US February ISM Services PMI Preview: Will it influence Fed rate hike bets?

- ISM will release the Services PMI survey for February.

- Inflation and employment components will be watched closely by market participants.

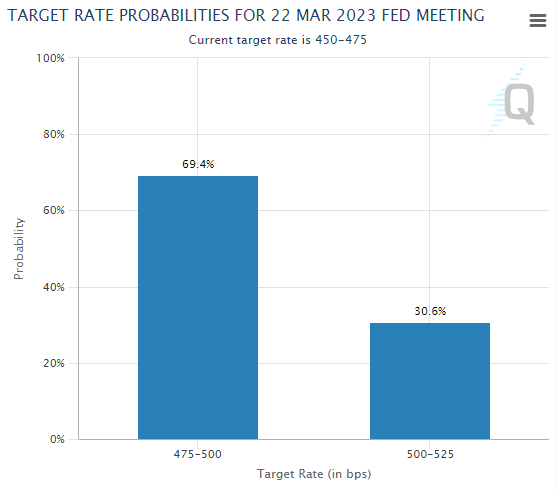

- Markets are pricing in a 30% probability of a 50 bps Fed hike in March.

The US Dollar’s poor performance in the last quarter of 2022 continued into the new year and the US Dollar Index (DXY) registered losses for the fourth straight month in January. Following the upbeat January jobs report and hot inflation figures, however, the currency regathered strength and the DXY gained nearly 3% in February.

At this point, markets are fully pricing in at least two more 25 basis points (bps) Federal Reserve rate hikes in March and May, according to the CME Group FedWatch Tool. The probability of a 50 bps rate increase at the next policy meeting stands at around 30% and the upcoming ISM Services PMI survey could influence the rate hike expectations.

In February, the business activity in the service sector is forecast to post an expansion with the headline ISM Services PMI coming in at 54.5, compared to 55.2 in January.

Market implications

Following the first policy meeting of the year, FOMC Chairman Jerome Powell noted that they were observing early signs of disinflation but added that the inflation in the service sector, non-housing core services specifically, was uncomfortably high. Hence, investors will pay attention to the Prices Paid component of the ISM’s survey.

In January, the Prices Paid sub-index rose to 67.8 from 65.5 in December, revealing that input inflation in the service sector continued to rise at an accelerating pace. In February, this component is forecast to edge lower to 64.5. A reading above January’s print could fuel speculations for a 50 bps hike in March and provide a boost to the US Dollar. While speaking at the Sioux Falls Business CEO event on Wednesday, Minneapolis Federal Reserve Bank President Neel Kashkari said that he is "open-minded" on either a 25 or a 50 bps rate hike at the next meeting. "I think my colleagues agree with me that the risk of undertightening is greater than the risk of overtightening," Kashkari further elaborated.

On the other hand, a significant decline to 60 or below in the inflation component could be seen as a development that could allow the Fed to refrain from returning to bigger rate increases. In that scenario, the USD is likely to come under renewed selling pressure heading into the weekend.

Market participants will also keep a close eye on the Employment sub-index. The Fed is concerned that wage growth in the service sector - due to the supply-demand imbalance - will feed into higher inflation. In February, the Employment component is projected to decline slightly below 50 and show a loss of momentum in the sector’s payroll growth. If that sub-index falls well below 50, it could counter the potential positive impact of a strong Prices Paid print on the USD and vice versa.

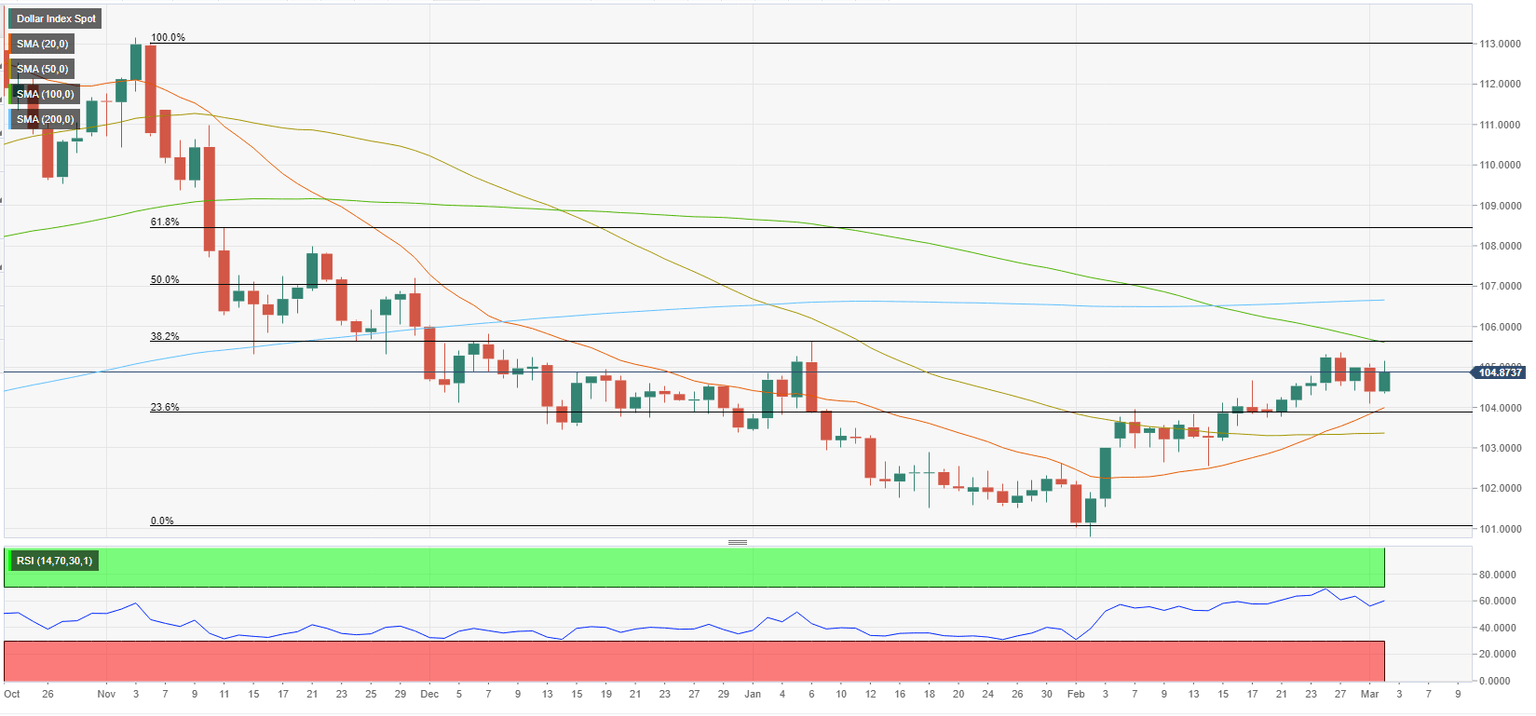

DXY Technical Analysis

DXY faces strong resistance at 105.50, where the 100-day Simple Moving Average (SMA) and the Fibonacci 38.2% retracement of the downtrend that started in early November meet. In case the index manages to flip that level into support, it could target 106.60 (200-day SMA) and 107.00 (Fibonacci 50% retracement).

On the downside, 104.00 (Fibonacci 23.6% retracement, 20-day SMA) aligns as initial support before 103.30 (50-day SMA) and 103.00 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.