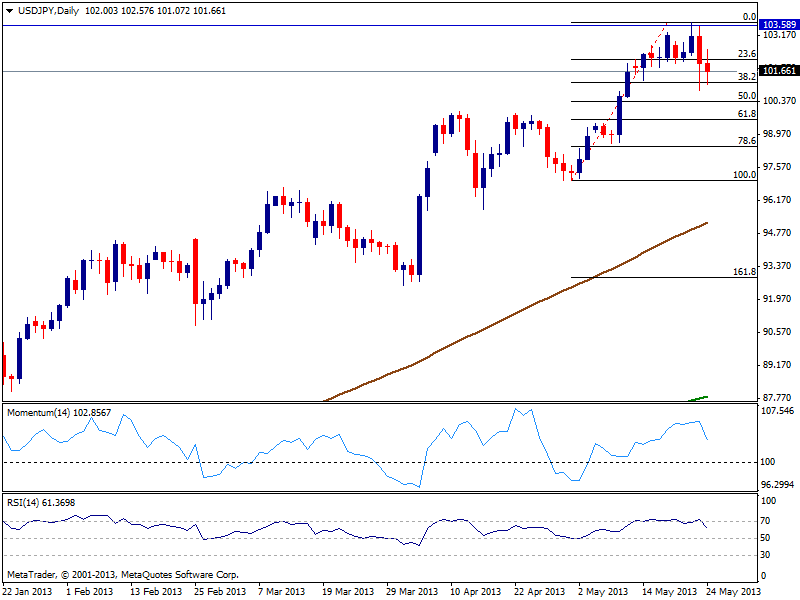

A weekly close below that mark will be however a different story, with further downward correction expected towards 99.50/70 price zone, 61.8% retracement of the same rally and past April highs. Daily chart shows indicators heading lower, finally correcting the overbought readings seen for the past two weeks, which supports some probable correction ahead. However, even if the 99.50/70 area is reached, the long term perspective won’t change as a quick recovery should follow on approaches to the 100.00 level.

But the upside seems now not that easy after 8 months of straight rises and 103.60 has proved strong. Investors will need a high dose of convincement to continue buying at current levels, either further BOJ easing or signs of dollar strength, neither quite clear at the time being. Steady gains above 103.60 however, should lead to an extension towards 105.00, this upcoming week, as there’s not much in the middle.

View Live Chart for USD/JPY

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.