UK wage growth proves sticky despite rising unemployment

Wage growth is temporarily stuck in the 6% area and that’s another reason to think the Bank of England will wait until August to cut rates for the first time, despite signs of a cooling jobs market.

The latest UK jobs report is a bit of a mixed bag, but a surprise surge in private sector pay will be what ultimately catches the eye of Bank of England policymakers. Regular pay, which strips out volatile one-off/bonus payments, rose by 12% on a month-on-month annualised basis.

Admittedly, one month doesn’t make a trend and in fact, if you average out the last three months of data and compare it to the same period a year ago, the rate of private sector pay growth was still down a fraction to 6.0%. Nevertheless, we know that the Bank has occasionally flagged this month-on-month change as something it does pay attention to. And at the very least, policymakers will have a keen eye on the next round of data to see if that sort of monthly growth is sustained.

Private-sector pay up 12% annualised on a month-on-month basis

Source: Macrobond, ING calculations

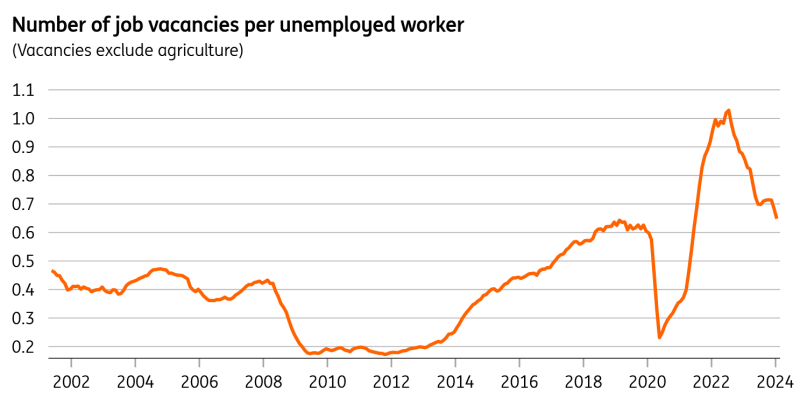

That said, this does need to be set against the broader labour market data which does appear to have softened further. The unemployment rate notched up to 4.2% from 3.9%, the highest since last summer. Meanwhile, both of the headline measures of employment fell. It’s worth saying that the unemployment/jobs figures are still suffering from sampling issues, so we can’t take these figures as gospel. But taken at face value it suggests hiring appetite is fading and the vacancy-to-unemployment ratio – something we know the BoE thinks is a useful barometer – is within spitting distance of its pre-Covid level.

In other words, the latest jobs report is a nuanced one, but we suspect most policymakers will read it as net-hawkish on the basis of those wage figures. At the margin, it moves the dial towards an August rate cut over June, though it remains a close call. Tomorrow’s services inflation data will also be important.

The vacancy-to-unemployment ratio is closing in on pre-Covid levels

Source: Macrobond, ING calculations

We would however expect wage growth to slow further into the summer, reaching the 4-4.5% area. A BoE survey of Chief Financial Officers has been pointing to both lower actual and expected wage settlements. There is a bit of uncertainty surrounding the near-10% rise in the National Living Wage this month, and this should start to show up in numbers available just before the BoE’s June meeting. However, we think the macro impact won’t be huge, in part because the percentage of workers on the NLW is relatively small, but more importantly because wage growth for lower-paid workers is already running at close to 10% on an annualised basis.

Read the original analysis: UK wage growth proves sticky despite rising unemployment

Author

James Smith

ING Economic and Financial Analysis

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies.