UK Jobs Preview: Gloomy mood opens door to GBP/USD upside? Three scenarios

- Economists expect the UK jobs report to show a slowdown in wage rises in November.

- The BOE closely watches the figures ahead of its all-important rate decision.

- A series of data disappointments may have led many to expect even worse outcomes.

If everybody is short, who is left to sell? Pound bears may be stretched, allowing room for gains if UK pay has rises have not fallen far.

Fourth consecutive disappointment? Not so fast

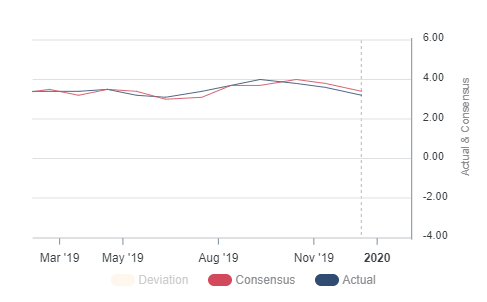

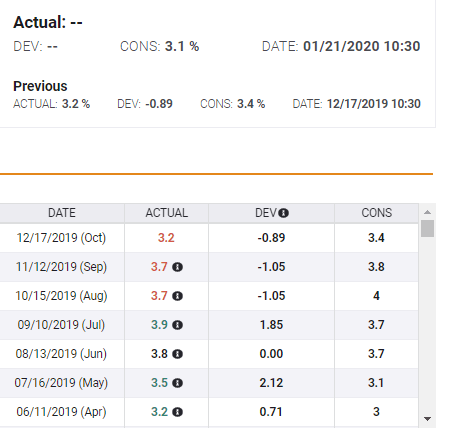

While the economic calendar is showing that the Unemployment Rate is expected to remain at 3.8% – the historic low – the focus is on wages. Economists project a deceleration of 0.1% in both Average Hourly Earnings that include bonuses and those that exclude them – from 3.2% to 3.1% in the headline and 3.5% to 3.4% in the core.

Examining the broader headline measure, the data shows that salaries' figures missed expectations in the past three months. Back in October, a lower estimate of 3.4% was followed by a disappointing increase of only 3.2% yearly.

For November, forecasts stand at a slower rate of 3.1%. Will pay rises fall short of expectations for the fourth time in a row? That was last seen in mid-2016 – and chances of it reoccurring now are slim.

Investors are already pricing in a rate cut

While the probability of another miss is low, investors may still be bracing for yet another shortcoming. Last week, the UK reported dreadful figures. Markets learned that the economy contracted by 0.3% in November, that retail sales dropped in December despite Christmas shopping and inflation – which the Bank of England targets – slowed to lowest levels since 2016.

The pound plunged as investors began preparing for the Bank of England to cut rates as soon as this month. In this atmosphere, even an "as expected" number would be good enough to trigger a recovery.

Here are three scenarios

1) As expected – GBP/USD edges up

If wage growth meets estimates of 3.1% – or even misses with 3% – the pound has room to rise. As mentioned earlier, the absence of yet another downfall may leave BOE expectations for this month unchanged – but would leave investors speculating about the next moves.

It would show that not all is doom and gloom in the UK economy, as long as wage growth holds above the round 3% level. The probability is high.

2) Above expectations – GBP/USD shoots higher

After three consecutive shortfalls, perhaps economists have been undershooting, and the salary increases may have stabilized at 3.2% or even accelerated to 3.3%. Some of the previous downbeat streaks were followed by upside surprises rather than with figures that met expectations.

In this scenario, GBP/USD has considerable room for an upside correction as the markets will begin casting doubts about next week's rate decision. The probability is medium.

3) Below expectations – GBP/USD falls

If earnings dig at the bottom and fall below 3%, sterling bulls may have to surrender, and bears would push it lower. The statistics would join weaker data and cement the rate cut next week. Speculation would move to the timing of the next rate cut.

The probability is low, given everything discussed above.

Conclusion

The UK jobs report for November and especially salary figures are critical for the pound. Given low expectations, GBP/USD has room to rise even if the data marginally misses expectations. An upside surprise would send it higher, and only a substantial miss would send it lower.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.