EUR/PLN 4H Chart: Channel Down

Comment: The bears are unlikely to remain in control of EUR/PLN for long. Even though there is a downward-sloping channel emerging in the four-hour chart, we hold a bullish bias towards the Euro. The main reason is the pair’s proximity to a major rising support line, which has been successful in underpinning the price since this year’s April. An additional reason to be bullish is the technical indicators, which are mostly sending ‘buy’ signals for the four-hour and weekly time frames. In the short run however, there is likely to be a selloff from 4.2350, but the decline should be limited by 4.19. Nevertheless, the SWFX market is dominated by bears: 73% of open positions are short.

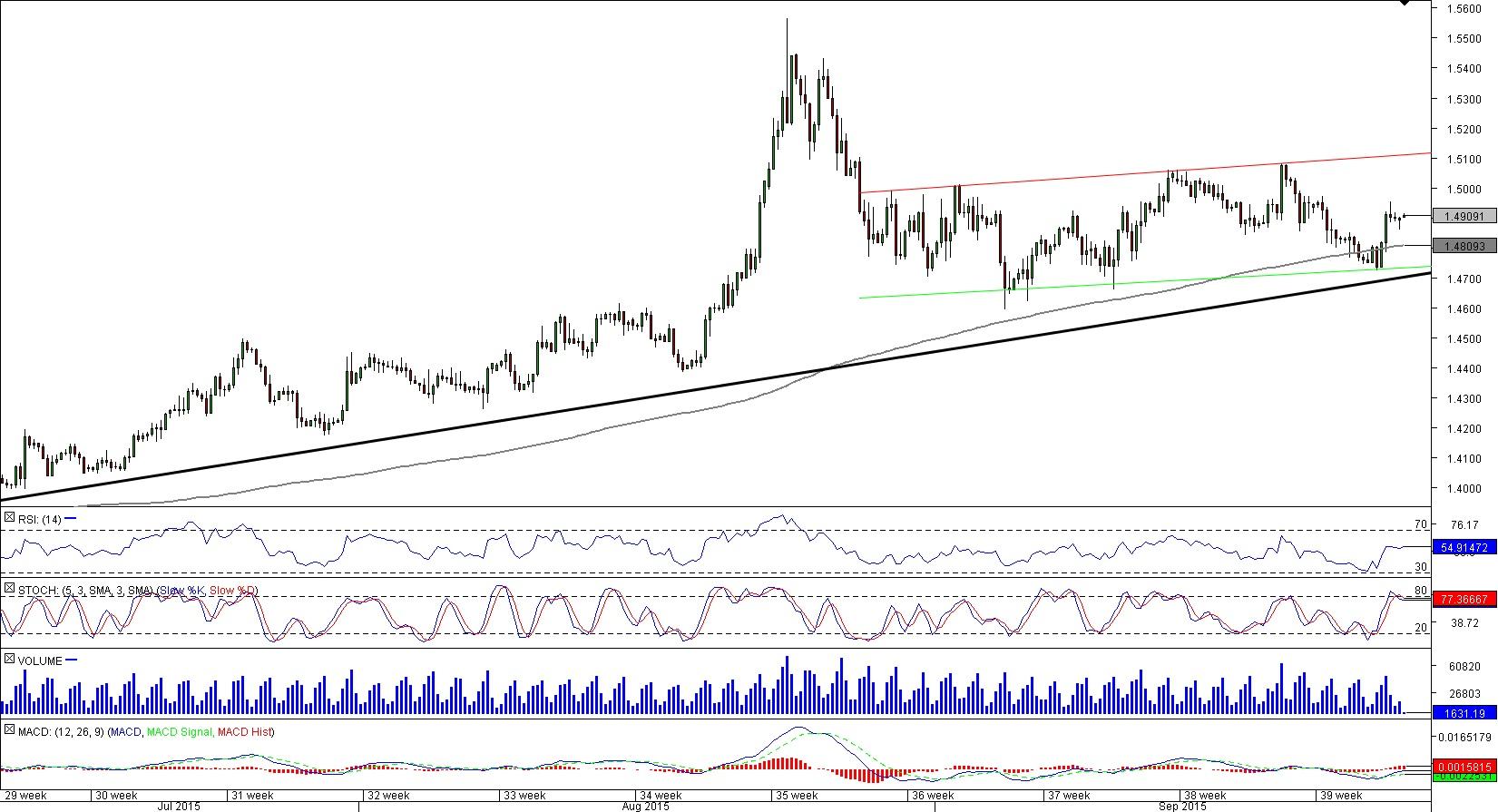

EUR/CAD 4H Chart: Channel Up

Comment: EUR/CAD appears to be bullish in all time frames. During the next few days the currency pair is expected to extend recovery up to 1.51 after it confirmed the green trend-line. The medium-term outlook is bullish due to the channel the Euro is currently forming. Finally, the long-term prospects are positive as well because of the six-month up-trend that is likely to prevent dips beneath 1.47 and because the spot price remains above the long-term moving average. Additionally, a large portion of the technical studies is pointing north. Still, the sentiment in the market towards EUR/CAD is strongly bearish, as 71% of open positions are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.