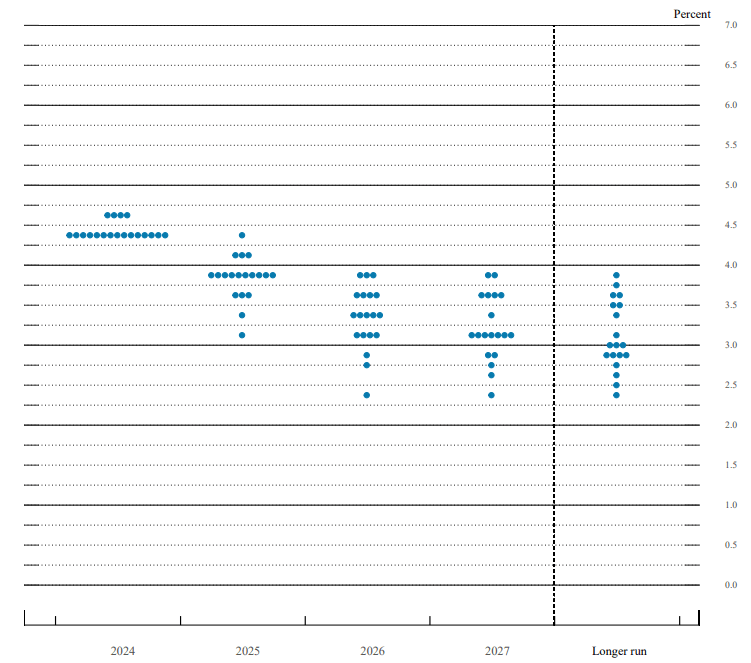

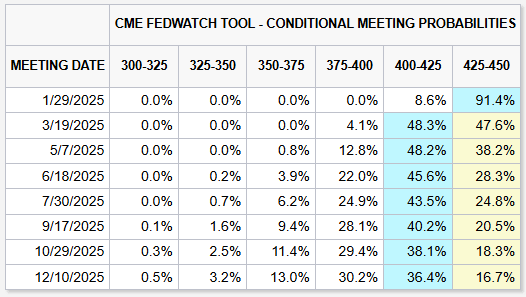

The Fed expects to deliver only two additional rate cuts in 2025, according to its Summary of Economic Projections (SEP) or dot plot of interest rate expectations. The Fed’s latest dot plot, released at its last meeting of 2024 on December 18, shows that the overwhelming majority of Fed policymakers only expect the Fed to deliver two more quarter-point rate cuts for all of 2025, far below the four-plus that markets had been predicting as recently as the first week of December.

If the BoC continues to slash rates in an effort to bolster its lopsided economy, and the Fed begins to pull the brakes on rate cuts through the next year, the CAD’s rate differential could widen significantly, sending the Loonie even lower against the Greenback.

Uncertainty is the name of the game to kick off 2025, and tepid risk sentiment heading into the new year could see the Greenback kicking things off with a fresh bout of strength as investors adjust to a new geopolitical paradigm that features risk-off market sentiment more often than not. The Canadian Dollar is poised to continue falling in the first quarter. However, CAD investors will be looking to reassess the state of play between the Fed and the BoC heading into the middle quarters of next year.

