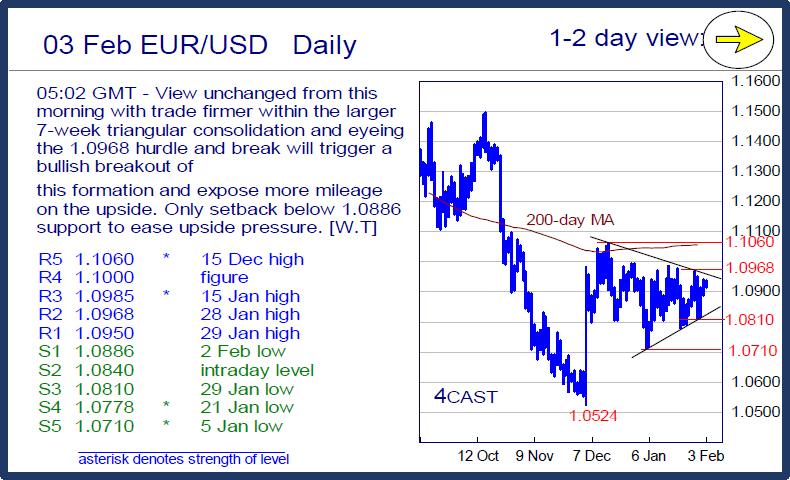

EUR/USD Daily

View unchanged from this morning with trade firmer within the larger 7-week triangular consolidation and eyeing the 1.0968 hurdle and break will trigger a bullish breakout of this formation and expose more mileage on the upside. Only setback below 1.0886 support to ease upside pressure. [W.T]

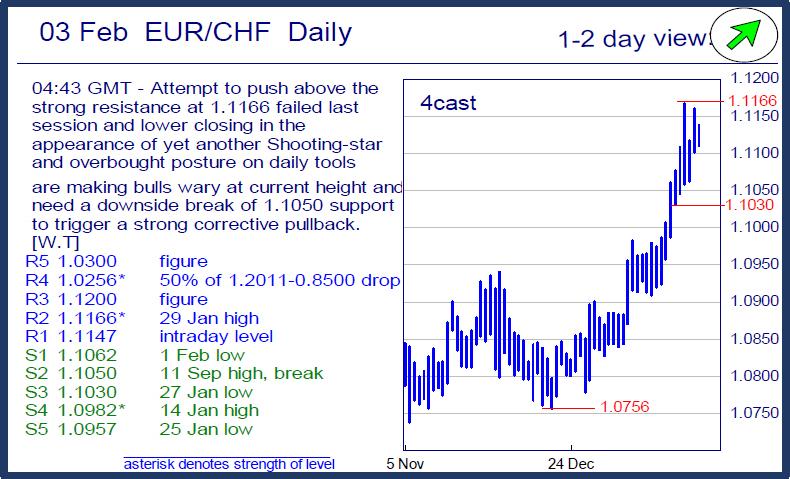

EUR/CHF Daily

Attempt to push above the strong resistance at 1.1166 failed last session and lower closing in the appearance of yet another Shooting-star and overbought posture on daily tools are making bulls wary at current height and need a downside break of 1.1050 support to trigger a strong corrective pullback. [W.T]

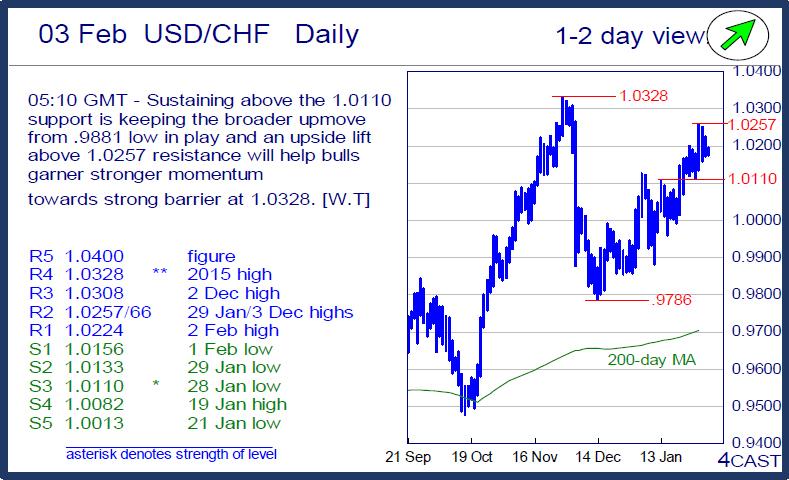

USD/CHF Daily

Sustaining above the 1.0110 support is keeping the broader upmove from .9881 low in play and an upside lift above 1.0257 resistance will help bulls garner stronger momentum towards strong barrier at 1.0328. [W.T]

