- The Federal Reserve and markets are fully focused on US inflation figures.

- Economists expect the Core Consumer Price Index to have risen by 0.5% last month.

- Relatively high expectations may trigger an initial dollar decline, followed by a renewed rise.

Russia's war in Ukraine? Covid-zero policies in China? Britain's budget debacle? For markets, all these significant issues only play distant second fiddles to US inflation data. And within the Consumer Price Index (CPI) report, the figure that matters most is Core CPI MoM. Every 0.1% makes a difference.

Why it is the most important economic release

The Federal Reserve is fully focused on its mandate of price stability. It is even willing – and arguably wanting – to see pain in its full employment mandate as a prerequisite to falling inflation. That is why every inflation figure is important.

The CPI report is the top indicator of price rises – it measures actual inflation, contrary to surveys of expected cost changes. While the Personal Consumption Expenditure (PCE) is the Fed's preferred measure of inflation, it is published only late in the month, making way for CPI to become the #1 indicator.

Among the components, Core CPI, which excludes volatile food and energy costs, is more important than headline inflation. The price at the pump matters to politicians, but underlying inflation is what markets and the Fed are focused on. As the bank kicked off its rate hiking cycle only in March this year, the month-over-month changes are watched more than yearly developments.

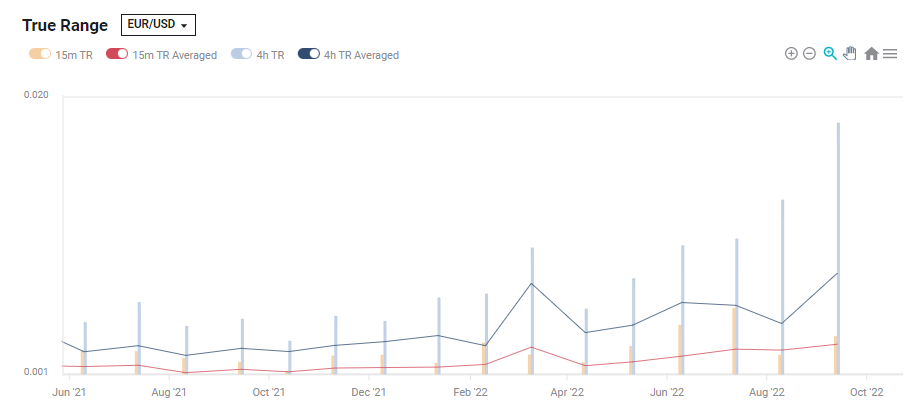

Even if you do not buy the full explanation above, a quick look at this EUR/USD true range graph shows how the response to data is growing:

Source: FXStreet

How expectations are set (high)

The economic calendar points to an 0.5% increase in Core CPI MoM in September, which is below August's 0.6% read. Nevertheless, that is extrapolated to roughly 6.6% annualized Core CPI growth, which is more than triple the Fed's 2% target – and higher than the year-over-year change of 6.3% recorded in August.

I believe economists have learned last month's lesson of forecasting only 0.3% and getting bitten by double that rate, to raise their expectations this time around. Are high expectations setting up for a miss and therefore a drop in the dollar? Not so fast.

The Fed wants to see underlying inflation beginning to climb down toward 2% in a meaningful and sustainable way. A considerably lower level is needed.

What to expect – three scenarios

1) Meeting high expectations: In this case, Core CPI MoM rises by 0.5% or even only 0.4%. On the one hand, there is no upside surprise, providing some hope that price rises and Fed hikes are nearing their end.

On the other hand, even a 0.4% monthly change would represent an annualized increase of 5% – too high by all measures. It is also above the lows of the year. Core CPI rose by 0.3% twice in 2022, so 0.4% would still be significant.

How would markets react? I expect markets to breathe a sigh of relief and currency traders to take profits on dollar longs – but only as the initial reaction.

After the knee-jerk response, fresh calculations about what the data means would reverse at least part of the first reaction. Later on, Fed officials will likely reiterate their stance that more rate hikes are needed to fight inflation, which is still too high.

Therefore, such an outcome could serve as a dollar-buying opportunity. It has the highest probability and would leave expectations for a 75 bps hike in November largely unchanged.

2) Below expectations: I consider 0.3% or lower as an outcome that would trigger a more significant rally in stocks and a substantial sell-off in the dollar. Fed officials would welcome such an outcome.

It could be used as proof that the previous month's 0.6% increase was a one-off, as it is sandwiched between two weaker data points. Moreover, it would push the YoY rate to 6.2%, below August's 6.3%. Bond markets would begin pricing a moderate 50 bps hike in November.

There is a medium probability for this scenario to occur, given the unsnarling of supply chains and the impact of higher interest rates on mortgage payments.

3) Above expectations: Matching last month's 0.6% increase or higher would already show that July's 0.3% read was a one-off – and that inflation is high. Markets would, once again, begin speculating about a 100 bps hike coming in November.

This scenario – and especially one in which Core CPI rises by 0.7% – would trigger massive dollar buying and a crash in stock markets.

I think the probability is low due to the reasons stated above. Nevertheless, such a scenario cannot be ruled out – and it carries the highest risk.

Final thoughts

We were all disappointed by the muted response to Nonfarm Payrolls – but CPI is far more important, and the past two publications sent volatility skyrocketing. Trade with care, and if in doubt, stay out.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0800 after German sentiment data

EUR/USD stays in a consolidation phase at around 1.0800 on Tuesday after closing in positive territory on Monday. The upbeat ZEW sentiment data from Germany fails to provide a boost to the Euro as investors await producer inflation data from the US and Fed Chairman Powell's speech.

GBP/USD drops below 1.2550 after UK jobs data

GBP/USD struggles to build on Monday's gains and trades in the red below 1.2550 in the European session on Tuesday. The data from the UK showed that the Unemployment Rate edged higher to 4.3% in the three months to March as forecast, failing to help Pound Sterling find demand.

Gold price edges higher ahead of US PPI data, Fed’s Powell speech

The gold price (XAU/USD) rebounds despite the consolidation of the US Dollar (USD) on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week.

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

Entering a crucial run of data for financial markets

We are entering a crucial period for financial markets and forecasters as Americans' near-term inflation expectations rise again. Upcoming reports on the CPI and PPI for April, along with new data on retail sales and industrial production, will provide valuable insights.