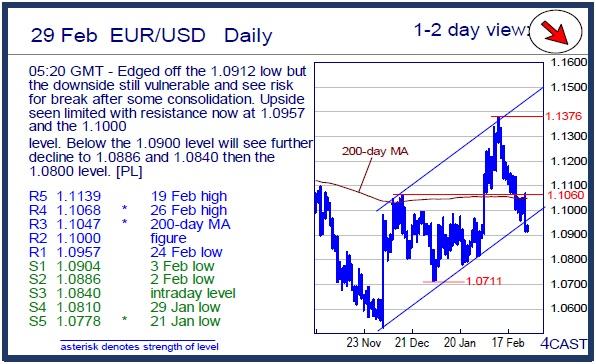

EUR/USD Daily

Edged off the 1.0912 low but the downside still vulnerable and see risk for break after some consolidation. Upside seen limited with resistance now at 1.0957 and the 1.1000 level. Below the 1.0900 level will see further decline to 1.0886 and 1.0840 then the 1.0800 level. [PL]

EUR/CHF Daily

Rejection from the 1.0950 resistance and break of the 1.0900 level see pressure returning to the downside. Below the 1.0865 support will see resumption of the drop from the 1.1200, Feb high. Lower will see scope to 1.0827 then the 1.0800 level. Only above the 1.0950 resistance will fade downside pressure. [PL]

USD/CHF Daily

No follow-through on the break below the .9900 level and rebound keep ranging action in play above the .9853 support. Rally to clear the parity level will resume the up-leg from the .9661 low. Support starts at .9905 then the .9871 and .9853 lows, seen protecting the downside. [PL]

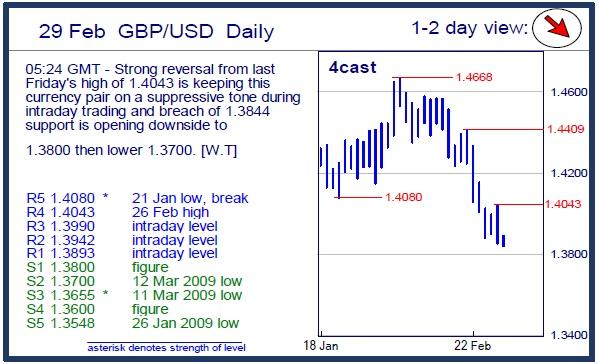

GBP/USD Daily

Strong reversal from last Friday's high of 1.4043 is keeping this currency pair on a suppressive tone during intraday trading and breach of 1.3844 support is opening downside to 1.3800 then lower 1.3700. [W.T]

USD/JPY Daily

Recovery checked at the 114.00 level following strong recovery from the 111.04 low. Lift over the 114.00 level will clear the way for retest of 114.51 then strong resistance at 114.87 high. Dips see support now at the 113.40/22 area then the 112.56 low. [PL]

EUR/GBP Daily

Setback from the .7929 high signals a small top pattern though the .7845 support keeping pullback in check. See break needed to swing focus lower to the .7776 and .7708 support. Above .7929 will see further strength to the .8000 level then .8050, the 10-mth base measuring objective. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.