- The impulsive moves out of the January squeeze brought the Euro is back in familiar territory against the dollar as we can see from a broader view;

- Another successful bullish offensive overcoming the high made on the 11th can propel the pair out of the ascending channel resistance and shoot towards 1.16 and above;

- The risk, like we have seen in gold recently, is that a bounce turns into a major squeeze towards 1.22;

- My personal bias is bullish as long as we stay within this channel, specially in the upper half of it;

- The mid-term downside risk implied by an eventual failure below the ascending channel base at 1.0900 offers a potential recapture of the previous swing low at 1.0400:

- As a cautious reminder heading into next week: a trend line cross coming in around the 26th-29th could mark the next turning point or acceleration date;

- In volatility terms we are expanding, so mixed with directional changes it can become interesting and all together this pair can try to relocate temporarily to a new auction zone;

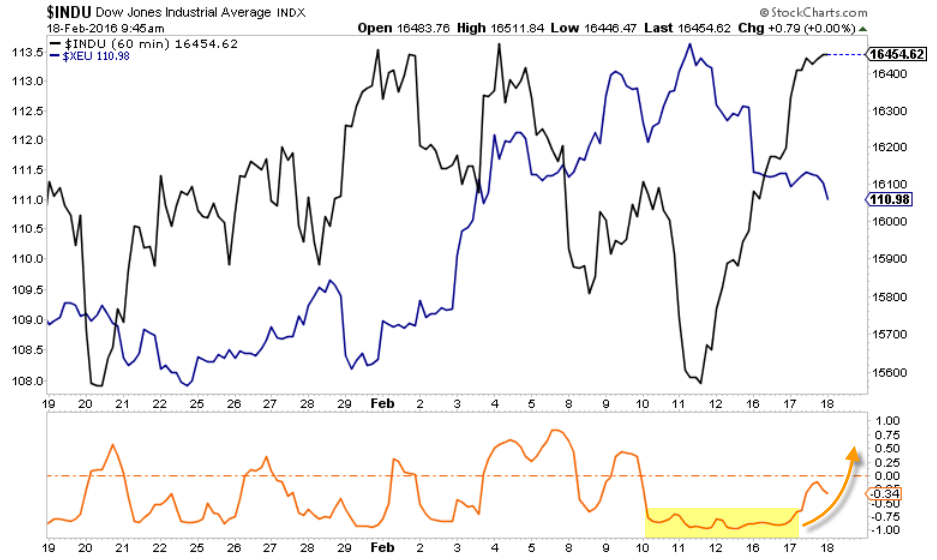

- Looks like global capital, in Dow Jones terms, has been painting a predominantly negative correlation to the EUR/USD, specially in recent trading days. If conditions become tense and anxious for the Euro, we may see both assets decoupling the correlation. Dow’s technical landscape suggests the negotiaon of a new bull move towards 17,000 is in the making. The Dow is flirting with the 16,500 highs from recent weeks. A perfect negative correlation would see the EURUSD now at 1.0900. Just saying...

- My bidding interest aims for a bit lower execution and just bought at 1.1075. Next buy comes at 1.0902 and 1.0850

- A sell limit is awaiting for a brief retracement to 1.1250 to get executed. Follow me on twitter for real time execution updates.

The trading methodology reported in this analysis is based on a non-directional approach. It is meant to capture the most amount of pips from the constant price oscillations, either up or down. Each trade has a take profit of 50 pips, a stop loss of 500 pips. The size of each trade is regular, but trades can be stacked around key support and resistance zones, increasing the overall position size around certain price zones. The system can perform either in trending or range bound markets, but it suffers when there is an extreme unidirectional price advance. Buy and sell positions are taken with two separate real accounts.

To learn more about the method, you can watch these special webinar series:

Exploring the Coast Line of Foreign Exchange Land - Part I

Exploring the Coast Line of Foreign Exchange Land - Part II

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.