A strong Treasury auction yesterday led to a sharp pull back in US yields. The US 10yr topped out at 1.1855% before pulling back below 1.13% allowing the USD to ease back after the recent short squeeze driven by higher US yields. We see this as the signal needed to keep markets risk-on as we wait for today’s US CPI figures.

Today the marketing is evaluating the comments from various Fed speakers who are now dialling back on some of the tapering expectations which they built up at the start of the week.

Rosengren said “The Federal Reserve will continue to purchase long-term assets until the economy is on a stronger economic footing.” Meanwhile Bullard said it is too soon to discuss tapering, he did add that it is encouraging to see the Treasury 10-2 spread returning to more normal levels. And, Esther George said that policy makers won’t react if inflation tips above 2% due to average inflation targeting.

US CPI today will be of added importance given the focus on US yields at the moment. US CPI ex food and energy expected at 1.6% YoY, this would need to come in at 1.9% or higher for market to turn bullish on USD.

Looking ahead, Biden should lay out his stimulus plans on Thursday. Some details have already been leaked including a plan for $2,000 stimulus checks. This comes as Alabama, Mississippi, Georgia, and Arizona report record Covid deaths. We would not be surprised if stricter restrictions are brought in once Biden is inaugurated on 20th January.

Our overview and outlook of the key trading pairs and indices is as follows:

EURUSD – The Euro hit our 1.2215 target as US yields retreat from multi-month highs. Equities are seen trading mixed this morning despite optimism over fiscal stimulus in the US. investors are still cautious about a possible overvaluation in the stock market but also optimism over a speedy economic recovery. Today, the US CPI and Lagarde's speech could influence markets while US yields are expected to continue to fall and thus the EUR/USD currency pair to retest the 50-SMA and possibly trade slightly higher.

GBPUSD – The pound surged to nearly 1.37 after US yields pulled back from the highs, triggering a US Dollar sell-off. Moreover, the intraday momentum picked up pace after the BOE Governor Andrew Bailey downplayed speculations on negative interest rates. Today, some profit booking is expected on the GBP/USD currency pair however our overall bullish view remains intact while a break above the major resistance level at 1.37 to confirm further gains towards 1.3750 and 1.38 by next week.

USDJPY – The dollar/ yen is back below 104, as the bulls failed to break above 104.30 yesterday as retreating US bond yields weighed on the greenback. Policymakers toned down talks of reducing the asset purchase program and reiterated that the policy is going to stay supportive. As a result, expectations of a larger government borrowing could limit the ongoing pullback in the US bond yields and probably push the pair lower.

FTSE 100 – The FTSE100 index is still expected to remain within the same 6700 / 6880 trading range as investors lean optimistic for a speedy economic normalization despite London’s hospitals facing an increasingly dire situation. The economic calendar today has eurozone industrial production at 1000 GMT and US inflation at 1330 GMT which should steer market direction in the coming days.

