US Inflation Analysis: As high as it gets? Fed may still stick to “transitory” stance, dollar could suffer

- US headline inflation hit 5% in May, more than 4.7% expected.

- Prices of used cars and airfares were among the upside drivers.

- The Fed may still see through these reopening struggles and refrain from any major change.

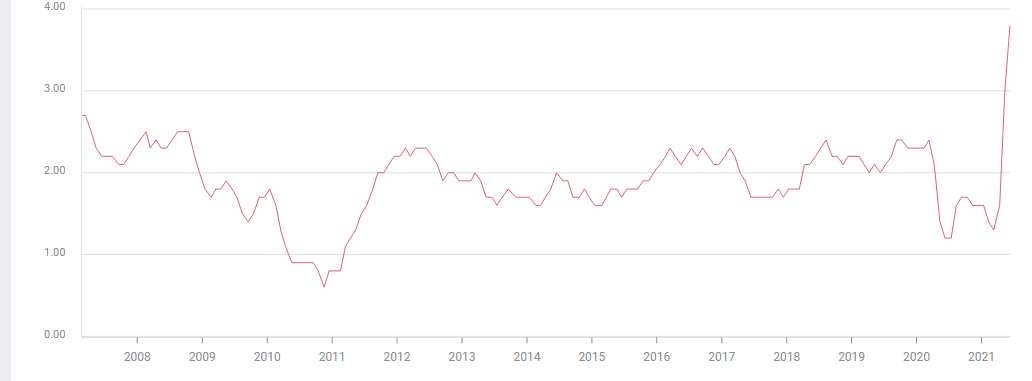

Highest since August 2008 – at 5% YoY headline US Consumer Prices Index has not only beaten expectations but also causes jitters in markets. Core CPI, which excluded volatile food and energy figures, rose by 3.8% yearly, also above estimates and substantially beyond the Federal Reserve's 2% target.

Time to taper bond-buying and raise rates? That is the main question for the Fed, which is watching these figures closely ahead of next week's decision. If the economy is overheating, the central bank would raise rates.

However, the Fed's stance is that inflation is only "transitory" and that is divided into two parts. First, the high year-over-year increases are partially due to base effects – prices tumbled last year. That is a known fact to all and well anticipated.

The second reason for the quick monthly price rises – 0.6% in headline CPI and 0.7% on the core – stems from the rapid reopening, which is causing shortages and therefore price pressures. Is this temporary or not?

Diving into the details, there is reason to believe the Fed's stance accurately, at least for now. Americans are on the move once again in response to the successful vaccination campaign. Once again, prices of used cars have shot higher, and so have airfares. There are not enough clunkers nor flights to satisfy the instant surge in demand. As people go out, they are also buying new clothes, pushing apparel higher.

Prices of home improvement products – which were on the rise in response to lockdowns – have yet to drop as American still has significant amounts of additional cash in their pockets.

Markets expect a rate hike to come only around this time in 2023 – two years from now – so tapering of bond buys may wait for some time in 2022. Those expecting a preannouncement of a reduction in the bank's current purchase pace of $120 billion/month may be disappointed.

The furthest the Fed could go is something along the lines of "the time will come to think about thinking of raising rates" or something along these lines. The thinnest of hints of tapering means only a meager upside bump in the dollar. Conversely, the greenback could drop if the Fed sees through the data. That is the most likely scenario.

More European Central Bank Preview: Why June's decision presents a buy the dip opportunity

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.