EUR/TRY 1H Chart: Channel Down

Comment: EUR/TRY has been rapidly depreciating since mid-July. At that time the pair was caught by a downward sloping channel that sent the instrument to a seven-month low of 2.8115 on Jul 23.

Currently the likelihood of continuation of the bearish tendency is rather high, especially given steepness of the pattern and the SWFX sentiment. According to the SWFX numbers, more than 94% of all orders are placed to sell the pair. Technical indicators also suggest the forthcoming hours will be a hard time for the pair to reverse the downside; technical data points to a possible weakness in the medium and long terms.

CAD/JPY 1H Chart: Ascending Triangle

Comment: CAD/JPY entered an ascending triangle pattern in mid-July; however, an upside pressure pertaining to the nature of the pattern may have failed to push the pair higher. In particular, CAD/JPY has exited the formation to the downside and given the proximity of the apex (it will be reached later in the day) the breakout may appear to be real. Nevertheless, traders on the SWFX still believe the currency pair is capable to swing to gains in the hours to come – about two thirds of traders are bullish on the pair.

EUR/NOK 1H Chart: Channel Down

Comment: The Euro has been losing ground against the Norwegian Krone for around a week. While moving in the southern direction, EUR/NOK shaped a 141-bar long channel down pattern, inside which it is trading now and is likely to remain the foreseeable future. This is propped up by a strong bearish bias on the SWFX – over 90% of market participants hold short positions. If these expectations materialize, the pair may retreat from the 50-hour SMA at 8.3443, the formidability of which was confirmed by the fact EUR/NOK has been unable to surpass this mark for several hours thus being forced to halt the winning streak it started after a plunge to a one-month low of 8.3187.

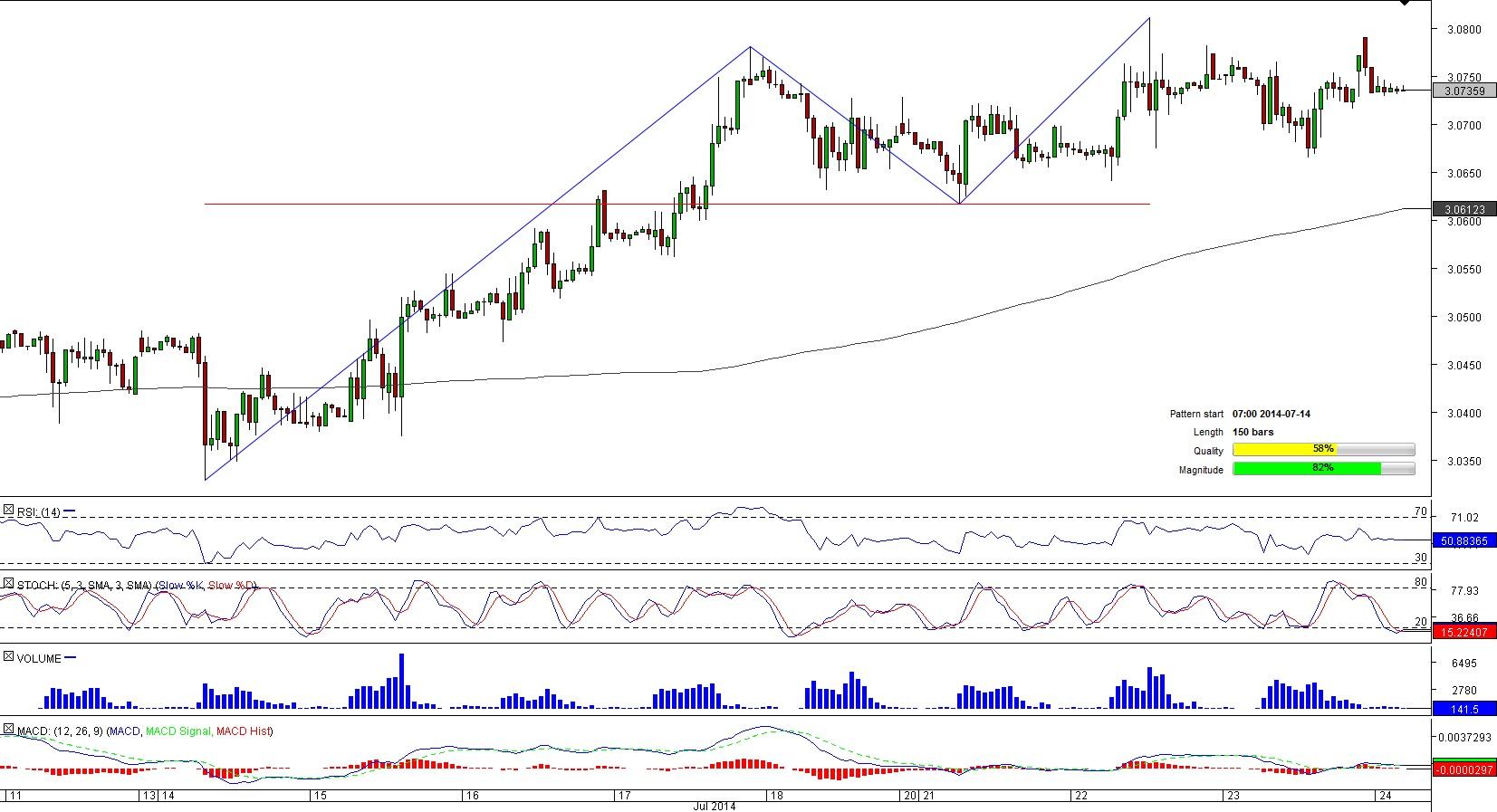

USD/PLN 1H Chart: Double Top

Comment: The 50-hour SMA at 3.0740 seems to be strong enough not to allow USD/PLN to fall to the neck-line of the 150-bar long double top pattern. The short-term SMA has been acting as a strong support level for almost 12 hours and may continue doing so as over 70% of traders on the SWFX bet on appreciation of the pair at a time when the instrument was likely to be in the down-trend. In particular, the pair was expected to follow a bearish trend after the second jump from the neck-line at 3.0617 that usually leads to a downside breakout and a sell-off. Meanwhile, technical data also alludes to the pair’s willingness and ability to move higher and prove previous expectations were false.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.