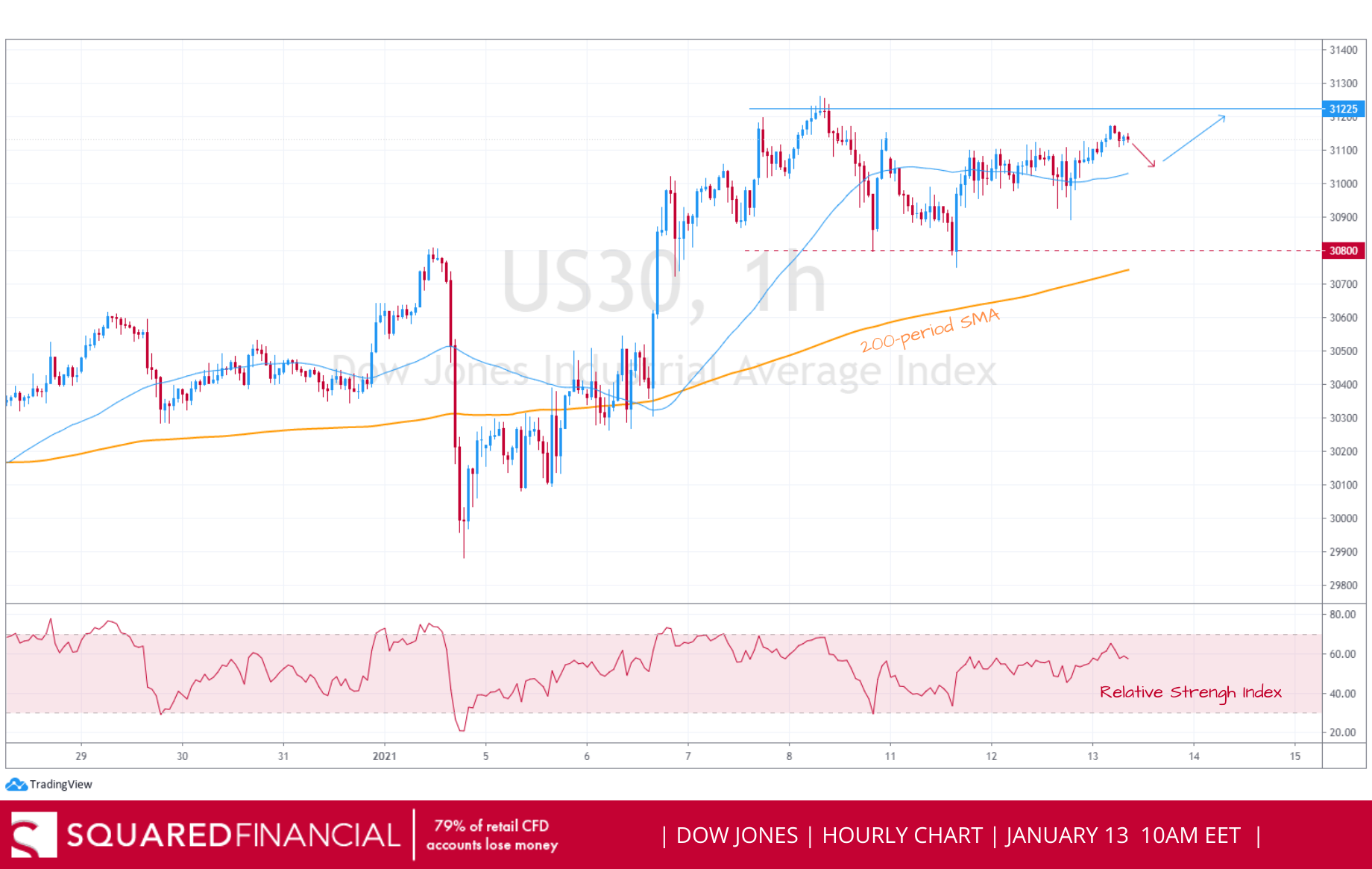

DOW JONES – The market remains incredibly well supported by monetary and fiscal stimulus efforts coupled with optimism over vaccine rollout and a speedy activity normalization, despite today’s expected impeachment vote in the House of Representatives and concerns that the move may create further unrest in Washington. Energy stocks are leading the way higher as oil prices continue to rise on reduced output. The Dow Jones index is expected to gain slightly today despite an announcement that travellers entering the United States will need a negative Covid-19 test as the country hit a record of nearly 4500 deaths in a single day.

DAX 30 – German stocks are seen opening slightly higher on Wednesday tracking modest gains in Asia as prospects of an eventual victory against coronavirus shored up recovery hopes, while oil prices jumped to their highest in a year reflecting recent output cuts. With US futures little changed for the time being, European markets are also expected to trade in a narrow range ahead of the eurozone industrial production due at 1000 GMT and US inflation to be released at 1330 GMT.

GOLD – Upside momentum on Gold is looking sluggish after the yellow metal printed an hourly close above 1860 and failed to turn it into support despite a pullback in yields and the greenback. All eye’s today on U.S. CPI data as a weaker reading could have the yellow metal print fresh new lows, while many support levels exist on the downside.

USOIL – WTI Crude climbed to near 11 month-highs in yesterday’s session after API inventory data registered a surprise drawdown (-5.821 Mb vs. Prev: -1.663Mb), breaching our first long resistance target at $43.50 and topping slightly below $54 resistance. An hourly close $53.50 resistance now turned into support, will favour further downside with $52.60 as next major support.

This information is only for educational purposes and is not an investment recommendation. The information here has been created by SquaredFinancial. All examples and analysis used herein are of the personal opinions of SquaredFinancial. All examples and analysis are intended for these purposes and should not be considered as specific investment advice. The risk of loss in trading securities, options, futures, and forex can be substantial. Customers must consider all relevant risk factors including their own personal financial situation before trading.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.

-637461246130332308.png)