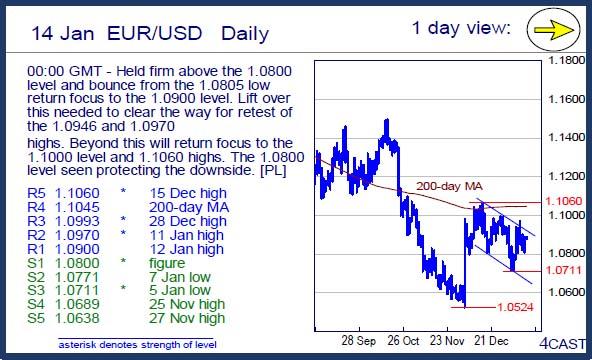

EUR/USD Daily

Held firm above the 1.0800 level and bounce from the 1.0805 low return focus to the 1.0900 level. Lift over this needed to clear the way for retest of the 1.0946 and 1.0970 highs. Beyond this will return focus to the 1.1000 level and 1.1060 highs. The 1.0800 level seen protecting the downside. [PL]

USD/CHF Daily

Strength checked at the 1.0107 high but upside stays in focus and see scope for retest of the 1.0125 high. Break here will see scope to target the 1.0200 level. Hold above the parity level keep focus on the upside and only break will see return to .9966 then the .9881 low. [P.L]

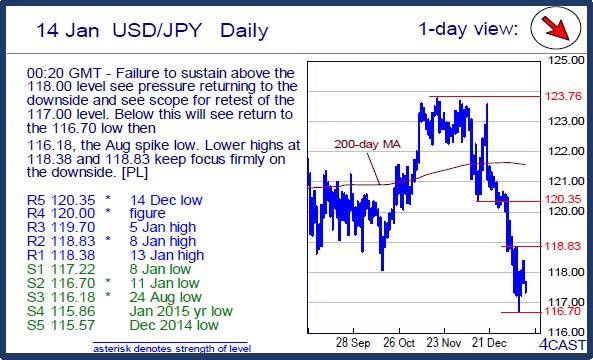

USD/JPY Daily

Failure to sustain above the 118.00 level see pressure returning to the downside and see scope for retest of the 117.00 level. Below this will see return to the 116.70 low then 116.18, the Aug spike low. Lower highs at 118.38 and 118.83 keep focus firmly on the downside. [PL]

EUR/CHF Daily

Break of the 1.0900 level has seen follow-through to take out the 1.0940, Dec high. Clearance here now shift focus to the 1.0983 high then the 1.1000 level. Beyond this is the 1.1050, Nov high. Support starts at the 1.0912 then the 1.0900 level, now seen protecting the downside. [PL]

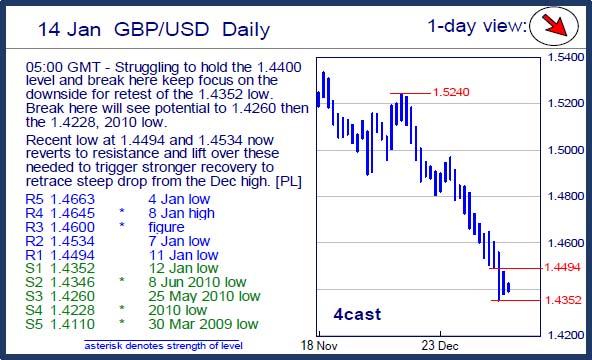

GBP/USD Daily

Struggling to hold the 1.4400 level and break here keep focus on the downside for retest of the 1.4352 low. Break here will see potential to 1.4260 then the 1.4228, 2010 low. Recent low at 1.4494 and 1.4534 now reverts to resistance and lift over these needed to trigger stronger recovery to retrace steep drop from the Dec high. [PL]

EUR/GBP Daily

Driving higher with and clear break of the .7500 level confirm the 10-mth base pattern and see stronger recovery to retrace the drop from the Feb 2013 high. Nearby see resistance at .7592, Feb 2015 high. Beyond this will target .7654, 38.2% retracement level. support now at .7500 level and .7443/24 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.