EUR/USD Daily

Edged off the 1.0859 low but the downside still vulnerable towards nearby support at 1.0840 then the 1.0800 level. Break of the latter will shift focus to the 1.0778 and 1.0711 lows. Resistance well defined at 1.0957 and the 1.1000 level. Regaining the latter needed to ease downside pressure and see stronger bounce to 1.1047/68 resistance.

EUR/CHF Daily

Sharp drop yesterday see the pair down to fresh low at 1.0810. Subsequent sounce see resistance now at the 1.0885 and 1.0900 level. While the latter caps, the downside seen vulnerable. Break of the 1.0810 low will see return to the 1.0778 and 1.0756, Dec lows. [PL]

USD/CHF Daily

Failed to sustain break above parity level and rejection from 1.0038 high see a long upper wick weighing. Setback see support now at .9949 and .9905 ahead of the .9871/53 lows. Above the latter keep overall focus on the upside and higher low sought to further pressure the parity level then 1.0038 high. [PL]

GBP/USD Daily

Intraday trade sustaining the bounce from last session's low of 1.3836 and with the downmove from 1.4668 high still dominating, strategy still favour selling towards the 1.4043/80 resistances. Below 1.3836 support will trigger extension to 1.3800 then 1.3700. [W.T]

USD/JPY Daily

Further setback checked at 112.16 low and keep the 112.00 level out of reach for now. However, the downside still vulnerable and break will see return to the 111.65 support then the 111.00 level. Upside see resistance now at 113.25 then the 114.00 level. [PL]

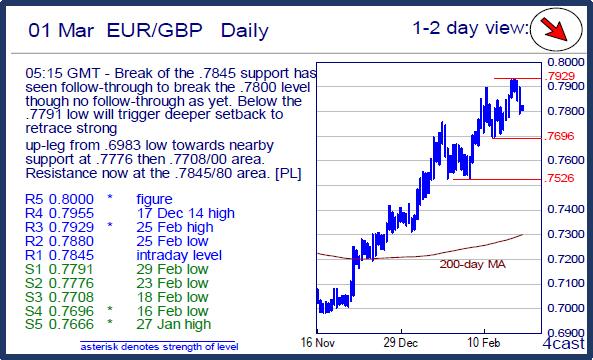

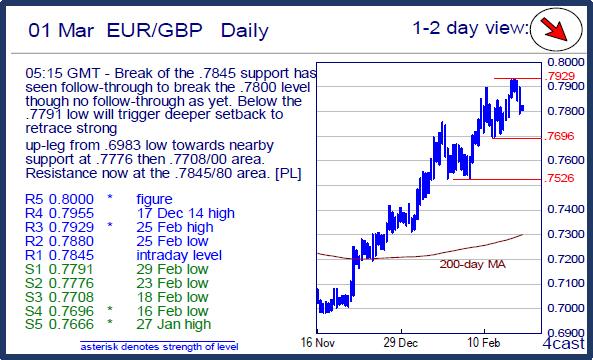

EUR/GBP Daily

Break of the .7845 support has seen follow-through to break the .7800 level though no follow-through as yet. Below the .7791 low will trigger deeper setback to retrace strong up-leg from .6983 low towards nearby support at .7776 then .7708/00 area. Resistance now at the .7845/80 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.