- UK inflation has likely extended its fall to 0.5% yearly in May.

- Coming 24 hours ahead of the BOE, the size of QE and tone on negative rates may move.

- GBP/USD is sensitive to any developments amid ongoing Brexit and coronavirus uncertainty.

The rush to buy toilet paper is over – and even the bounce in oil prices is unlikely to have lifted inflation. Consumer Price Index figures for May are set to show another fall, and the Bank of England is watching it ahead of its decision on Thursday.

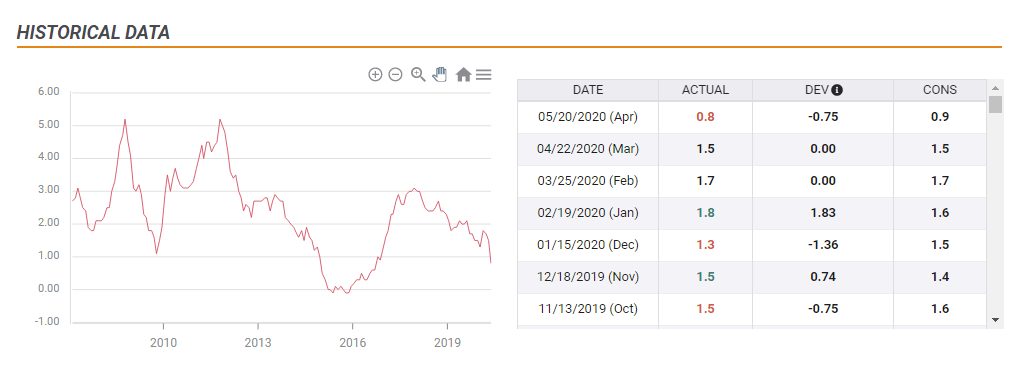

The economic calendar is showing a potential drop from 0.8% in April to 0.5% in May. CPI floated well above 1% in the pre-pandemic era. The crash in demand due to the efforts to cub coronavirus have been outweighing localized supply issues.

A drop to 0.5% would send inflation to the lowest since 2016 before sterling's post-referendum slump sent it back up. The BOE's target is 1-3% and it will likely miss it not only in April and May this year but for many months to come.

Potential reaction – it all depends on the BOE

CPI is published on Wednesday, ahead of the BOE's decision on Thursday. The "Old Lady" is on course to expand its Quantitative Easing program by between £100 to £150 billion on top of the current £645 billion.

Contrary to the days preceding coronavirus, investors cheer money-printing as it allows governments to stimulate the economy – worries about devaluation seem to belong to history.

Following this logic means lower inflation would trigger more BOE action – turning bad news into good news for sterling.

However, the London-based institution is also considering setting negative interest rates – and that would already depress the pound. Andrew Bailey, Governor of the Bank of England, said in May that the topic is "under active consideration." Other officials also publically toyed with the idea. While most of them hinted the move is not imminent, setting sub-zero borrowing costs remains an option.

If inflation falls too fast, real interest rates would cease to become accommodative – with borrowing costs exceeding price rises. That could lead the BOE to move in that direction.

For the pound to rise, CPI would need to hit the sweet spot of between around 0.3% and 1% – showing that inflation is low and that more QE would help.

If inflation surprises with over 1%, it could result in less stimulus from the BOE – perhaps under £100 billion in new funds, thus sending sterling down.

On the other extreme, CPI that is close to 0% – and especially negative CPI, deflation – would already raise the specter of negative rates, potentially punishing the pound.

Apart from the BOE, GBP/USD has been moving on fresh Brexit hopes following a video-call between Prime Minister Boris Johnson and several EU officials. However, the lack of details causes doubts among investors.

Other concerns are coronavirus, with cases remaining stubbornly high in both the US and the UK. Volatility remains high and cable is sensitive to any developments.

Conclusion

CPI is set to move sterling, yet an increase depends on meeting expectations – not too hot nor too cold. Investors will have the BOE in mind.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.