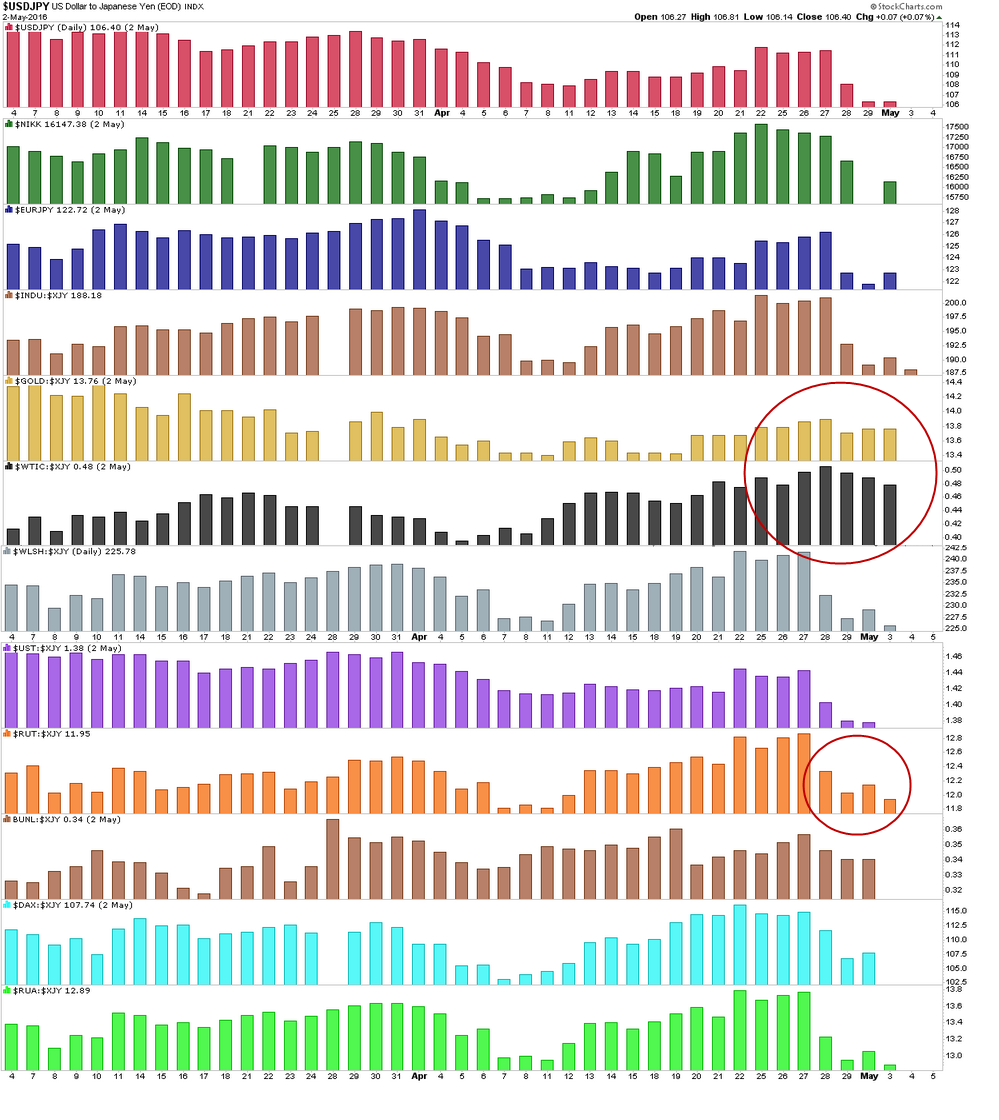

One of the ways we have to monitor current capital flows is looking at development of the yen in recent trading and to track price behavior of some benchmarks priced in the Japanese currency.

On the 22nd, in a knee-jerk reaction to the BOJ headlines on negative interest rates the USDJPY was about to climb back into positive territory for the month, but from the 28th on it has been all downhill after the BOJ disappointed markets by keeping its monetary policy setting unadjusted.

More recently, the Dax and German Bunds found that challenge just a step too far and finished last week with some of the losses recaptured, whereas major currencies such as USD and EUR kept an heavy tone against the yen.

In the equities world, Russel 2000 had similar modest end-of-week recoveries and seemed to contain the damage better of than the and 3000, the broad Wilshire or the Dow Jones Industrials Average.

This hints to what issues are holding the market up, besides from treasuries, notably small-cap stocks considered less risky. Commodities also kept its chin up when priced in yen. In dollar terms, gold flirted with January's highs, and Oil with its highest level since November last year. It is this combination which is casting a shadow on risk sentiment and the one to monitor these days.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.