EUR/USD

Pressure stays on the downside from the 1.1342 high and break of the 1.1218/00 area see risk for deeper correction. Lower will see scope to the 1.1125 support then the 1.1058/42 area. Upside seen limited with resistance now at 1.1260 and the 1.1300 level. [PL]

EUR/CHF

Break of the 1.0893 support saw the downside checked at 1.0879/75 area and rebound to regain the 1.0900 level sets up scope for stronger recovery to the 1.0944 and 1.0996 high. Would need lift over the latter to clear the way for stronger recovery to the 1.1023 and 1.1061 highs. [PL]

USD/CHF

Edging higher from the .9651 low to consolidate sharp drop last week from the .9914 high of last week. However, upside still limited with resistance now at .9750 then the 200-day MA at .9807. Lower high sought to further pressure the downside later for retest of the .9661/51 lows. [PL]

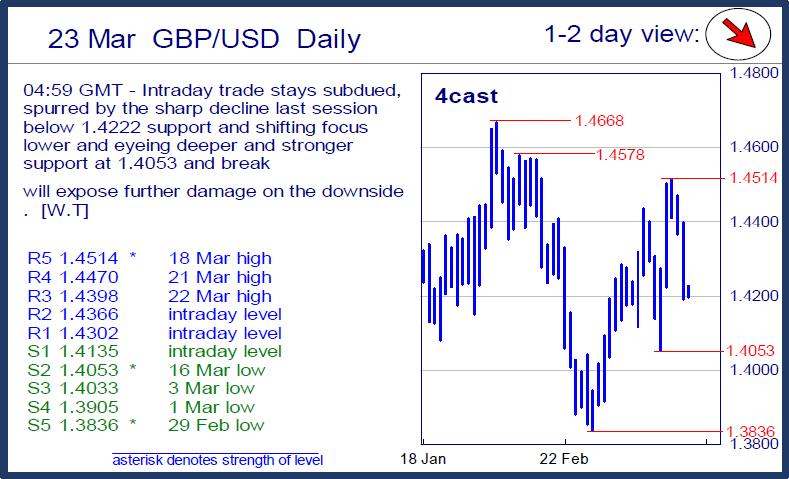

GBP/USD

Intraday trade stays subdued, spurred by the sharp decline last session below 1.4222 support and shifting focus lower and eyeing deeper and stronger support at 1.4053 and break will expose further damage on the downside . [W.T]

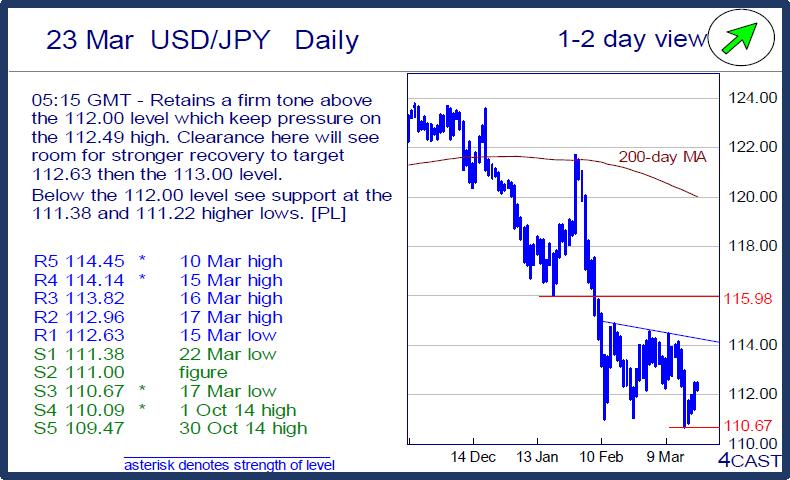

USD/JPY

Retains a firm tone above the 112.00 level which keep pressure on the 112.49 high. Clearance here will see room for stronger recovery to target 112.63 then the 113.00 level. Below the 112.00 level see support at the 111.38 and 111.22 higher lows. [PL]

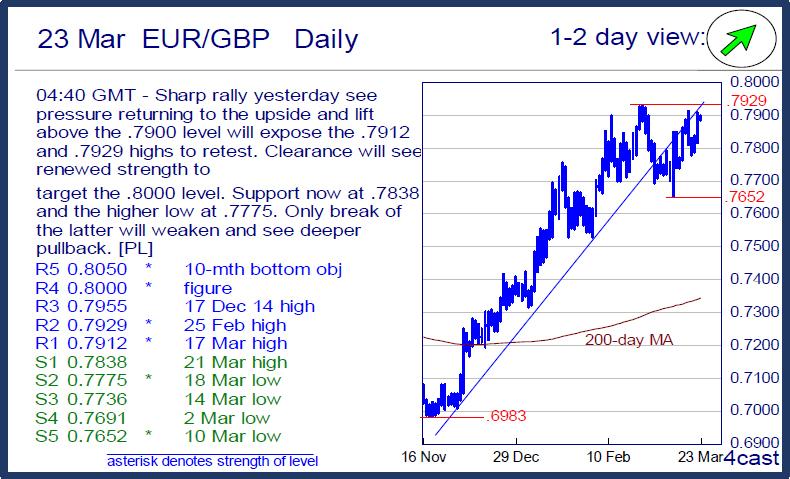

EUR/GBP

Sharp rally yesterday see pressure returning to the upside and lift above the .7900 level will expose the .7912 and .7929 highs to retest. Clearance will see renewed strength to target the .8000 level. Support now at .7838 and the higher low at .7775. Only break of the latter will weaken and see deeper pullback. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.