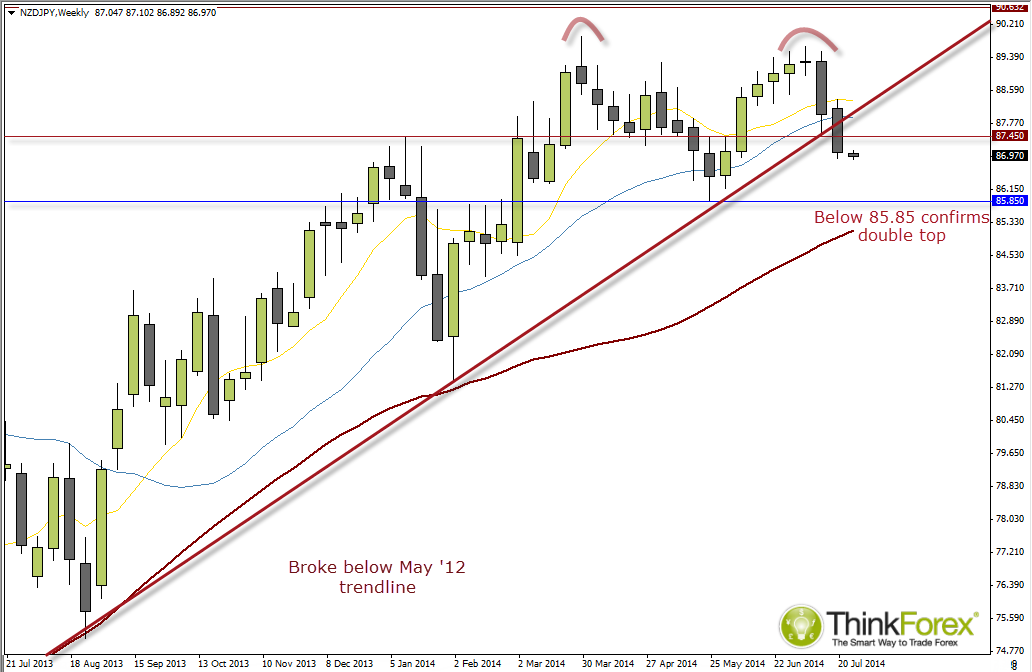

After highlighting the potential for a topping pattern to be forming, losses accelerated to treat traders to some much needed volatility.

The week closed by breaking below the bullish trendline from the 2012 lows to suggest a deeper bearish move may be underway. Whilst not pictured above, we did previously highlight that the 50 period DPO had formed a bearish divergence and suggested a retracement back towards the 50-week moving average was likely. At time of writing the 50-week MA is around 85.14, but a more obvious price target is the 85.85 swing low in May this year.

The Futures volume shows that the decline was seen with suitably bearish volume so at this stage we expect to see the decline continue and for any rally to be capped by 87.45 resistances.

The Futures volume shows that the decline was seen with suitably bearish volume so at this stage we expect to see the decline continue and for any rally to be capped by 87.45 resistances.

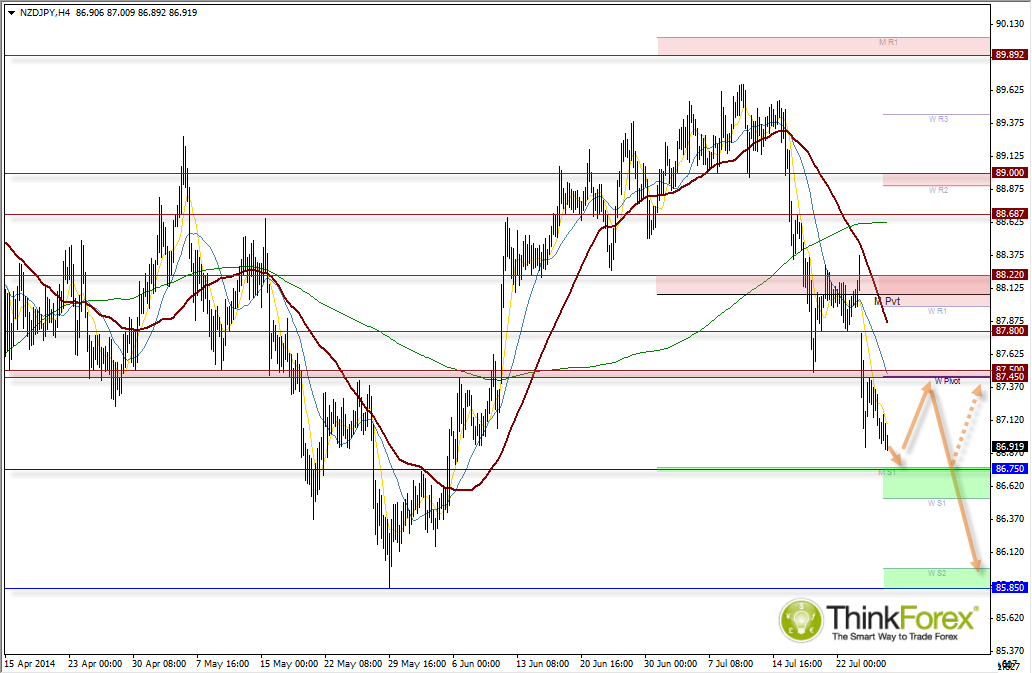

Currently trading near last week’s lows the decline has slowed somewhat but this still leaves room for a dip down to 86.76 (MS1) before we see any retracements. Take note of the breakaway gap which occurred when NZD raised interest rates. This gap appears to be a 'breakaway' gap (also called a measuring gap) which if successful will project a target around 85.90, May lows.

- Due to the gap I suspect retracements to be limited and for 87.45-50 to cap as resistance

- A break above 87.50 raises the odds of the gap closing

- A break above 88.40 invalidates the bias for price to test 85.85

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.