US Dollar Weekly Forecast: Focus shifts to data and the health of the US economy

- The US Dollar Index (DXY) bounced off 13-month lows.

- Fed officials aligned behind the idea of a September interest-rate cut.

- Markets’ attention should rotate towards data and NFP.

The US Dollar (USD) finally saw a bit of light at the end of the tunnel this week, managing to rebound from levels last recorded in mid-July 2023 near 100.50 to the area well beyond the 101.00 barrier just ahead of the closing bell on Wall Street on Friday.

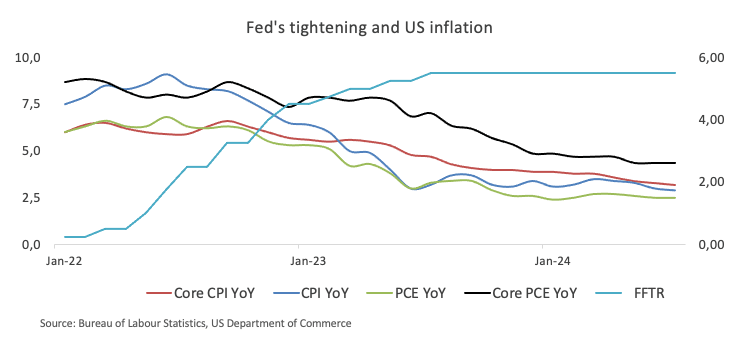

Despite the rebound seen in the latter part of the week, persistent downward pressure on the Greenback mostly stemmed from growing expectations that the Federal Reserve (Fed) might begin reducing its Fed Funds Target Range (FFTR) in September. The likely size of such a move, however, still remains uncertain and hinges almost exclusively on upcoming data releases.

Furthermore, Friday’s negative surprise from the US Personal Consumption Expenditures (PCE) Price Index in July reinforced the view that US inflation appears to be heading in a consistent direction towards the Fed’s 2% target.

A September rate cut appears certain amidst caution on the economic outlook

Investors continued to price in the likelihood that the Fed might start its easing cycle as soon as next month, a view that has also been bolstered by some Fed policymakers, albeit not without prudence. This comes in direct response to incipient concerns over the health of the US economy and, therefore, the chances of a soft landing scenario.

So far, market participants seem to lean towards a 25 bps interest rate reduction on the back of firm results from US fundamentals seen in past days. While a 50 bps rate cut is not entirely ruled out, its occurrence necessitates a further deterioration in the economic outlook, which looks pretty unlikely for the time being.

Expectations for a Fed interest rate cut next month have continued to grow this week, particularly after Chair Jerome Powell’s speech at the Jackson Hole Symposium on August 23. Furthermore, this sentiment is seemingly shared by some Fed officials.

It is worth remembering that Powell openly endorsed the idea of interest rate cuts, expressing concern about further job market cooling and conveying optimism that inflation was approaching the bank's 2% target.

Earlier this week, Richmond Federal Reserve President Thomas Barkin warned that the current "low-hiring, low-firing" approach used by US businesses might not last, and that job market concerns have grown at the Fed. His colleague at the San Francisco Federal Reserve Bank, President Mary Daly, argued that "the time is upon us" to cut borrowing costs. However, the size of the first rate cut would depend on the data. Finally, Federal Reserve Bank of Atlanta President Raphael Bostic suggested that with inflation declining further and the unemployment rate rising more than expected, it might be the right time to consider rate cuts, but he would need confirmation from the upcoming monthly jobs report and two inflation reports before the Fed's meeting on September 17-18.

According to the CME Group's FedWatch Tool, there's almost 70% probability of a quarter-point rate cut in September, while a 50 bps reduction has around 30% chance.

Looking beyond the highly anticipated September rate cut, market participants are likely to shift their focus to evaluating the US economic performance. While earlier recession fears seem to have subsided, upcoming economic indicators could still influence monetary policy decisions, especially concerning the magnitude of the expected rate reduction.

Outlook on overseas monetary policy: What to expect?

