Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

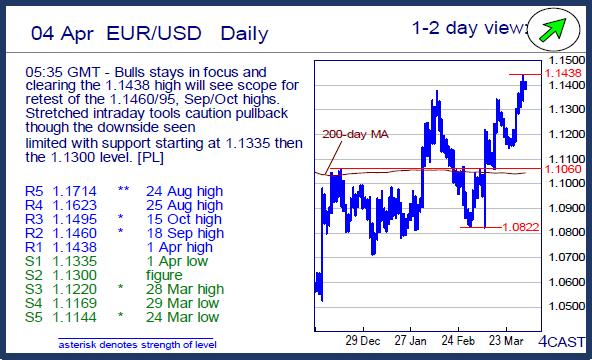

EUR/USD

Bulls stays in focus and clearing the 1.1438 high will see scope for retest of the 1.1460/95, Sep/Oct highs. Stretched intraday tools caution pullback though the downside seen limited with support starting at 1.1335 then the 1.1300 level. [PL]

USD/CHF

Pressure stays on the downside with break of the .9600 level last week shifting focus to the .9500 level then .9476, Oct low. Upside seen limited with resistance starting at .9626 then the .9651/61 recent lows. Regaining the latter needed to fade the downside pressure and trigger recovery. [PL]

USD/JPY

Pressure stays on the downside to reach 111.32 low following the breakdown from the 112.00 level on Fri. Below the latter return focus to the 111.00 level then the 110.67 low. Resistance now at the 112.00 level then the 112.45/66 area. Would need to regain the latter to fade downside pressure. [PL]

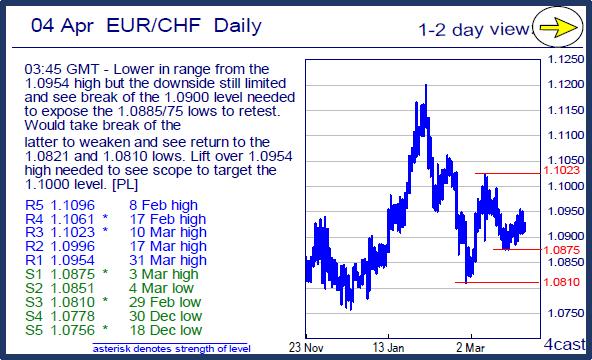

EUR/CHF

Lower in range from the 1.0954 high but the downside still limited and see break of the 1.0900 level needed to expose the 1.0885/75 lows to retest. Would take break of the latter to weaken and see return to the 1.0821 and 1.0810 lows. Lift over 1.0954 high needed to see scope to target the 1.1000 level. [PL]

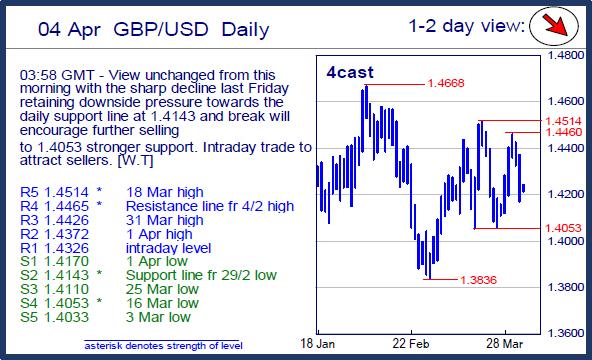

GBP/USD

View unchanged from this morning with the sharp decline last Friday retaining downside pressure towards the daily support line at 1.4143 and break will encourage further selling to 1.4053 stronger support. Intraday trade to attract sellers. [W.T]

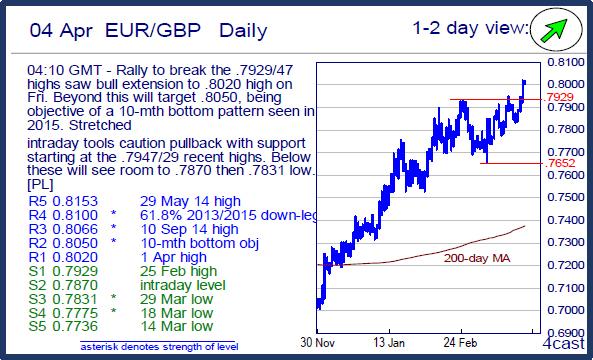

EUR/GBP

Rally to break the .7929/47 highs saw bull extension to .8020 high on Fri. Beyond this will target .8050, being objective of a 10-mth bottom pattern seen in 2015. Stretched intraday tools caution pullback with support starting at the .7947/29 recent highs. Below these will see room to .7870 then .7831 low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.