Crude

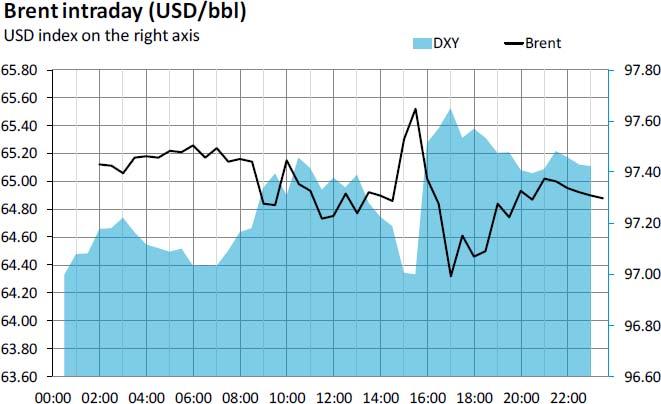

After soaring by more than 4% on Friday, the oil price fell by about a percent yesterday and the front-month contract on Brent thus returned below 65 USD/bbl. The move was probably driven mainly by the strengthening US dollar but market positioning ahead of this Friday’s OPEC meeting could also have played a role.

Regarding possible outcomes of the meeting, our expectations are in line with those of market and we do not expect any change in the cartel’s policy. Key members of the OPEC, namely Saudi Arabia and its Gulf allies, are likely to be happy with a swift reaction of US oil producers on the one hand and with relatively stronger growth of oil demand (vis-à-vis last year’s estimates) that has been spurred by low oil prices on the other. Let us recall that a combination of both factors led to about 13% increase in oil prices on a year-to-date basis.

Metals

Although base metals prices were on average only little changed yesterday, aluminium and nickel in particular grew quite strongly.

The metals more or less ignored China’s PMI which came out broadly in line with market expectations. The official index showed that growth in China’s factory sector edged up to a six-month high in May, but export demand shrank and jobs were shed. The headline index improved marginally, from 50.1 to 50.2. On the other hand, a private survey conducted by Markit showed a somehow more negative picture as the headline index remained at its flash estimate at 49.2 point. China’s PMI figures thus confirmed that risks for base metals prices remain tilted to the downside.

Chart of the day:

Brent vs DXY on 6/1/2015.a

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.