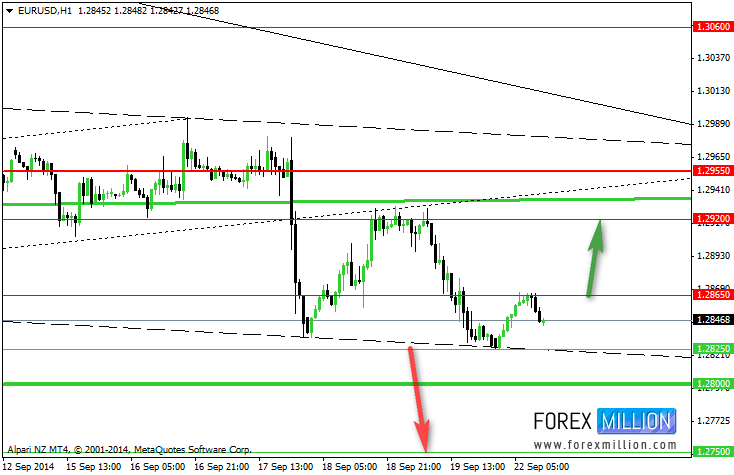

The pair is trading along an sideways trend.

The downtrend may be expected to continue in case the market drops below support level 1.2825, which will be followed by reaching support level 1.2750.

Alternative scenario:

An uptrend will start as soon, as the pair rises above resistance level 1.2865, which will be followed by moving up to resistance level 1.2920.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD flatlines below 1.2500 ahead of US data, Fed

GBP/USD is off the lows but stays flatlined below 1.2500 early Wednesday. The US Dollar strength caps the pair's upside amid a cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold treads water below $2,300, as Fed decision looms

Gold price is catching a breather below $2,300 on Wednesday, having hit a fresh four-week low at $2,281. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.