Crude

The oil price got under a modest pressure today in early morning as China’s PMI flash estimate for March surprised significantly to the downside and Saudi Arabia said that its oil production is close to 10 million barrels per day. Moreover, Saudi’s oil minister Naimi said that his country is willing to supply even more oil if needed. The latest comments thus confirm that the kingdom sticks to its policy announced in November last year and is not willing to give up its market share in favor of other producers.

Regarding news, CEO of Schlumberger – one of major oilfield service companies – said that a sharp decline in oil prices could have a permanent effect on US shale oil producers in a sense that oil producers would be more prudent while investing into new production capacities. Let us recall that, according to the latest EIA Drilling Productivity Report, oil production may slightly decline in three major US shale oil producing regions as soon as in April as a result of slumping number of active rig count and high decline in oil production from legacy wells.

We believe that factors mentioned above support our scenario that bets on a decline in oil prices in months to come and their recovery above current levels towards the end of this year.

Metals

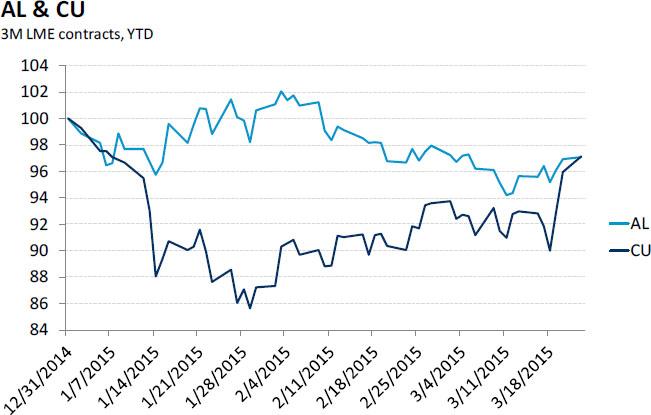

After hitting a nearly four-month high in early morning, the price of copper (LME 3M) got under modest pressure after the release of flash estimate of China’s PMI. After having expanded in February, the Chinese manufacturing sector fell back into contraction in March as new orders shrank. The HSBC manufacturing PMI dropped from 50.7 to 49.2, its lowest level in 11 months, while only a marginal decline was expected.

Although base metals prices are traditionally sensitive to any signs of slowing demand in China, the impact of worse than expected PMI has so far been rather limited as market probably bets on an introduction of pro-growth measures should the prospects of China’s economy further deteriorate.

Chart of the day:

Copper price hit a nearly four-month high today in early trading

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.