AUD/USD 4H Chart: Double Top

Comment: Since the beginning of March the Aussie has been appreciating against the US Dollar, eventually forming a double top pattern. Since double tops arise at the end of the upward trends, a bearish trend is soon likely to take over. Technical studies also imply a decline, but in longer timeframes a recovery is possible, suggesting that the pattern might turn into a triple top. This could occur only if demand, represented by the 200-period SMA around 0.7454, is sufficient to cause a rebound. A failure to regain the bullish momentum is to set the AUD/USD pair on a bearish path, until the March low of 0.7108 is reached, with another interim support located at 0.7415, namely the March 16 low. Meanwhile, 68% of traders hold long positions.

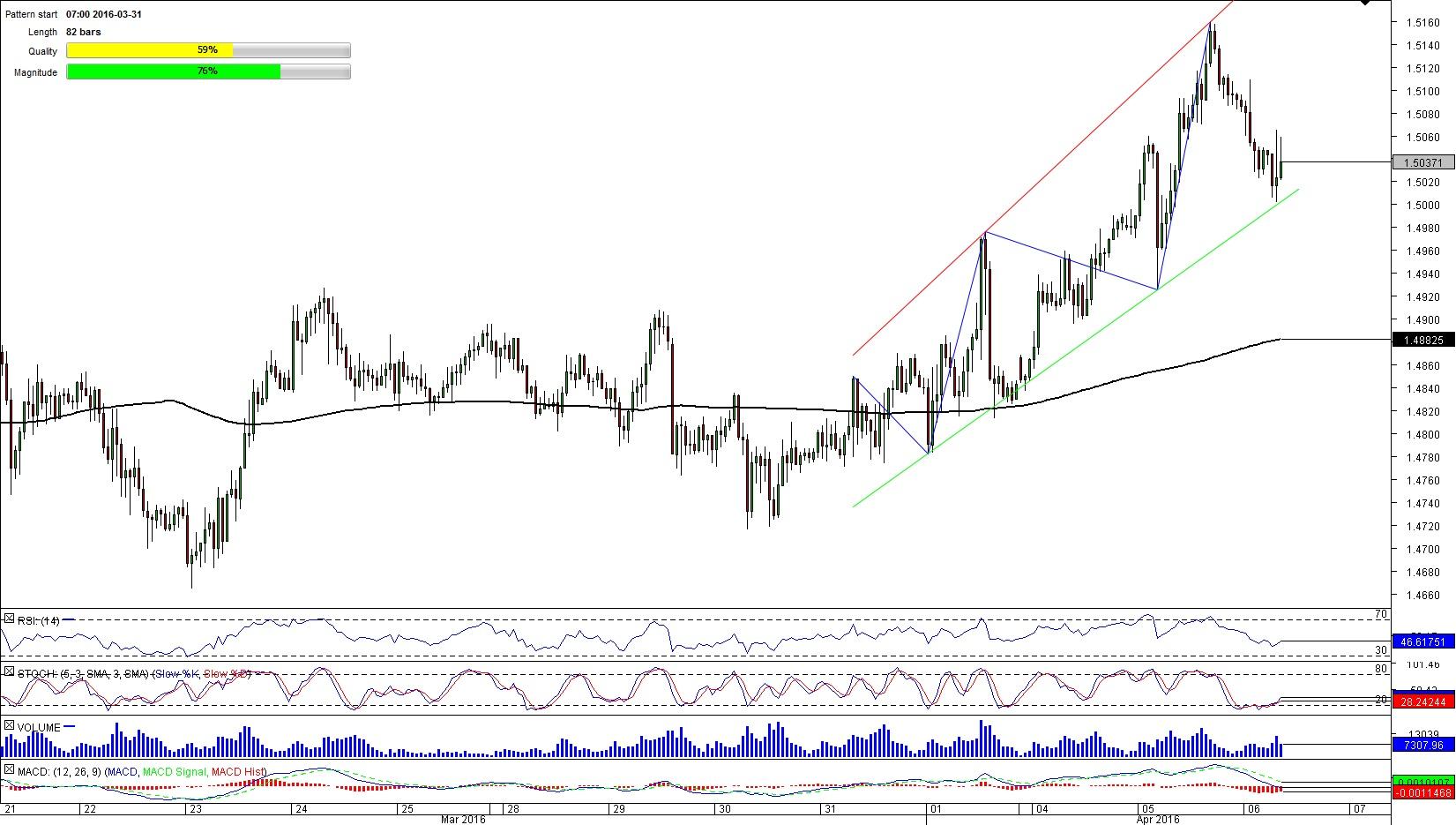

EUR/AUD 1H Chart: Broadening Rising Wedge

Comment: The EUR/AUD cross is now poised for more weakness, as that is the direction, where the rising wedge usually breaks out. Moreover, market sentiment is bolstering this possibility, as 54% of all open positions are short. However, the 55-hour SMA has been reinforcing the wedge’s lower border since it first emerged, making it difficult for a breakout to occur just yet. In case this support area is pierced, the exchange rate should continue falling towards the March 30 low of 1.4716; on the other hand, if bulls push the pair higher, the target will be the pattern’s resistance line, unless the April’s high of 1.5160 manages to reverse the rally earlier. According to technical indicators, the EUR is to continue rising against the Aussie in the medium term.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.