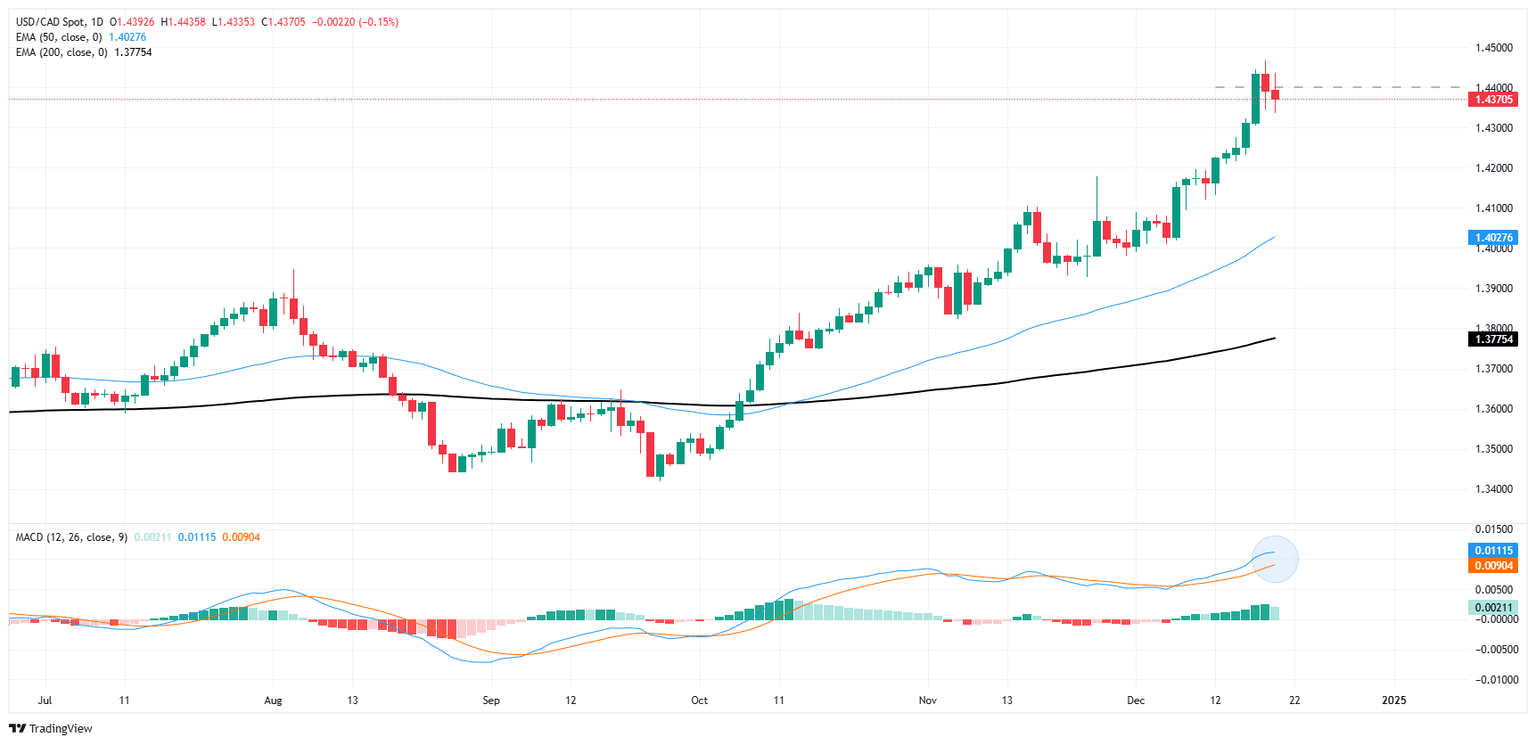

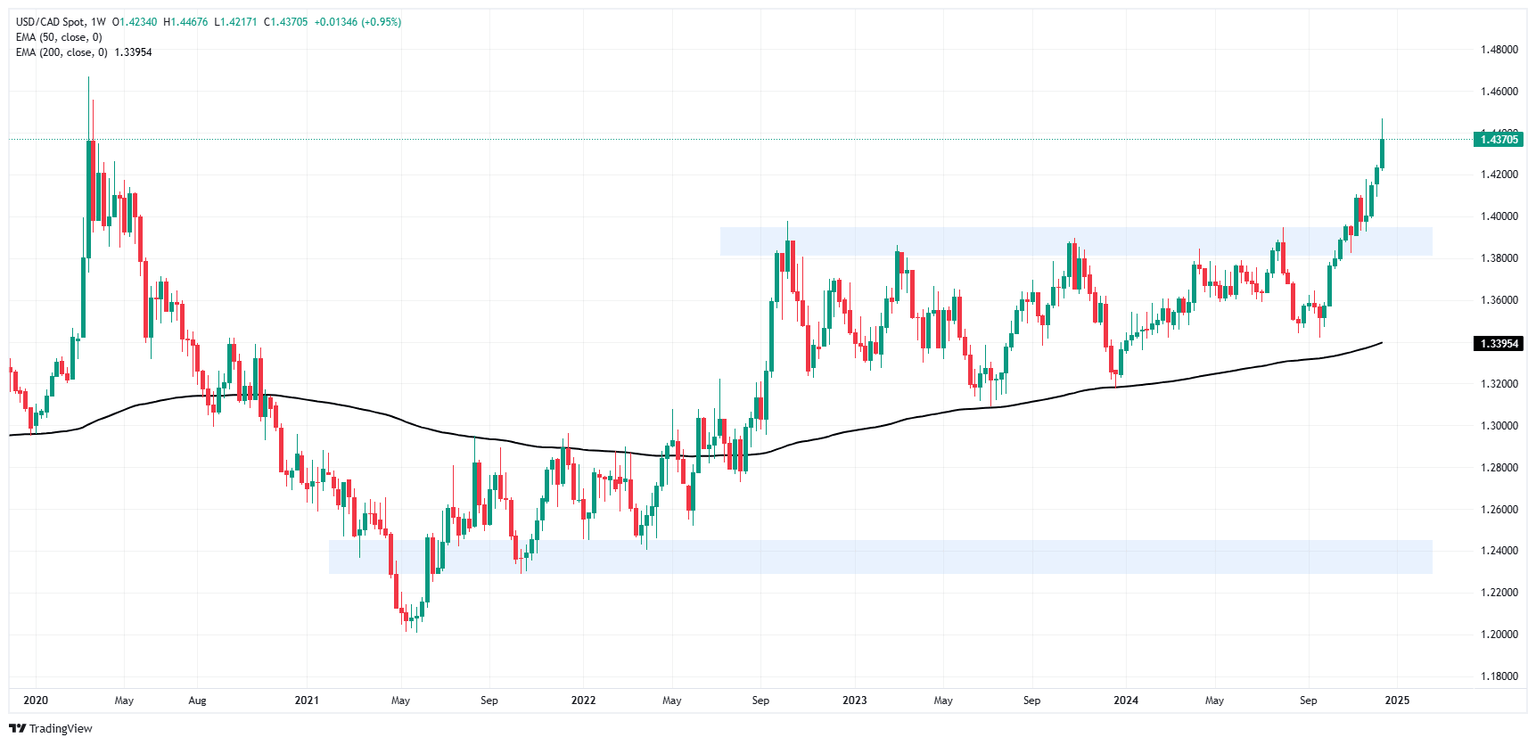

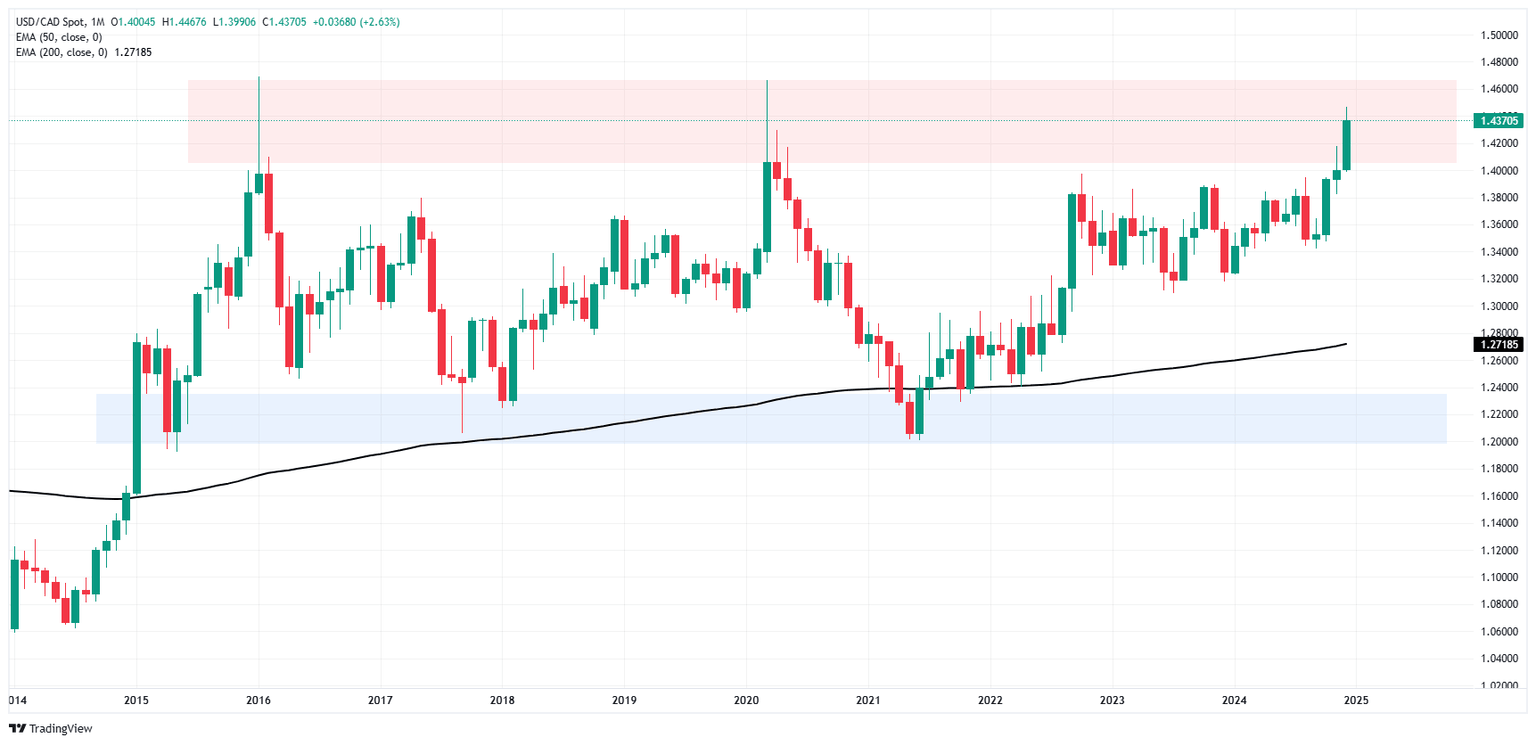

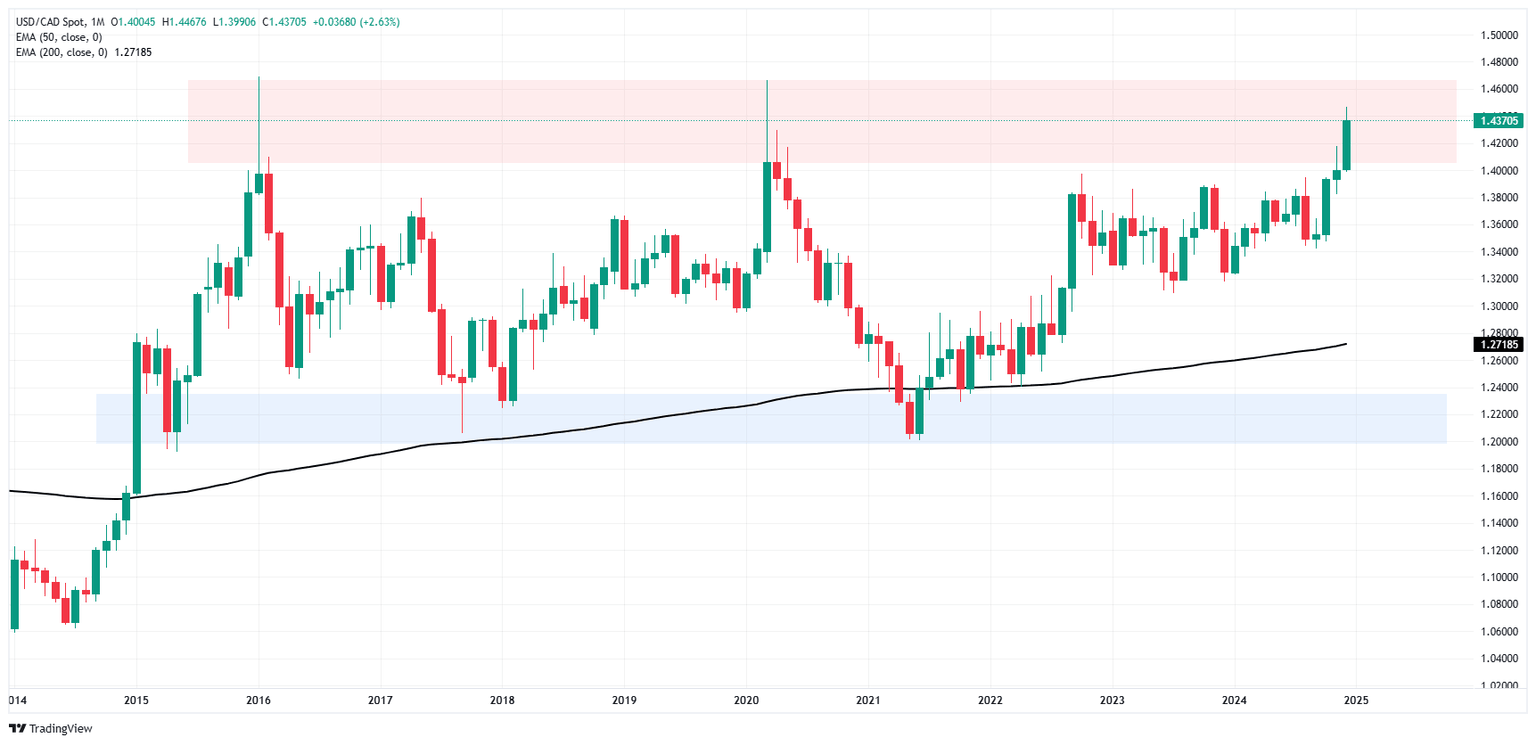

USD/CAD Technical Analysis: Chances of pullback increase

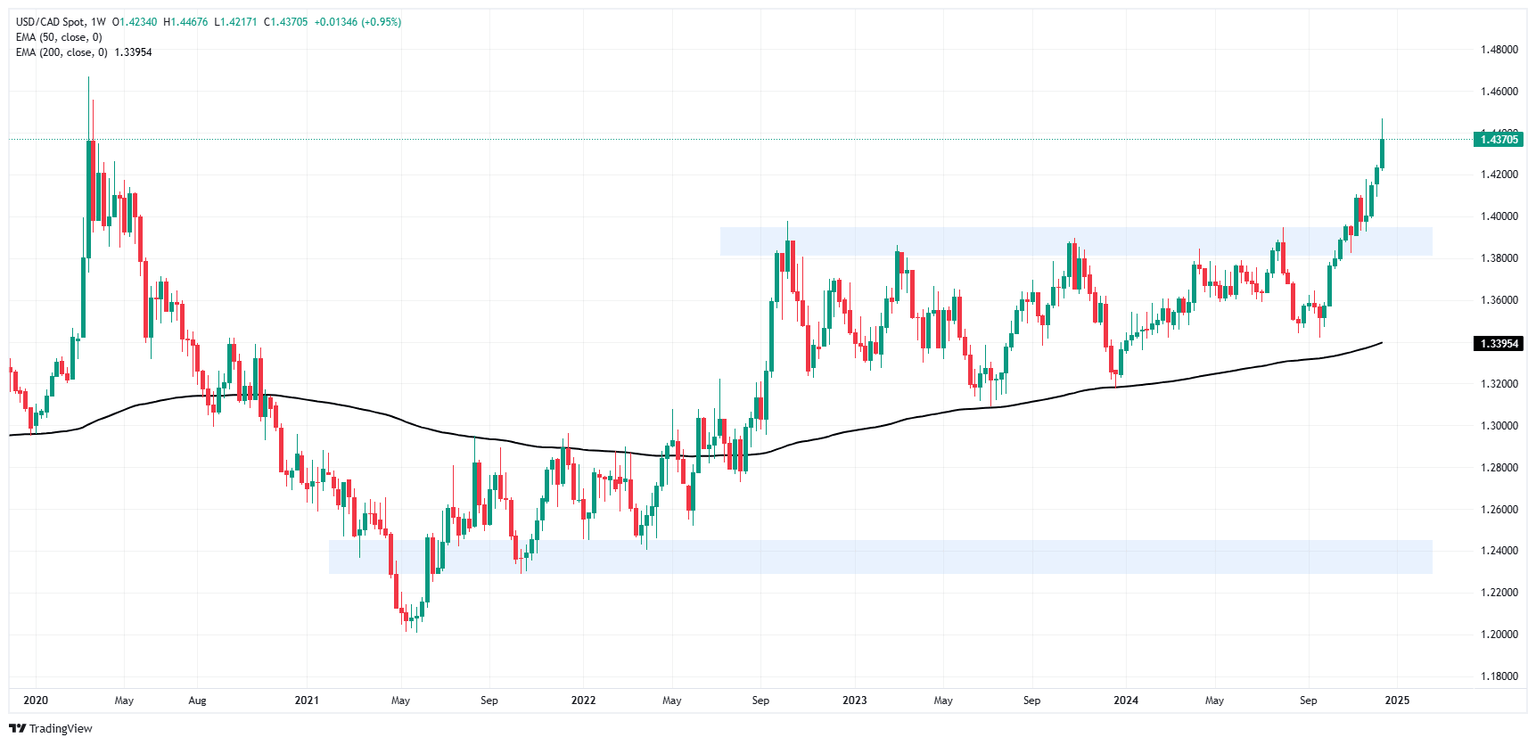

2024 was a lossmaker for the Canadian Dollar. The Loonie shed around 8.5% against the US Dollar, sending the USD/CAD chart to 56-month highs and contending with the 1.4400 handle, the pair’s highest price since the 2020 pandemic. Excluding the COVID pandemic, USD/CAD hasn’t tested the 1.4400 region since January 2016, an eight-year span.

With the CAD testing multi-year lows and sending the Dollar into the attic, momentum traders will be looking hungrily to collect into bullish CAD positions to force a downside correction with USD/CAD price action testing into overbought territory.

USD/CAD closed higher every month in 2024 except for three, gaining ground during the other nine. Despite the year’s one-sided chart action for USD/CAD, the pair is poised for a technical ceiling as bids struggle to pierce the key barrier decisively.

If USD/CAD bears get their wish and a fresh bull run is ignited in the Canadian Dollar, short position holders could expect a long, slow grind back to the bottom end of the pair’s long-term sideways trend below 1.2500.

The signal lines of the Moving Average Convergence-Divergence (MACD) have broken into their highest levels since late 2022, and short-position seekers should wait for the fast signal line to cross below the slow line before taking a stab at accumulating entries through the first quarter of 2025.

USD/CAD daily chart

USD/CAD weekly chart

USD/CAD monthly chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.