Crude

After the expiration of July contract on Brent, the new front-month contract (i.e. August) is trading above 64 USD/bbl today in early trading. In other words, yesterday’s oil price slide could be to a large extent attributed to the expiration of July’s contract. As regards the reaction to weaker than expected US data released later during the session, the oil price actually increased on disappointing US industrial production data as the dollar weakened.

An interesting piece of data was also released by the ICE on Monday. A so called Commitment of Traders report showed that net speculative position in Brent futures fell further last week mainly due to an increase in number of short contracts held by speculators. At the same time, number of traders holding short position increased quite significantly last week and was therefore well above its common historical level which signals that bearish mood among speculators may be growing.

Metals

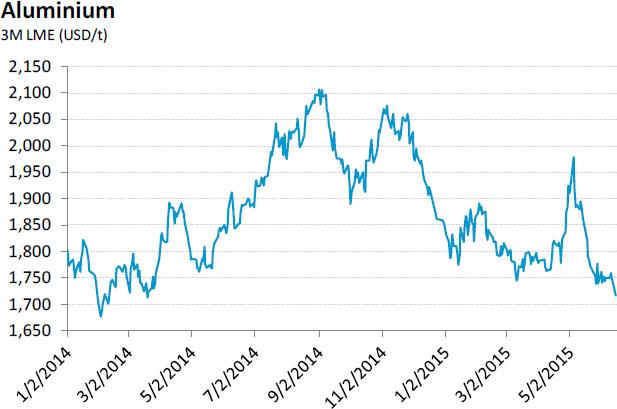

Base metals prices fell by about 1.1% on average on Monday. The latest development of aluminium prices has been particularly interesting as not only that LME prices have been falling in recent weeks (see the chart below) but physical premiums have also been under pressure recently. This means that the pressure on producers of the metal has been mounting lately. On the other hand, let us recall that recent slump in prices could probably be to a great extent attributed to soaring production of the metal in China whose production has traditionally been resilient to deterioration in market conditions...

Chart of the day:

Aluminium price hit a fifteen-month low yesterday.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.