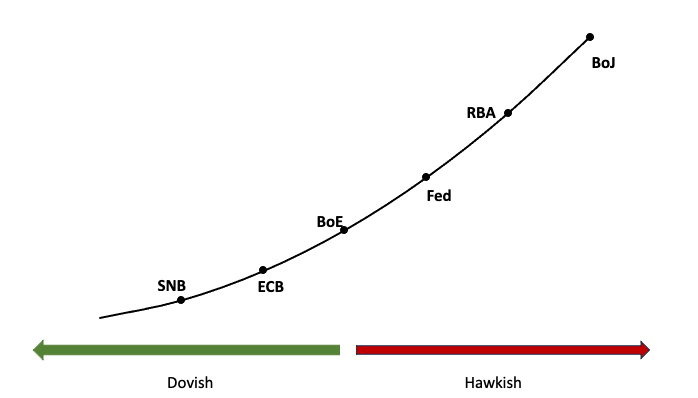

The Eurozone, Japan, Switzerland, and the United Kingdom are all experiencing increasing downward pressure on inflation. The European Central Bank (ECB) responded by implementing a 25 bps rate cut in June and maintained a cautious approach in July. While ECB policymakers remain uncertain about further rate reductions after summer, investors are already anticipating two more cuts later this year. The Swiss National Bank (SNB) made an unexpected 25 bps rate cut in June, and the Bank of England (BoE) followed suit with a quarter-point reduction on August 1. Taking a different approach, the Reserve Bank of Australia (RBA) held rates steady at its August 6 meeting, adopting a more hawkish stance. Market expectations suggest the RBA may begin easing rates at some point in Q4 2024. In contrast, the Bank of Japan (BoJ) surprised markets on July 31 with a hawkish message, raising rates by 15 bps to 0.25%.

Shifting the view to politics

Since Kamala Harris became the Democratic Party's presidential candidate for the US elections on November 5, polls are now showing a mixed outlook on the potential outcome. However, it is crucial to consider that another Trump administration, along with the potential reintroduction of tariffs, could disrupt or even reverse the current disinflationary trend in the US economy, potentially leading to a shorter cycle of rate cuts by the Fed.

US yields kept an erratic performance

US Treasury yields headed mostly lower on the short end of the curve against a gradual and persistent increase on the belly and the long end. This choppy behaviour largely reflected shifting investor sentiment regarding the Fed’s anticipated interest rate cut in the coming month.

Upcoming key events

A glimpse at next week’s economic calendar highlights the publication of the always-relevant Nonfarm Payrolls at the end of the week. Earlier, the labour market report is expected to remain at centre stage with the releases of the ADP report, and usual weekly Initial Jobless Claims. In addition, the final S&P Global PMIs are due, along with the key gauges of the manufacturing and services sectors tracked by the ISM.

