FTSE - a tale of two trend lines

The FTSE has been one of the better performing indices in the latest run up but having broken key resistance at 6130-50 last week it failed to hold above this area. Monday will see two important trend lines come together around the 6115-20 area. One marks the lower highs from the past two weeks and the other is the steep up trend from the most recent lows. If we break below this area on Monday and hold then shorts will be favoured with support on the way down at 6065 and 6045-50. A further break below here will target the gap close at 6000.I would only want to be long if we see a daily close above the 6150 area, and even then stops should be tight at 6120.

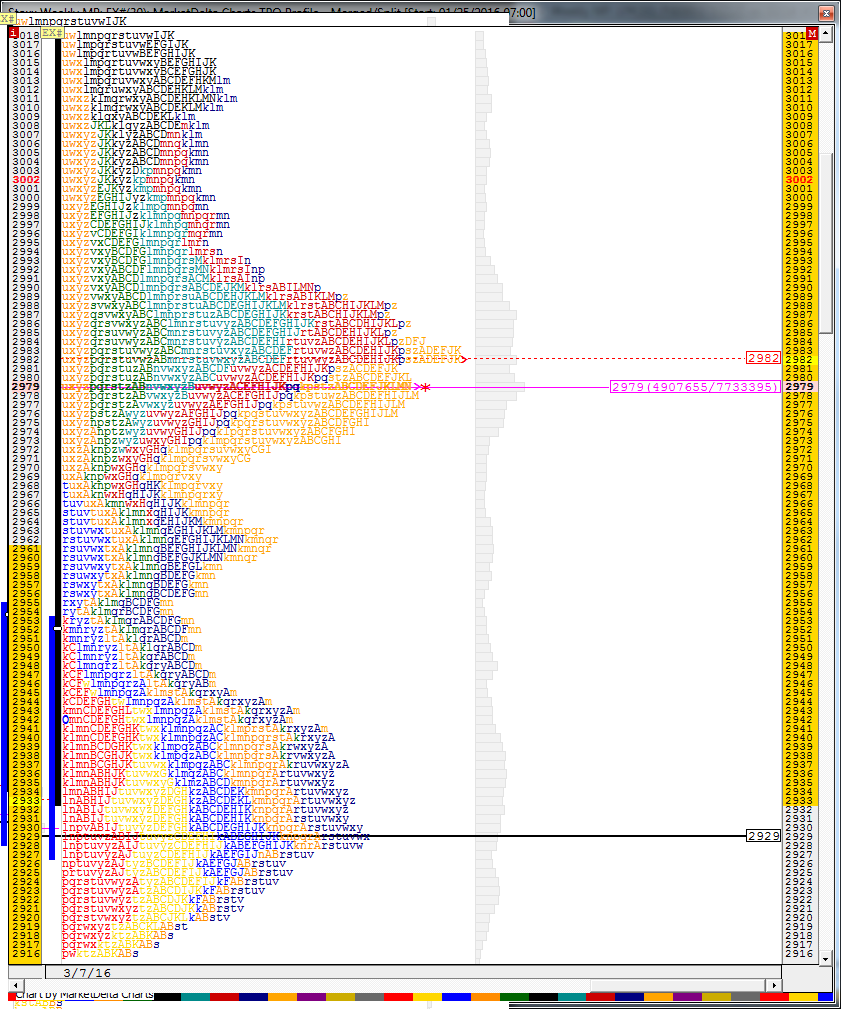

Eurostoxx in acceptance zone

This Stoxx chart shows the last two weeks of trading merged together. You can see it closed right on the VPOC of this balance zone which is right in the most accepted area. For a bullish bias I think we need to see prices trade back above 2995. Then I would expect another run towards the most recent highs. If we stay below this area though I wouldn't be surprised to see lower prices this week with the LVN/midpoint at 2952/5 the key target below. Once through here 2929 becomes the next key objective. Some filling out of this range may be required this week before the market decides where the next big move is going.

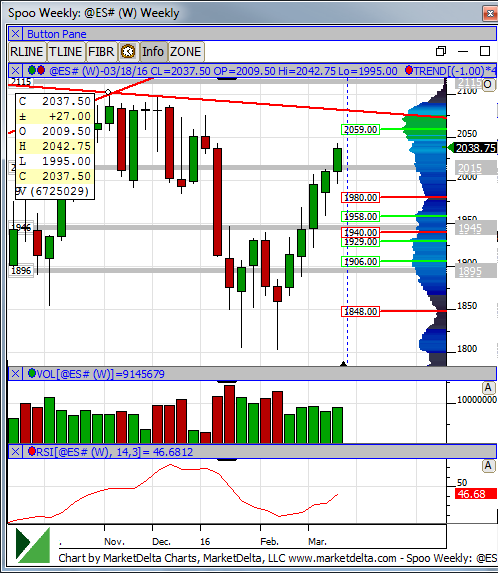

Spoo weekly still 1 time framing

The weekly Spoo chart underlines just how strong this most recent rally has been from the lows and we are now into the 5th week of 1 time framing. For now important overhead resistance lies at the trend line around 2070. Until that is broken and we get a close above there I would have to err on the side of caution for longs now as this move seems to be getting a little long in the tooth. So long as we remain above 2000 this week may be a range play but any break below here and we should see plenty of weak longs start to run for the hills with 1955 the key target below.

.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.