A snapshot view of yesterday’s New York - London session with technical notes.

BoE Votes show no change in the stance for interest rate rises - all coma in unanimously to remain on hold. However in the following statement Carney stated rate rises are drawing closer. Mortgage approvals remained steady but Retail Sales fell short of expectations at +0.1% vs +0.3% forecast. This saw GBP sell off early London trading but recover losses through the session.

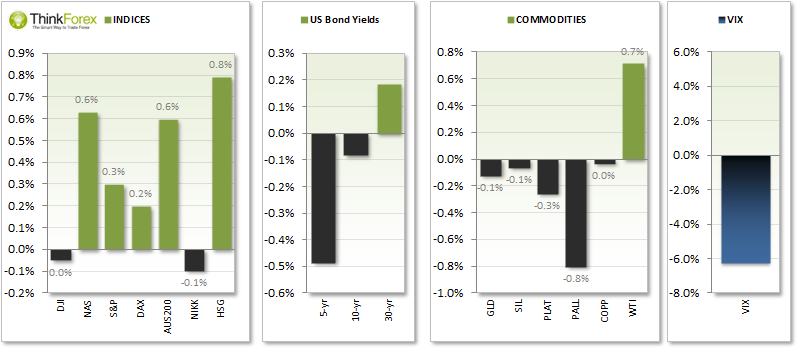

S&P500 closes at record highs following positive earnings

VIX (fear gauge) retreats further and now sits at similar levels pre Malaysian Flight MH17 crashed

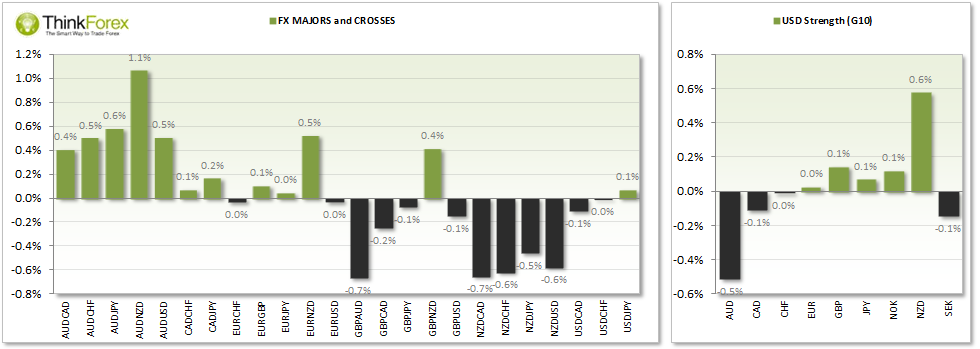

FOREX:

DXY Rikshaw Man Doji warns of sideways trading; Intraday shows potential for a bearish wedge to form (and create new highs) prior to retracement

AUDUSD Back above 94c but meandering around 0.945; Expecting a pullback but open to the idea of gain above 0.945

EURUSD Trades cautiously sideways; Bias is for a 'pop' higher towards 1.35 before losses resume

GBPUSD Edges lower but closed on 1.704 support; Seeking buy setups above 1.07

USDCAD Continues to hover above 1.07 with potential base forming to an upside break above bearish trendline from March '12 highs

USDCHF Rikshaw Man Doji warns of sideways trading, lower volume makes it less likely to be a retracement

USDJPY Neutral bias on D1

NZDUSD Bearish bias below 0.8650 on D1; See today's post for technical levels

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.