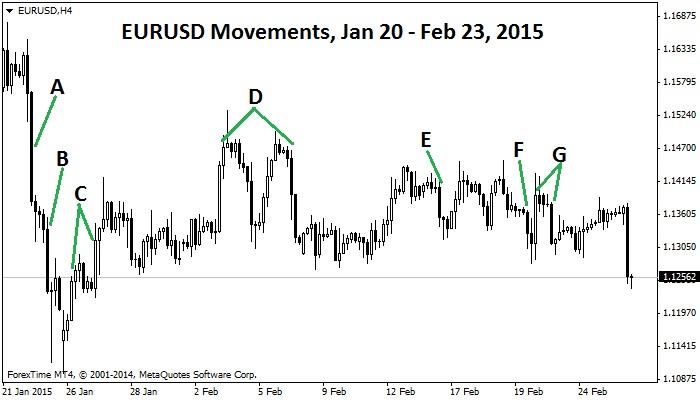

As the common currency of 19 out of the 28 member states of the European Union, the euro can be affected by various factors in relation to each of these countries. Developments in Greece, however, (whether political elections or discussions of the Greek debt and its accompanying austerity measures) seem to have had a particular impact on the value of the currency in recent weeks. But how direct is the correlation between news coming out of Greece and the swings of the EUR on the forex charts? Are the markets becoming jaded with all the news related to a potential Grexit, or are investors still worried about the adverse effects the Greek crisis might have on the overall health of the EUR? FXTM Chief Market Analyst Jameel Ahmad takes a look at the EURUSD movements over the past month to try and find out.

January 22: With anti-austerity party Syriza poised to win Greek elections, German Chancellor Angela Merkel warns that each member of the Eurozone must continue to “show solidarity along with responsibility to shoulder one’s own risks.” Fears of Eurozone debt crisis reignite and the euro drops.

January 23: As Syriza stretches its election lead, incumbent Greek Prime Minister, Antonis Samaras, warns of catastrophe if Syriza gets elected and reassures people that “the Tsipras accident will not happen.” The euro plummets further on fears of new unrest in Greece.

January 26 & 27: Alexis Tsipras is named new Prime Minister of Greece and announces new cabinet. Euro rises on positive feelings of change, though Germany warns it will hold Greece to austerity measures.

February 3 – 6: New Greek government enters negotiations with EU proposing a “bridging programme” and toning down its demands for debt forgiveness. Investor sentiment wavers greatly during the first week of talks.

February 16: After two weeks of negotiations, Greece’s talks with the EU break down and the euro begins to lose ground again. Greek finance minister Yanis Varoufakis deems the agreement proposed by Europe “unacceptable” and insists on receiving an “honourable agreement.”

February 20: With just one week left in the negotiation period, German finance minister, Wolfgang Schäuble says that “the letter from Athens is not a substantive solution” and the euro slides again.

February 21 - 23: Late on 20th February, Greece agrees to EU proposal and the euro gains the following day, only to fall back down again when Greece delays sending list of reforms to Europe.

So far, 2015 has been quite tempestuous for Greece, and the EUR has certainly felt the turbulence first hand. The month of January saw the EURUSD plummet from 1.20 to 1.10 and although the major catalyst behind the move was caused by the Swiss National Bank (SNB) decision to remove the EURCHF minimum exchange rate and the indication this provided to traders that the ECB would introduce QE, some of the bearish momentum did stem from the uncertainty over a possible Grexit. The EURUSD then traded in an extremely narrow range throughout February, which I think says a great deal regarding how cautious traders became over the issues surrounding Greece. It was apparent to traders from an early stage that negotiations were going to go down to the wire and because of this, the EURUSD volatility that we had become accustomed to seeing basically disappeared.

To be honest, one of the problems was that hands were tried for both negotiating parties and neither wanted to look weak by surrendering negotiating power. If you looked at it from the perspective of Greece, you had to be sympathetic to its citizens. The austerity measures are clearly tough and its citizens are continuing to face hardship. The new parliament also made ambitious promises to end austerity, which obviously were absolutely critical to the Syriza party winning the election. If Syriza can’t deliver on its promises, the credibility of the new parliament will be at risk.

On the other hand, you can also understand the complete reluctance from Greece’s creditors and its stance that Greece must abide by the terms of the bailout deal. If the creditors let Greece have its way, it would have just opened the doors for other nations to renegotiate their debt.

Although at the time of writing it looks all but confirmed that Greece will be granted a four-month extension, this basically means we are heading for round 2 in June. We will then return to the question of whether Greece will be able to come to an agreement with the EU to pay its debts, or will it exit the euro, leaving the European Union to deal with new and unpredictable dynamics in the value of its currency? No one can yet say with certainty, but what is certain is that the markets will continue to closely monitor all developments in Greece while the extension takes place.

Comparebroker is a comparison site and we spend hundreds of hours to keep the information up to date. However, users are advised to do their own due diligence and nothing can be perceived any advise. The content on the website is purely for education purposes only

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.