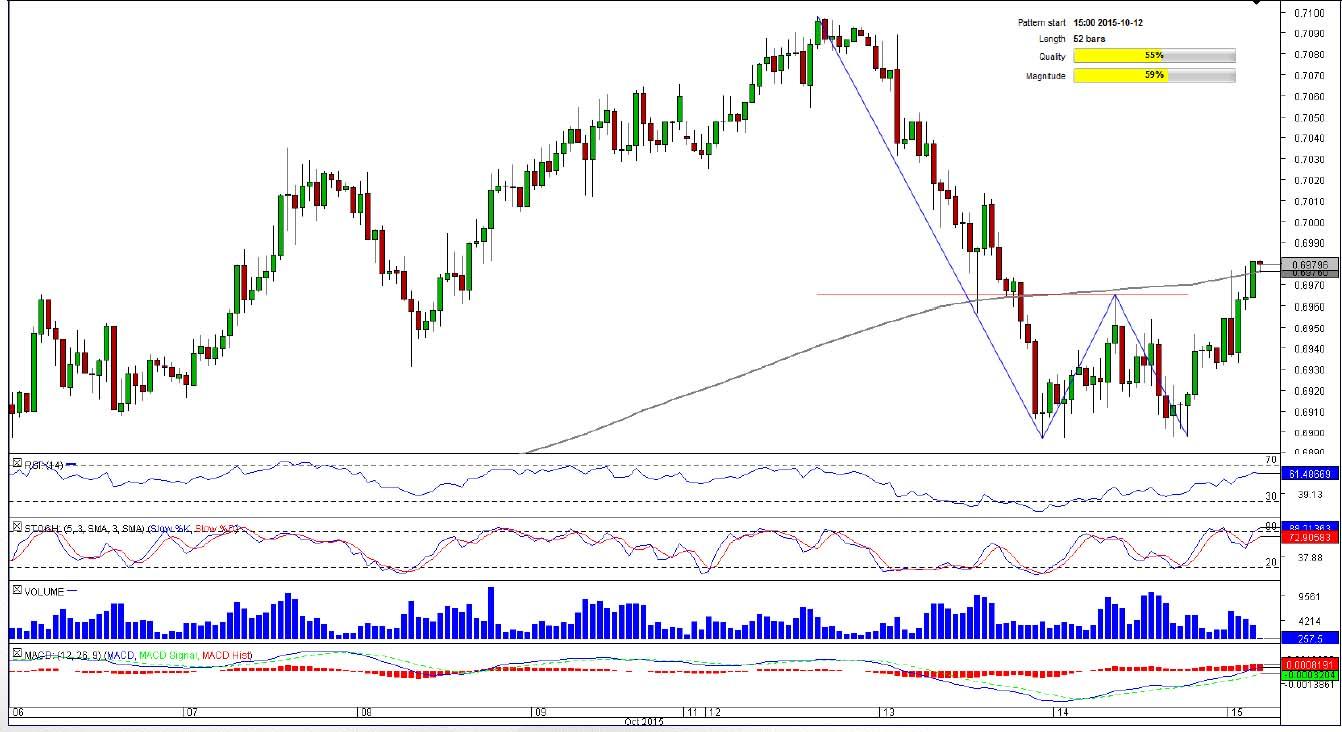

AUD/CHF 1H Chart: Double Bottom

Comment: Our bias towards AUD/CHF for today is strongly bullish, even though the technical indicators at the moment are mixed. The currency pair has just broken through the neck-line of the double bottom, and by the end of Thursday the price of the Australian Dollar is likely to increase by 70 pips, which is the distance between the neck-line and the Oct 13 low. The target coincides with the daily R3 level, which is currently standing at 0.7039. In case the Aussie preserves bullish momentum after hitting the target, the next objective could be 0.7097, namely the October 12 high. Meanwhile, the sentiment among the SWFX market participants is distinctly positive: 74% of all open positions are long.

CHF/JPY 4H Chart: Channel Up

Comment: In the lower time-frames (H1) going long in CHF/JPY might seem to be a good idea, but the H4 chart suggests a decline is more likely. The pair has just encountered an upper boundary of an emerging channel, which is also reinforced by the monthly R1 level. Accordingly, we expect a sell-off from here, especially considering the weekly technical studies. The immediate support is at 124.54, but a serious test of the bearish momentum will be at 123.70, where the monthly PP merges with the weekly S1 and 200-period SMA. Correction should start near the lower edge of the pattern, namely circa 122.70. At the same time, SWFX sentiment is negative: 74% of positions are shorts.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.