Outlook:

Over the holiday, the number one-twenty popped unbidden into our head. Can it be a euro forecast? You bet. See the monthly chart below. The horizontal red line marks 1.20. The level would mean the blue resistance line would get broken, but resistance lines are more of a suggested region than a hard number, anyway. The euro at 1.20 is not a wild forecast. If the move persists, the end point could be a whole lot higher.

Loud warning: securities prices do not move in a straight line. We have to keep repeating this obvious fact because so many analysts see a move and extrapolate much too far. We don’t want to do that, and besides, forecasting the dollar’s demise has become so widespread that we are vulnerable to a bull attack. Don’t dismiss that some Big Boys might stage such a thing—a short squeeze—just to make a few bucks. Well, a lot of bucks.

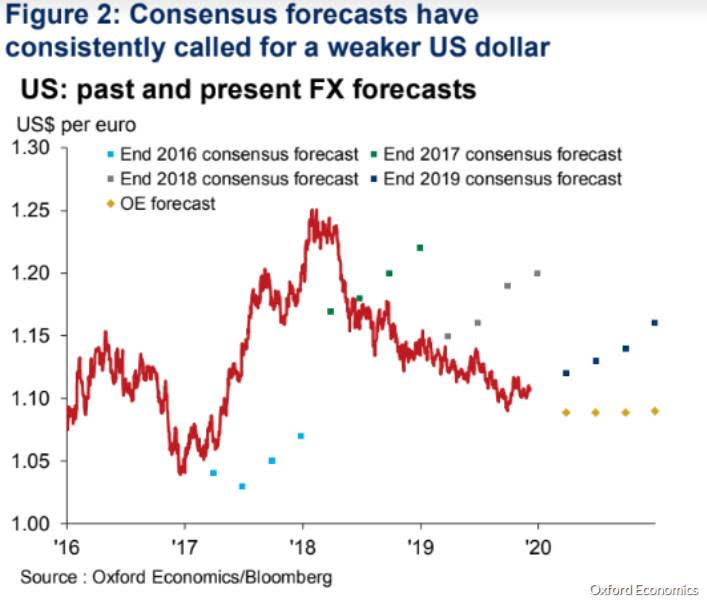

See the Oxford Economics summary of forecasts. The MarketWatch story says Oxford names a number of reasons why the dollar downfall forecast might be wrong. First is that the global slowdown is more harmful to all other economies than to the US. Second is the US having some return, if not a positive real return, compared to negative nominal and real returns elsewhere. And finally, there are the US twin deficits.

We can start a rebuttal but noting that the twin deficits are an outdated and ineffective argument from decades ago. The dollar does not move when US reports trade or budget deficits. If it’s a factor, it’s so well hidden that nobody ever mentions it anymore.

Another refutation applies both to the slowing economies and the yield differential. Yes, the US has the advantage, but it’s not the absolute numerical difference that counts—it’s the direction of the change. If the US keeps trundling along at 2% (from 3.5%) while some other country is getting 1%, the dollar can still lose advantage if that other country’s 1% is a rise from zero. Trajectory/momentum matter.

Finally, we are not willing to give up our idea that US politics count. Trump is a unique, once-in-history Event all by himself. Kissing up to N. Korea was weird and has now backfired. Going from a stance of getting out of stupid wars to threatening Iran is worse than weird. The China trade deal is fake. Trump was impeached for abuse of power but there are 77 other things he can be charged with, including the emoluments clause and tax fraud. Trump is a train wreck. As the New Yorker has it, we all have “Trumpschmerz” or pain, fear and loathing from Trump.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.