UK Jobs Outlook: Win-win situation for GBP/USD amid BOE forecasts, Farage

- The UK jobs report for September is set to show ongoing strength.

- Concerns from the BOE set a low bar for an upside surprise.

- GBP/USD has room to advance, also thanks to optimism about the elections.

Signs of a turn in the labor market – that warning by two members of the Bank of England will now come to the test. And those words by Michael Saunders and Jonathan Haskell – who dissented in favor of cutting rates – may determine sterling's reaction to the upcoming jobs report.

Market expectations and BOE conditioning

The jobless rate stood at 3.9% as of August – above the low of 3.8% seen earlier this year – but an excellent figure that is of envy to other countries. Economists expect the same result to be repeated in September.

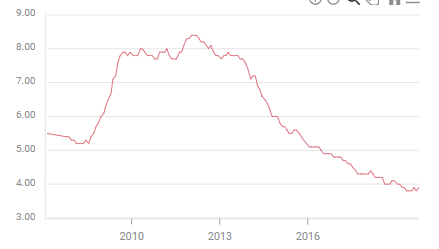

The chart below is showing how unemployment hit historic lows – below pre-crisis levels:

Average Earnings – which have been gaining traction in impacting the pound in recent years – were at 3.8% yearly growth in August. Also, here, a repeat is on the cards for September. With inflation standing at 1.7% that month, that would represent a real wage rise of 2.2% yearly – upbeat as well.

The UK labor market is booming and pushing salaries higher.

Is this about to change? The UK economy expanded by 0.3% in the third quarter and 1% on an annual basis – both figures below expectations and reflecting meager growth. Brexit uncertainty may have resulted not only in slower growth – but also in disappointing employment data.

An increase in the unemployment rate to 4% or deceleration of wage growth below 3.8% may, therefore, push the pound lower. However, after the warnings from the central banks – real expectations are probably more downbeat.

GBP/USD positioning and scenarios for the jobs report

Britain's jobs report is published against the backdrop of a pound-positive political development. Nigel Farage, leader of the Brexit Party, has announced that his new outfit will refrain from fielding candidates in seats won by Conservatives.

That may make it easier for Prime Minister Boris Johnson to secure an absolute majority. Investors prefer the certainty of Johnson's Brexit deal to the hard-left policies of Jeremy Corbyn, Labour leader.

1) As expected: Farage's dramatic decision joins lower BOE expectations in setting the stage for further GBP/USD advances. It would probably take an "as expected" – and it this case "unchanged" outcome to send the sterling higher. That is the base-case scenario.

2) Small disappointment: As mentioned earlier, a minor disappointment is probably priced into the pound. A minor miss of 0.1% or even 0.2.% in either or both key metrics may trigger choppy trading, but no substantial move in GBP/USD.

3) Considerable crash: To guarantee a slump in sterling, a miss of 0.3% is probably needed – the unemployment rate leaping to 4.2% and/or wage growth slowing to 3.5%. And that is highly unlikely.

4) Minor beat: Cable has room to rally upon a minor beat – a return of the unemployment rate to 3.8% or earnings advancing to 3.9%. That would defy the BOE's worries and also push the pound higher within the trend.

Conclusion

GBP/USD is entering the jobs report with upbeat political developments and downbeat expectations. It has room to fall only in one scenario out of four.

More GBP/USD Forecast: Levels to watch after Farage's fireworks, outlook bullish

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.