EUR/JPY 1H Chart: Rising Broadening Wedge

Comment: After falling below the 136 level for the second time this year EUR/JPY received a bullish impetus and started to form a rising broadening wedge pattern.

Currently, the pair is hovering near the lower trend-line, thus a bearish break-out could be more actual. Moreover, for rising wedge pattern a break-out to the downside is more common. However, technical studies are neutral, with only the daily ones pointing to the upside. Therefore, we are recommending to gauge pair’s future development by its near-term performance. If the pair breaches the cluster of resistances around 139 level then an advance could follow.

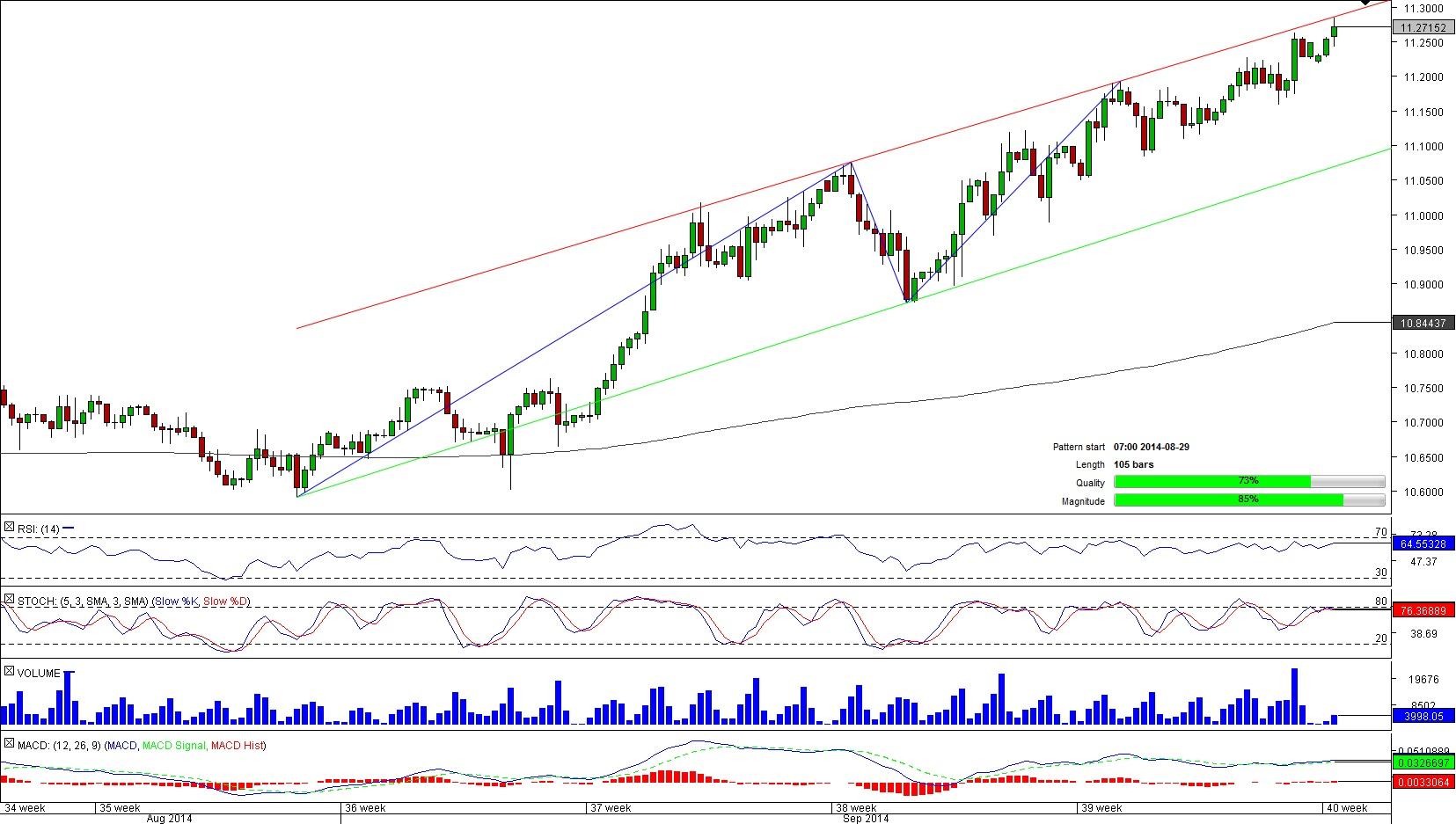

USD/ZAR 4H Chart: Channel Up

Comment: The USD/ZAR currency pair found a relatively strong support around 10.600 that pushed to pair higher. With this advance a bullish channel was formed.

For couple of weeks the pair has been challenging the upper boundary of the pattern. However, it has not been able to break above the trend-line for now. Nonetheless, a majority (67.15%) of the SWFX traders expect the pair to slide lower and possibly to break the pattern to the downside. In case the pair’s bulls give up and the U.S. Dollar starts weakening towards the monthly R3 at 11.146 then the possibility of a bearish scenario increases.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.