Crude

November’s contract on Brent expired yesterday in a relatively deep discount to December’s contract which basically means that the price of oil is seen a bit higher today in early trading. The new front-month contract on Brent is trading slightly below 86 USD/barrel level; yet, Brent is set to post quite sharp losses for the fourth week in a row.

Yesterday, oil has been supported by lower than expected figure on US initial claims while a sharp build in US crude oil stockpiles (which has been at least partly offset by decline in gasoline inventories as refineries cut utilization rates) had only a negligible impact.

Base Metals

Base metals prices were under a relatively strong selling pressure over the past two days and three month copper price (LME) fell to a six-month low yesterday. This time, overall demand worries and continuing sell-off in equity markets have probably played a role rather than effects of US dollar (which in fact slightly weakened yesterday).

Regarding the strong US initial jobless claims data (the figure was the lowest since April 2000) released yesterday, its impact has also been negligible although it somehow softened rather negative news from the US from the day before (Empire manufacturing, retail sales).

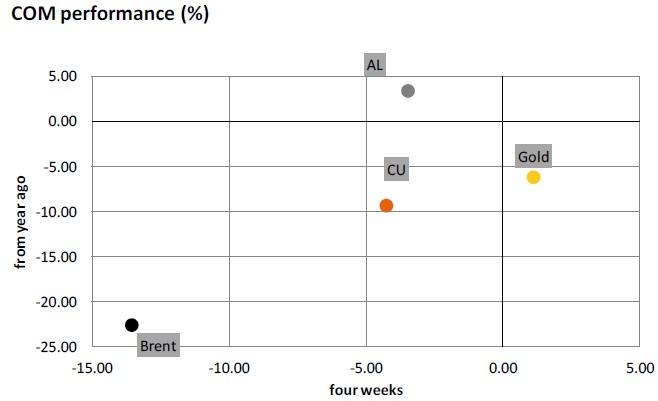

Chart of the day:

The oil price is seen sharply lower vis-à-vis a year ago…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.