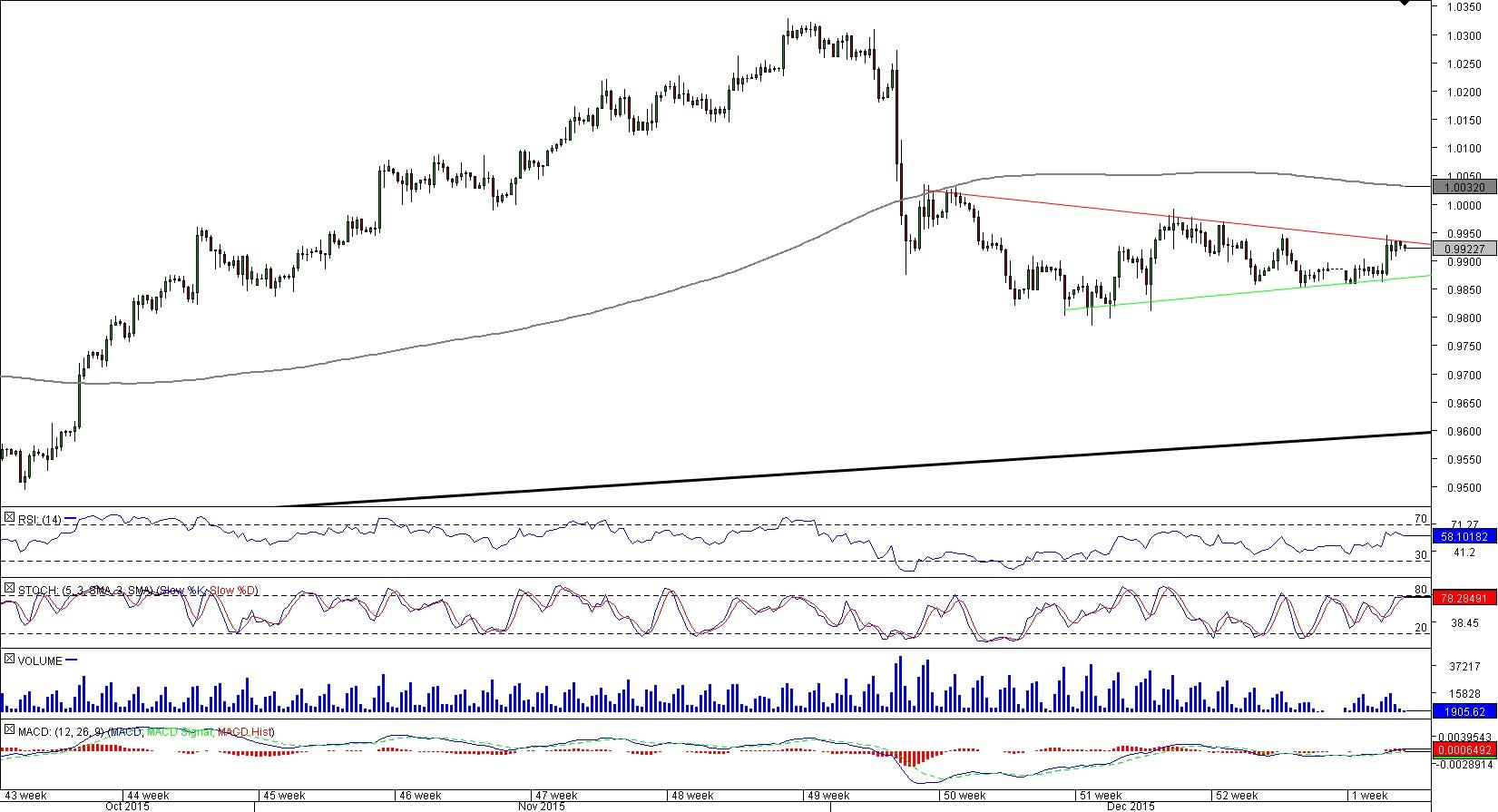

USD/CHF 4H Chart: Triangle

Comment: USD/CHF is currently consolidating after a decline as a result of the pair testing 1.0320. Since a triangle is a continuation pattern, a close beneath the up-trend and a follow-up sell-off to 0.96 is considered to be more likely than a break-out to the upside. Another strong bearish argument is the fact that the rate has broken through the long-term SMA. However, we must admit that there are also plenty of reasons to be bullish. For example, while the near-term indicators are mixed, the weekly studies are pointing upwards. At the same time, the distribution between the long and short positions is heavily skewed in favour of the former that take up 74% of the market.

GBP/NZD 4H Chart: Channel Down

Comment: The outlook on GBP/NZD is strongly bearish. The currency pair has formed a high-quality channel, which implies an immediate sell-off from 2.1688. Moreover, four-hour, daily and weekly indicators are giving ‘sell’ signals, and a majority of positions are long, implying there is plenty of room for new sellers. The June low at 2.1344 is unlikely to play an important role in the evolution of the exchange rate, but it may well trigger a bullish correction within the pattern. In the meantime, in case the bulls overpower bears near the falling resistance line, the new target will be set at 2.1940, which is the weekly pivot point, followed by the monthly S2 at 2.2170 and by the December 17 high at 2.2310.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.