Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

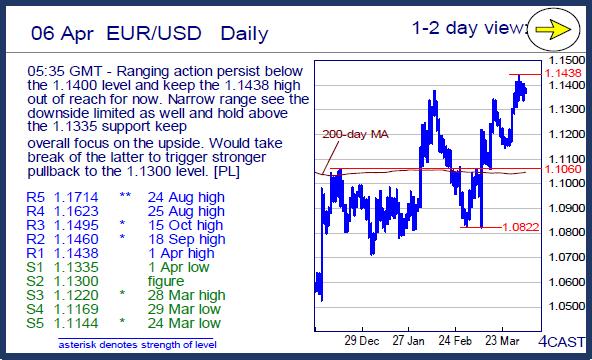

EUR/USD

Ranging action persist below the 1.1400 level and keep the 1.1438 high out of reach for now. Narrow range see the downside limited as well and hold above the 1.1335 support keep overall focus on the upside. Would take break of the latter to trigger stronger pullback to the 1.1300 level. [PL]

USD/CHF

Still struggling for traction below the .9600 level though divergence on intraday tools caution bounce to consolidate the down-leg from .9788 high of last week. Would need to regain the .9600/26 area to see room for stronger recovery to the .9651/61 recent lows. Above the latter needed to fade downside pressure. [PL]

USD/JPY

Off the 109.95 low to consolidate the drop from 113.80 high last week but upside seen limited with resistance now at 111.00/10 area and 111.75. While the 112.00 level caps, lower high sought to further pressure the downside and risk seen for break lower to extend deeper pullback. [PL]

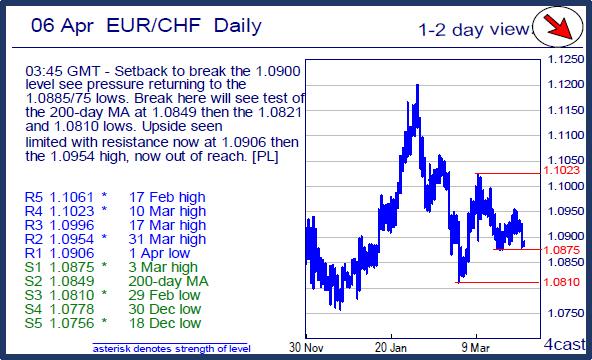

EUR/CHF

Setback to break the 1.0900 level see pressure returning to the 1.0885/75 lows. Break here will see test of the 200-day MA at 1.0849 then the 1.0821 and 1.0810 lows. Upside seen limited with resistance now at 1.0906 then the 1.0954 high, now out of reach. [PL]

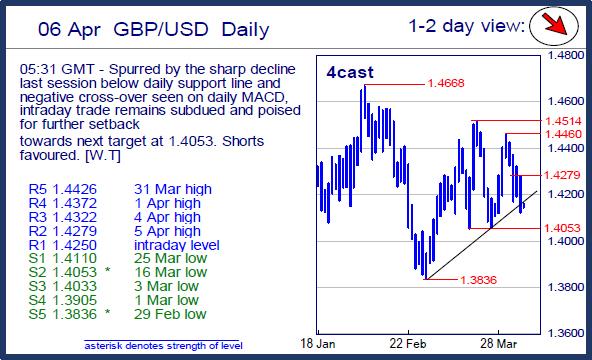

GBP/USD

Spurred by the sharp decline last session below daily support line and negative cross-over seen on daily MACD, intraday trade remains subdued and poised for further setback towards next target at 1.4053. Shorts favoured. [W.T]

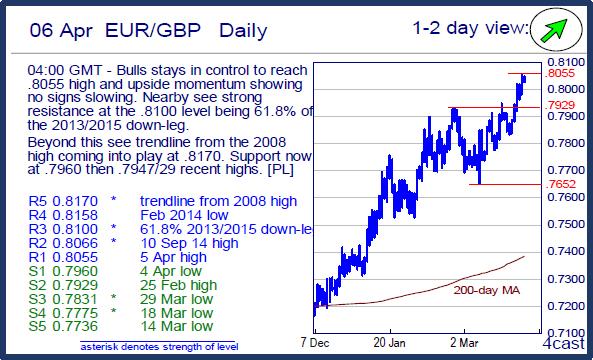

EUR/GBP

Bulls stays in control to reach .8055 high and upside momentum showing no signs slowing. Nearby see strong resistance at the .8100 level being 61.8% of the 2013/2015 down-leg. Beyond this see trendline from the 2008 high coming into play at .8170. Support now at .7960 then .7947/29 recent highs. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.