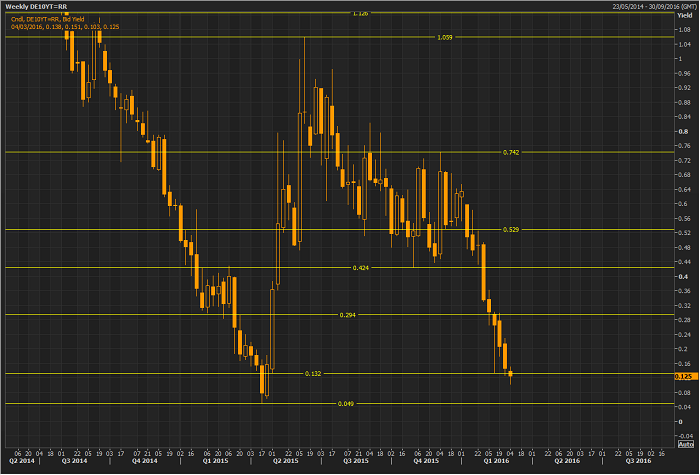

Bund Nearing theAll-Time Low in Yield

Bund yields have beengetting crushed on a weekly basis as can be seen in the chart above. With theMarch ECB meeting nearing and inflation expectations plummeting, the market hascontinued its run towards the negative yields. Currently the German curve isnegative all the way up until the 9 year paper. Current levels remain at the13.2bp and below at the all-time low of 4.9bp.

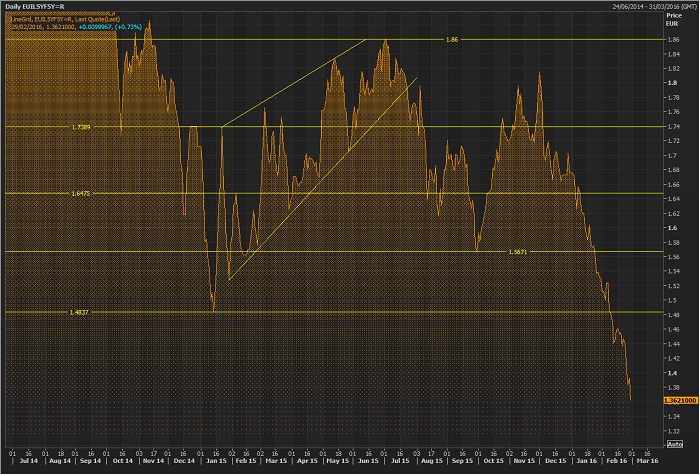

2s10s SpreadFlattening Further

The 2 year Tnotes vs the 10year Tnotes spread is now trading below 100bp with further flattening suppressing the US yield curve further as the Fed may stick to their path ofhiking rates in an environment where growth and inflation expectations areglobally low. This is a chart that we have been pointing to for over a yearnow, and if the Fed sticks to their path there could be much more flattening tocome as has been seen in previous hiking cycles.

5y5y InflationSwaps Continue to Break Lower

Ahead of the ECB, this isone of the most important charts to keep in mind. The ECB have increased thescope and duration of QE in late 2015 however the market has clearly statedthat it does not believe what they have done is enough to increase inflation.The ECB will likely be looking at this chart, as it is one of their preferredmeasures of medium term inflation expectations, and thinking they need toexecute very aggressively with their monetary policy in order to regainconfidence from the market. Otherwise the economy could begin to believe in adeflationary spiral which is exactly what the ECB do not want.

.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

USD/JPY holds positive ground above 155.50 following the BoJ Summary of Opinions

The USD/JPY pair trades in positive territory for the fourth consecutive day around 155.60 during the early Asian trading hours on Thursday. However, the fear of further intervention from the Bank of Japan is likely to cap the downside of the Japanese Yen for the time being.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.