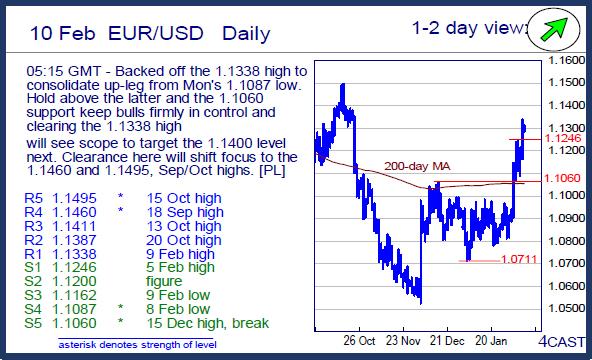

EUR/USD Daily

Backed off the 1.1338 high to consolidate up-leg from Mon's 1.1087 low. Hold above the latter and the 1.1060 support keep bulls firmly in control and clearing the 1.1338 high will see scope to target the 1.1400 level next. Clearance here will shift focus to the 1.1460 and 1.1495, Sep/Oct highs. [PL]

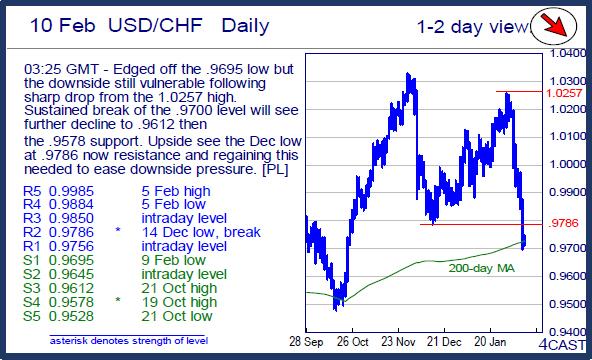

USD/CHF Daily

Edged off the .9695 low but the downside still vulnerable following sharp drop from the 1.0257 high. Sustained break of the .9700 level will see further decline to .9612 then the .9578 support. Upside see the Dec low at .9786 now resistance and regaining this needed to ease downside pressure. [PL]

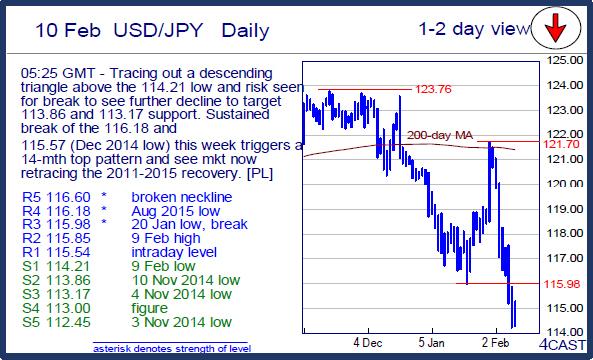

USD/JPY Daily

Tracing out a descending triangle above the 114.21 low and risk seen for break to see further decline to target 113.86 and 113.17 support. Sustained break of the 116.18 and 115.57 (Dec 2014 low) this week triggers a 14-mth top pattern and see mkt now retracing the 2011-2015 recovery. [PL]

EUR/CHF Daily

Edged off the 1.0958 low to consolidate the sharp drop from the 1.1200 high of last week. Lower will see deeper corrective pullback to the 1.0900 level. The 1.1019/34 lows now resistance while lift above 1.1100 level is needed to fade the downside pressure and clear the way back to the 1.1200 level. [PL

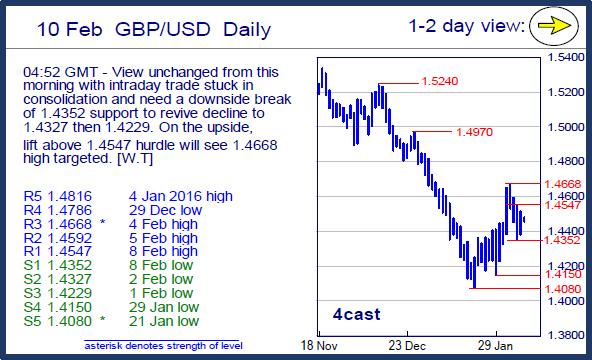

GBP/USD Daily

View unchanged from this morning with intraday trade stuck in consolidation and need a downside break of 1.4352 support to revive decline to 1.4327 then 1.4229. On the upside, lift above 1.4547 hurdle will see 1.4668 high targeted. [W.T]

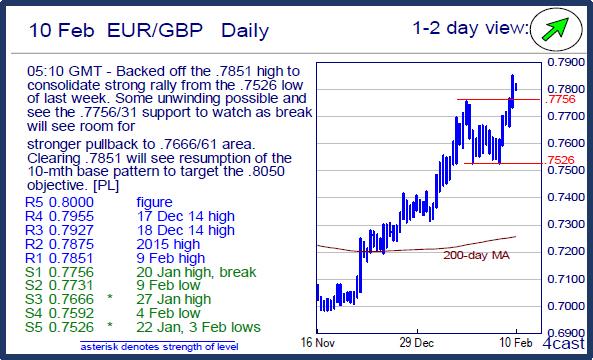

EUR/GBP Daily

Backed off the .7851 high to consolidate strong rally from the .7526 low of last week. Some unwinding possible and see the .7756/31 support to watch as break will see room for stronger pullback to .7666/61 area. Clearing .7851 will see resumption of the 10-mth base pattern to target the .8050 objective. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.