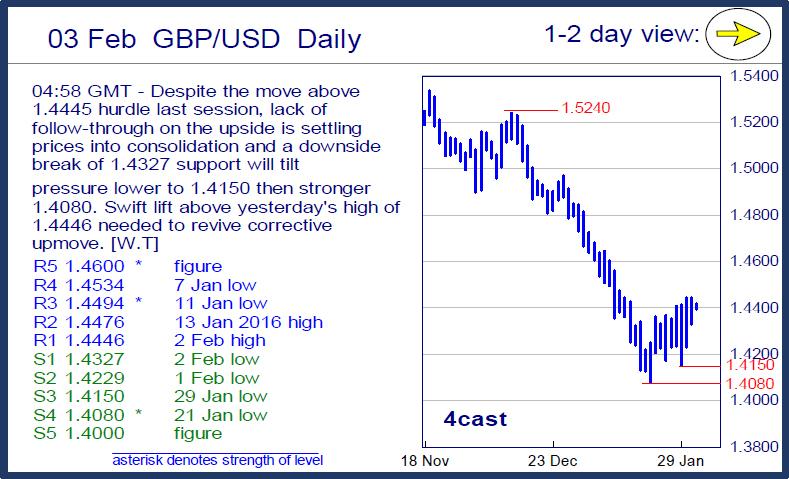

GBP/USD Daily

Despite the move above 1.4445 hurdle last session, lack of follow-through on the upside is settling prices into consolidation and a downside break of 1.4327 support will tilt pressure lower to 1.4150 then stronger 1.4080. Swift lift above yesterday's high of 1.4446 needed to revive corrective upmove. [W.T]

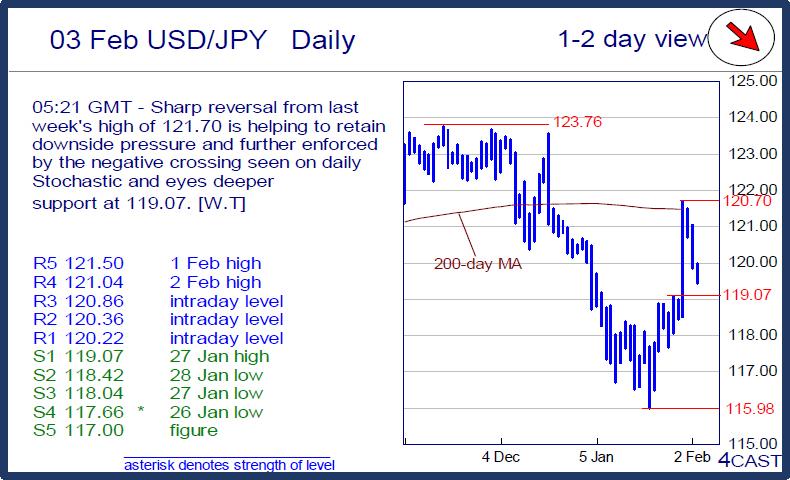

USD/JPY Daily

Sharp reversal from last week's high of 121.70 is helping to retain downside pressure and further enforced by the negative crossing seen on daily Stochastic and eyes deeper support at 119.07. [W.T]

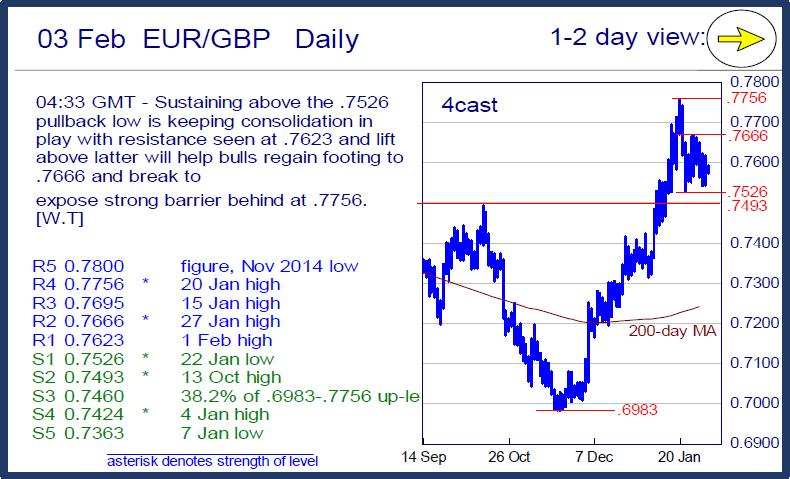

EUR/GBP Daily

Sustaining above the .7526 pullback low is keeping consolidation in play with resistance seen at .7623 and lift above latter will help bulls regain footing to .7666 and break to expose strong barrier behind at .7756. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.