Techs on the US Dollar Index

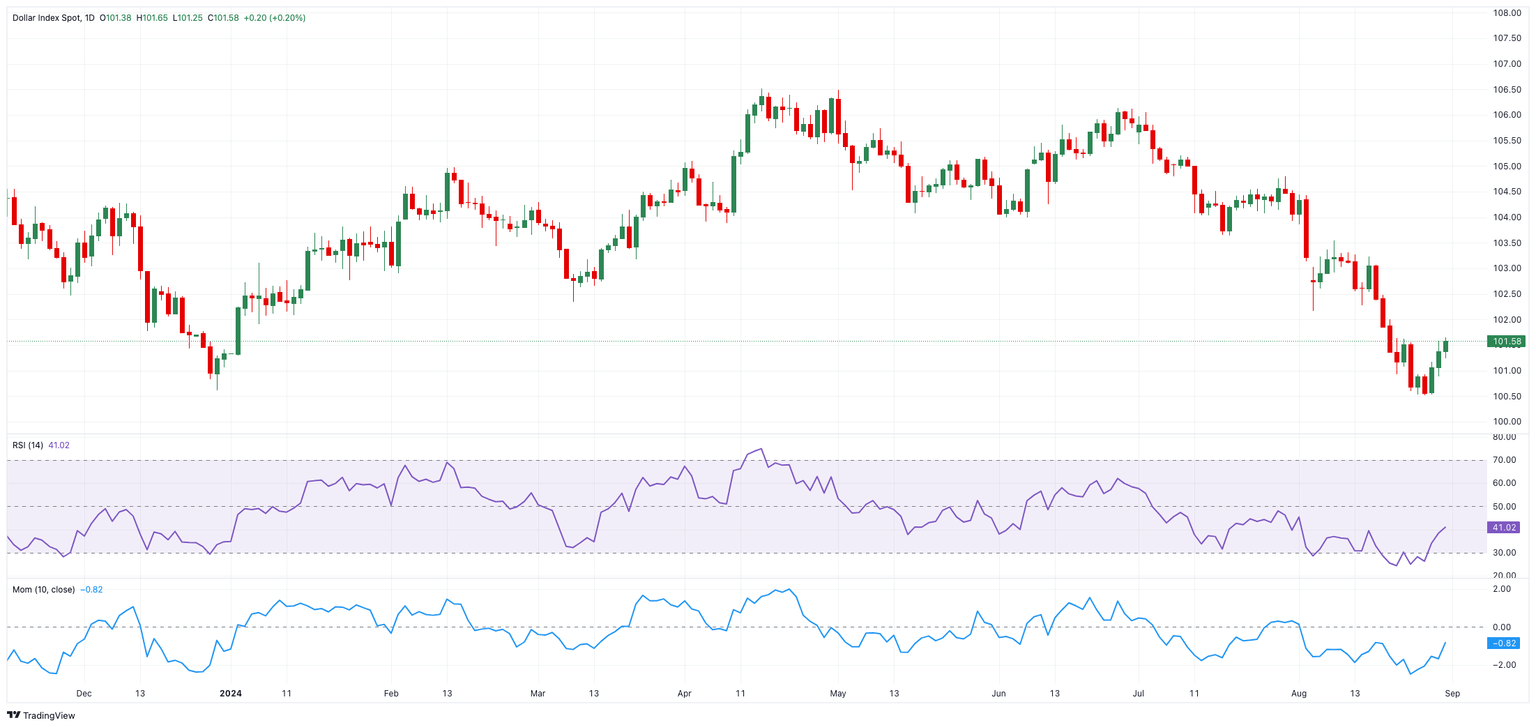

The likelihood of continued downward pressure on the US Dollar Index (DXY) has increased after it decisively broke below the crucial 200-day Simple Moving Average (SMA), currently at 103.95.

If the bearish trend persists, the DXY might initially target the 2024 low of 100.51 (reached on August 27), followed by the psychologically significant 100.00 level.

On the upside, immediate resistance appears at the August 8 weekly high of 103.54, followed by the key 200-day SMA and the July 30 weekly peak of 104.79. If this zone is trespassed, the DXY could potentially climb towards the June 26 top of 106.13 before challenging the 2024 peak of 106.51 set on April 16.

The daily chart's Relative Strength Index (RSI) rebounded to around the 40 region, after dropping to the oversold zone in previous days.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Sep 06, 2024 12:30

Frequency: Monthly

Consensus: 163K

Previous: 114K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.14% | 0.25% | 0.52% | 0.05% | 0.37% | 0.19% | 0.25% | |

| EUR | -0.14% | 0.09% | 0.39% | -0.09% | 0.23% | 0.03% | 0.11% | |

| GBP | -0.25% | -0.09% | 0.29% | -0.18% | 0.14% | -0.06% | 0.01% | |

| JPY | -0.52% | -0.39% | -0.29% | -0.45% | -0.13% | -0.34% | -0.26% | |

| CAD | -0.05% | 0.09% | 0.18% | 0.45% | 0.30% | 0.13% | 0.19% | |

| AUD | -0.37% | -0.23% | -0.14% | 0.13% | -0.30% | -0.21% | -0.13% | |

| NZD | -0.19% | -0.03% | 0.06% | 0.34% | -0.13% | 0.21% | 0.08% | |

| CHF | -0.25% | -0.11% | -0.01% | 0.26% | -0.19% | 0.13% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.