An unappetizing combination of elevated concerns over slowing global growth and incessant declines in oil prices have activated a wave of risk aversion that has engulfed the financial markets this trading week. Global stocks have been left heavily depressed with most major markets subdued as risk appetite sours amid the ongoing instabilities, while safe-haven investments such as the Japanese Yen received a handsome boost. European equities descended into the abyss during trading on Thursday and may be poised to sink lower following the ECB minutes which highlighted a deteriorating outlook for the global economy.Asian markets could be left under immense pressure as fading expectations that the BoJ will intervene to weaken the Yen, coupled with the strengthening Japanese Yen, should consequently leave Asian stocks capped. American markets were punished all week and the bearish domino expected from Europe later today may offer an opportunity for sellers an opportunity to send most major stocks lower.

The stock market decline this week should be of no surprise following the IMF’s meek global outlook that renewed fears of slowing global growth, while the dovish Fed minutes which pointed to instabilities dragged most investors back to reality. If this was not enough then the heavy declines in oil prices exacerbated investor concerns with confidence towards the global economy taking a hit as risk appetite soured. What complicates this situation further is that we live in a period where unorthodox central bank interventions have skewed the financial markets with market reaction to monetary policies almost having an opposite effect. Fears are lingering that central banks may have entered a phase of desperation to stabilize the financial turmoil and this should send stocks lower in the longer term as investors scatter away from riskier assets.

Yen bulls rattle currency markets

The growing fears over the state of the global economy combined with fading expectations of further intervention from the BoJ have installed Yen bears with inspiration this trading week with the currency hitting a 17 month high against the Dollar. This sharp appreciation of the Yen may continue to punish the Japanese economy that is engaged in a losing battle with inflation while global developments continue to expose the nation to downside risks. With Japan’s export competitiveness diminishing as the Yen surges the BoJ could be under some pressure to intervene in the future. Japan is a rare scenario; although the sentiment towards the Japanese economy is heavily bearish I am bullish on the Japanese Yen.

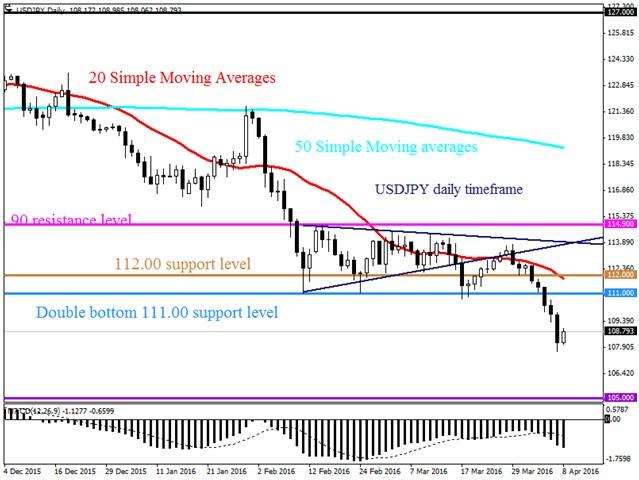

From a technical standpoint, the USDJPY is heavily bearish, as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support around 111.00 could become a dynamic resistance later this month for another decline towards 105.00.

ECB divide heightens uncertainty

The latest ECB minutes displayed a worrying divide in the decision to unleashing aggressive stimulus measures as a tool to boost Eurozone growth. This comes at a time when global anxiety is elevated with falling commodity prices sabotaging Eurozone inflation. Expectations may continue to mount that the ECB may unleash further stimulus measures in a desperate bid to weaken the Euro, but in this case Euro bulls could gain inspiration as the ECB finds itself in a similar situation to the BoJ.

Although the EURUSD has found comfort in a modest range in the first weeks of April, this pair is still bullish on the daily timeframe. A catalytic mixture of Dollar vulnerability and Euro appreciation could offer the platform for another incline towards 1.150. From a technical standpoint, pieces are trading above the daily 20 SMA while the MACD has crossed to the upside. A decisive breakout above 1.140 should open a path towards 1.150.

Sterling receives punishment

The Sterling was dealt a brutal lashing this trading week following the violent combination of risk aversion and Brexit anxieties which encouraged bearish investors to attack the currency pair. Sentiment is heavily bearish towards the pound and with uncertainties mounting as the EU referendum looms, investor attraction should diminish further consequently providing a platform for more selloffs. If the Brexit fears were not enough to keep prices depressed then the rapidly fading expectations over the Bank of England raising UK rates anytime soon should provide further encouragement for the bears to install another wave of selling momentum across the board.

This week the GBPUSD plummeted over 250 pips and may be poised to decline further in the months of April as horrible the cocktail of events mix in the favor of the bears. From a technical standpoint, this pair is bearish as there have consistently lower lows and lower highs while the MACD trades to the downside. Previous support at 1.4100 could transform into a dynamic resistance for a further decline towards 1.3850.

WTI meanders below $38.50

The crude oil saga continues with oil prices venturing towards $38.50 ahead of the cartel meeting in Doha which most anticipate will conclude unsuccessfully. As events unfold it feels like major oil players have no intention of cutting supply, but are instead looking to exploit the explosive levels of volatility in the oil markets to generate speculative boosts in prices. Even if an output freeze deal did materialize, it would occur at a point when production was at record high levels, in an already heavily saturated market. WTI is fundamentally bearish and with Iran on a quest to reclaim lost market share amid deal talks, prices could be set for another decline once the technical bounce comes to an end.

From a technical standpoint, WTI Oil is bearish on the daily timeframe and the daily 20 SMA could act as a resistance for another decline back down to $35.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.