Global sentiment deteriorated even further during trading on Wednesday following the International Monetary Fund’s (IMF) gloomy warning over the growing vulnerability of the global economy amid the incessant declines in oil prices and Chinas slowdown. These comments re-established a wave of risk aversion which soured risk appetite and encouraged anxious investors to frantically scatter away from riskier assets. With concerns over the unfavourable economic landscape already at elevated levels and mounting fears that the horrible mix of global woes could trigger another financial meltdown, confidence towards the global economy remains low and investors may desperately seek safety from safe-havens.

Stock markets gyrated during trading on Wednesday with American equities receiving an unexpected uplift from the violent and abrupt incline in oil prices which offered another false lifeline to bullish investors. Asian equities benefited slightly from the technical gains seen in Wall Street, but may be set to decline as renewed fears over China’s growth weigh heavily on sentiment while a strengthening Yen should leave Japanese stocks depressed. In Europe, equities concluded in the red and may be set to follow this negative path as the depreciation in oil prices continues to drain investor’s conviction in dabbling with riskier assets.

IMF issues warning of Brexit

The battle of the pros and cons for a Brexit continues to build momentum, with the IMF warning of the possible implications and economic uncertainties the UK economy may face if they leave the European Union. While some compelling points were made regarding the benefits of trade, migration and financial ties with the EU, the anxieties behind these talks should continue to enforce downwards pressure on the Sterling. With a few months left until the pending EU referendum vote, the Sterling may be left vulnerable and open to extreme losses as building uncertainty, anxiety and fear haunt investor attraction towards the currency.

The Brexit has added to the pound’s woes while external developments continue to expose the UK economy to downside risks which have consequently impacted GDP growth. Market participants may shift their focus today towards the second estimate GDP report for the UK economy, and if this signals further weakness then the Sterling may be offered a catalyst to plunge further across the currency markets. It must be remembered that before the Brexit scenario, the notoriously low levels of inflation and tepid wage growth offered little encouragement for the Bank of England to raise UK rates. With speculations mounting over the possibility that rates may be slashed rather than hiked amid the new developments, Sterling bears have been offered enough encouragement to rampage till June.

Core Durable goods in the States

The rapidly diminishing expectations towards the Fed raising US rates again in 2016 amid the unsettled economic landscape has left the USD noticeable vulnerable and open to losses. In the month of February, economic data from the States has been mild while the Fed’s fear towards the current global developments has left most investors cautious. Core durable goods in the States has followed a negative trajectory for an extended period and if today follows a similar route then USD weakness may take center stage as expectations fade further towards US rates being increased in 2016.

WTI Oil still under pressure

WTI Oil continued its chaotic swings during trading on Wednesday following the cocktail of data which overall signaled that oversupply remained a persistent problem in the global markets. U.S government data showed crude stockpiles increased by 3.5 million last week while gasoline demand in the past month surged 5% which caused the exaggerated rebound in oil prices that bears may take advantage off in the future. The fading expectations of any production cuts following Saudi oil minister Naima’s comments have created a highly sensitive trading environment which reacts explosively to any positive news. WTI Oil still remains heavily bearish, and with no emergency meeting coming forth despite the ongoing talks of fabled production cuts, prices may decline towards $25 and potentially lower. From a technical standpoint, a breakdown below $30 should encourage a further decline towards $25.

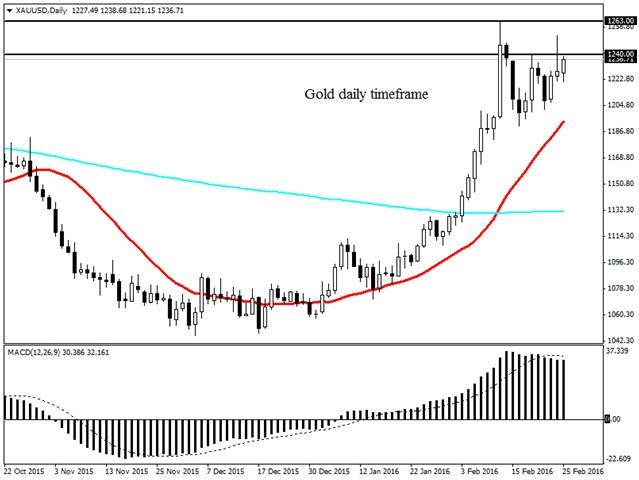

Commodity spotlight – Gold

The IMF’s warning on how vulnerable the global economy has become may have offered an opportunity for Gold bulls to install another round of buying as anxious investors flock to safe-havens. Sentiment towards the global economy is currently weak while fears of another financial meltdown amid crashing commodity prices and slowing global growth continue to boost attraction for this yellow metal. With most central banks enforcing negative interest rates, Gold becomes a star performer and as such should encourage further inclines towards the $1263 level and potentially higher moving forward. If the results for core durable goods for the States fail to hit expectations today then Dollar weakness may act as a catalyst which should send prices towards $1263. From a technical standpoint a breakout above $1240 may offer invite buyers to send prices towards $1263.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.