EUR/USD

Edged back from the 1.1242 high but upside stays in focus following rebound from the 1.1058 support yesterday. Break of the 1.1218 high see bulls back in focus and further strength will see trendline from the Aug high coming into play at 1.1310. Beyond this is the 1.1376 high. Support now at 1.1190 and 1.1125. [PL]

EUR/CHF

Firmer in range from the 1.0940/35 support though the lack of momentum keep range extension in play. Upside seen limited with resistance at 1.0992 then the 1.1023 high. Would take break of 1.0935 to expose the 1.0893 low of last week to retest and see scope for deeper pullback. [PL]

USD/CHF

Rejection from the .9914 high yesterday see resumption of the drop from the 1.0093 high of last week to reach .9750 low. Risk seen for further weakness to the .9700 level then .9661 low. The 200-day MA at .9799 now first resistance ahead of the .9914 high. [PL]

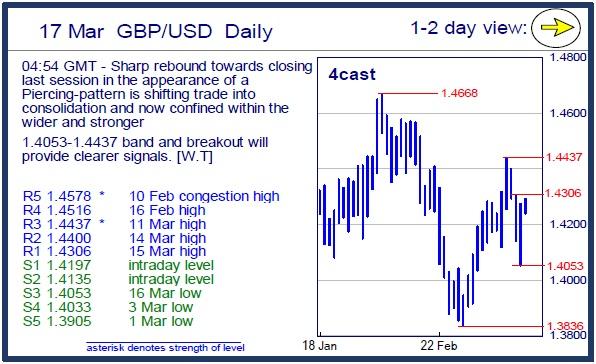

GBP/USD

Sharp rebound towards closing last session in the appearance of a Piercing-pattern is shifting trade into consolidation and now confined within the wider and stronger 1.4053-1.4437 band and breakout will provide clearer signals. [W.T]

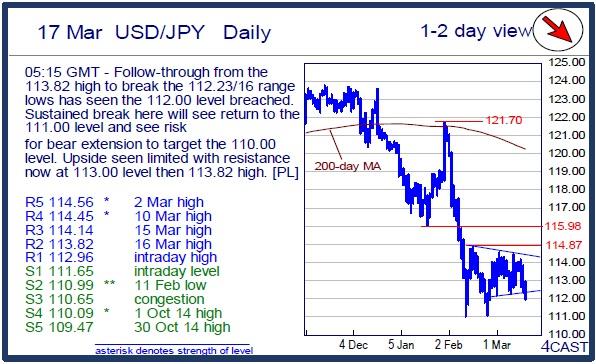

USD/JPY

Follow-through from the 113.82 high to break the 112.23/16 range lows has seen the 112.00 level breached. Sustained break here will see return to the 111.00 level and see risk for bear extension to target the 110.00 level. Upside seen limited with resistance now at 113.00 level then 113.82 high. [PL]

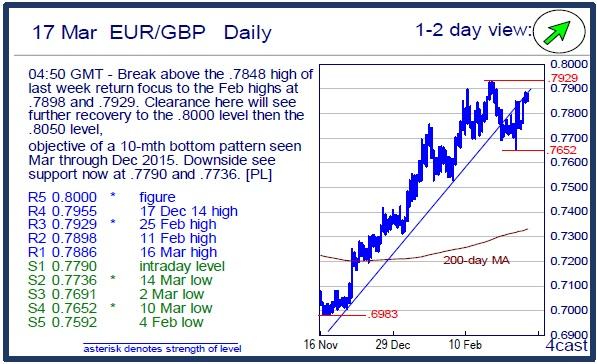

EUR/GBP

Break above the .7848 high of last week return focus to the Feb highs at .7898 and .7929. Clearance here will see further recovery to the .8000 level then the .8050 level, objective of a 10-mth bottom pattern seen Mar through Dec 2015. Downside see support now at .7790 and .7736. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.