- EUR/USD glued to weekly Pivot Point (1.1210) as well as to the 200-hour and 200-4H and 200-day SMAs

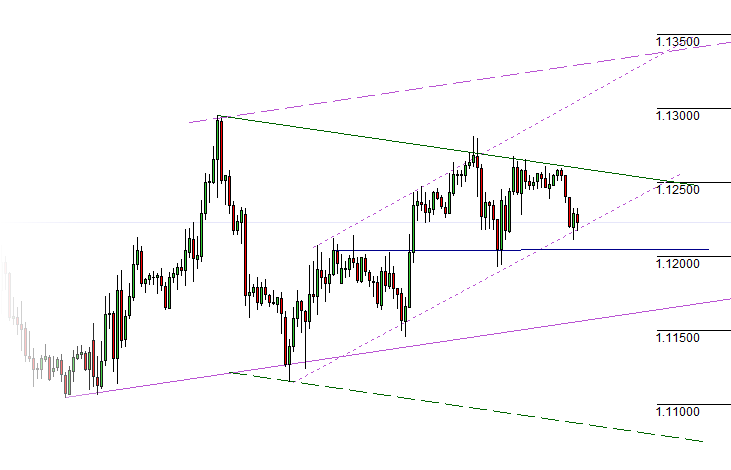

- The RSI(14) warns that momentum has waned with its printing around 50% on these same time frames increasing the risk of breakout either way as we approach the triangle's apex (see chart).

- Shorter horizon charts show interplaying of ascending channel within a symmetrical triangle which could morph into an up- or down trending channel on the aforementioned breakout.

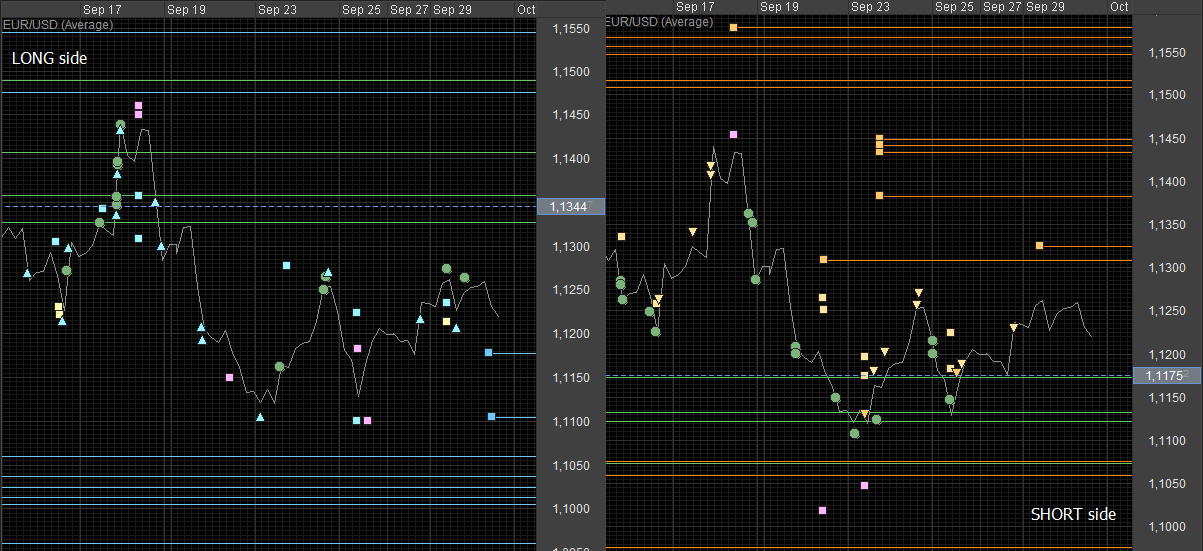

- My contemption is still that we will drop to the long term support line from the March and April lows, thus clustering buy orders around 1.10 with buy limits at 1.1059, 1.1037, 1.1024, 1.1013, and 1.1004. Open longs situated at 1.1111, 1.1189, 1.1214 are closed now and new longs were opened just above 1.12 and already closed (see chart).

- On the sell side, a recent upward retracement activated sell limits now open at at 1.1171, 1.1181, and 1.1223. Limits still to be activated are at 1.1308, 1.1324 and 1.1382. More limits awaiting around 1.1450

- Sell stops are to be triggered on a dip to the aforementioned channel at 1.1075 and 1.1059.

The trading methodology reported in this analysis is based on a non-directional approach. It is meant to capture the most amount of pips from the constant price oscillations, either up or down. Each trade has a take profit of 50 pips, a stop loss of 500 pips. The size of each trade is regular, but trades can be stacked around key support and resistance zones, increasing the overall position size around certain price zones. The system can perform either in trending or range bound markets, but it suffers when there is an extreme unidirectional price advance. Buy and sell positions are taken with two separate real accounts.

To learn more about the method, you can watch these special webinar series:

Exploring the Coast Line of Foreign Exchange Land - Part I

Exploring the Coast Line of Foreign Exchange Land - Part II

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.