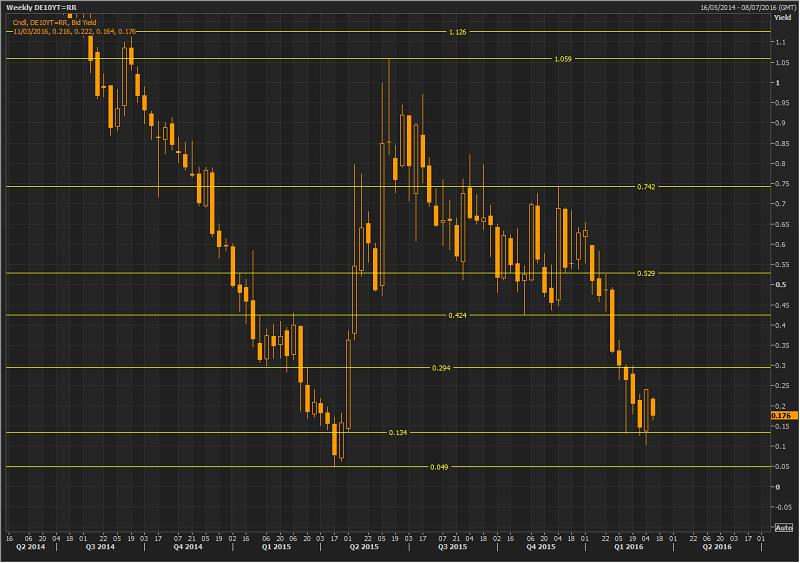

Bund Yields Rise

Last week we saw the BundMarch 16 futures progressively roll to the June 16 contract and with that camea wave of selling which led to a rise in the yields. The level of interest forsellers came at the 10bp mark. With the ECB meeting coming up, it's importantto note that there has been some strong longs positioning with about 40bp dropsince the last ECB meeting. If we get a strong signal of increased QE purchasesthat could induce more buying as there will be strong supply demand issues todrive yields lower. If however we see an increase in QE but only in corporatebonds, there could be a good chance Bunds sell off aggressively as this willcount as credit easing and equity markets will likely rally leading to risk onflows.

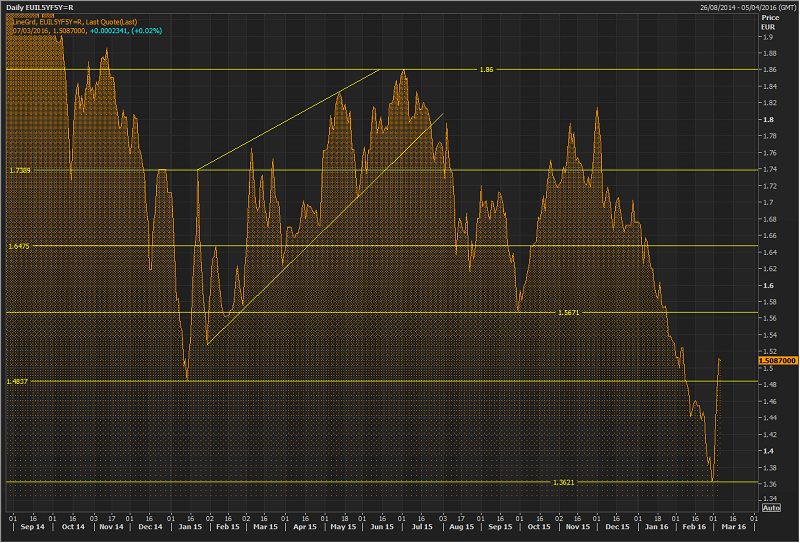

5y5y InflationSwaps Rebounding Aggressively into the ECB

Coming into the allimportant ECB meeting this week, the 5y5y inflation swap forwards have beenrallying aggressively, most probably due to investors and traders believing theECB will act to spark some inflation and also on the back of a strong commoditycomplex recently. Since the last ECB meeting, the swap rate has come off from1.57% down to the low at 1.36% and the bounce recently has us just above 1.5%.This rate is hugely important for the ECB as it measures the medium terminflation expectations of the market and thus shows us that if they do not actbig and shift their language to an even more dovish tone, the market may beginto price in potential deflationary scenarios.

.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.