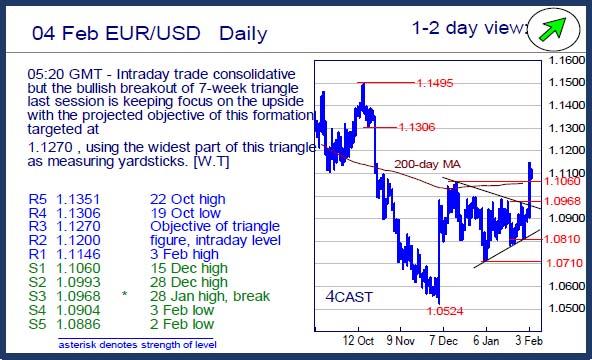

EUR/USD Daily

Intraday trade consolidative but the bullish breakout of 7-week triangle last session is keeping focus on the upside with the projected objective of this formation targeted at 1.1270 , using the widest part of this triangle as measuring yardsticks. [W.T]

USD/CHF Daily

Sharp decline below 1.0110 support last session , enforced by the negative cross-over seen on daily MACD are turning pressure towards downside and slip of 0.9988 low set prior session will trigger extension to 0.9959 then 0.9929. [W.T]

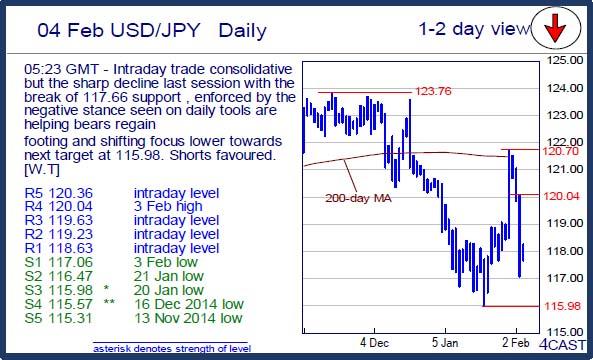

USD/JPY Daily

Intraday trade consolidative but the sharp decline last session with the break of 117.66 support , enforced by the negative stance seen on daily tools are helping bears regain footing and shifting focus lower towards next target at 115.98. Shorts favoured. [W.T]

EUR/CHF Daily

Lack of corrective pullback is helping bulls turn pressure towards the 1.1166 high and need a sustained lift above latter to resume uptrend to 1.1200 ahead of the 50% retracement mark at 1.0256. Only setback below 1.1100 support to trigger pullback. [W.T]

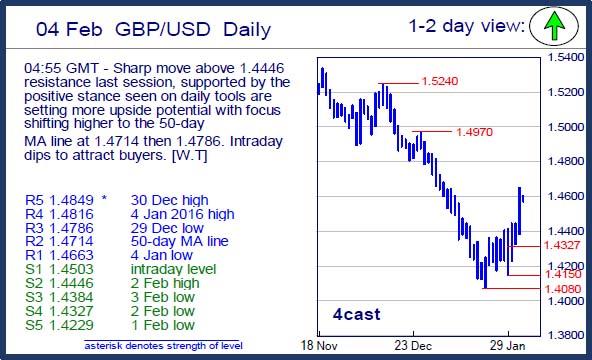

GBP/USD Daily

Sharp move above 1.4446 resistance last session, supported by the positive stance seen on daily tools are setting more upside potential with focus shifting higher to the 50-day MA line at 1.4714 then 1.4786. Intraday dips to attract buyers. [W.T]

EUR/GBP Daily

Bears failed to take out the .7526 support last session and rebound towards closing in the appearance of a Hammer is easing downside pressure as trade shifted into consolidation. Lift above .7623 hurdle will trigger further gain to .7666 then .7756. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.