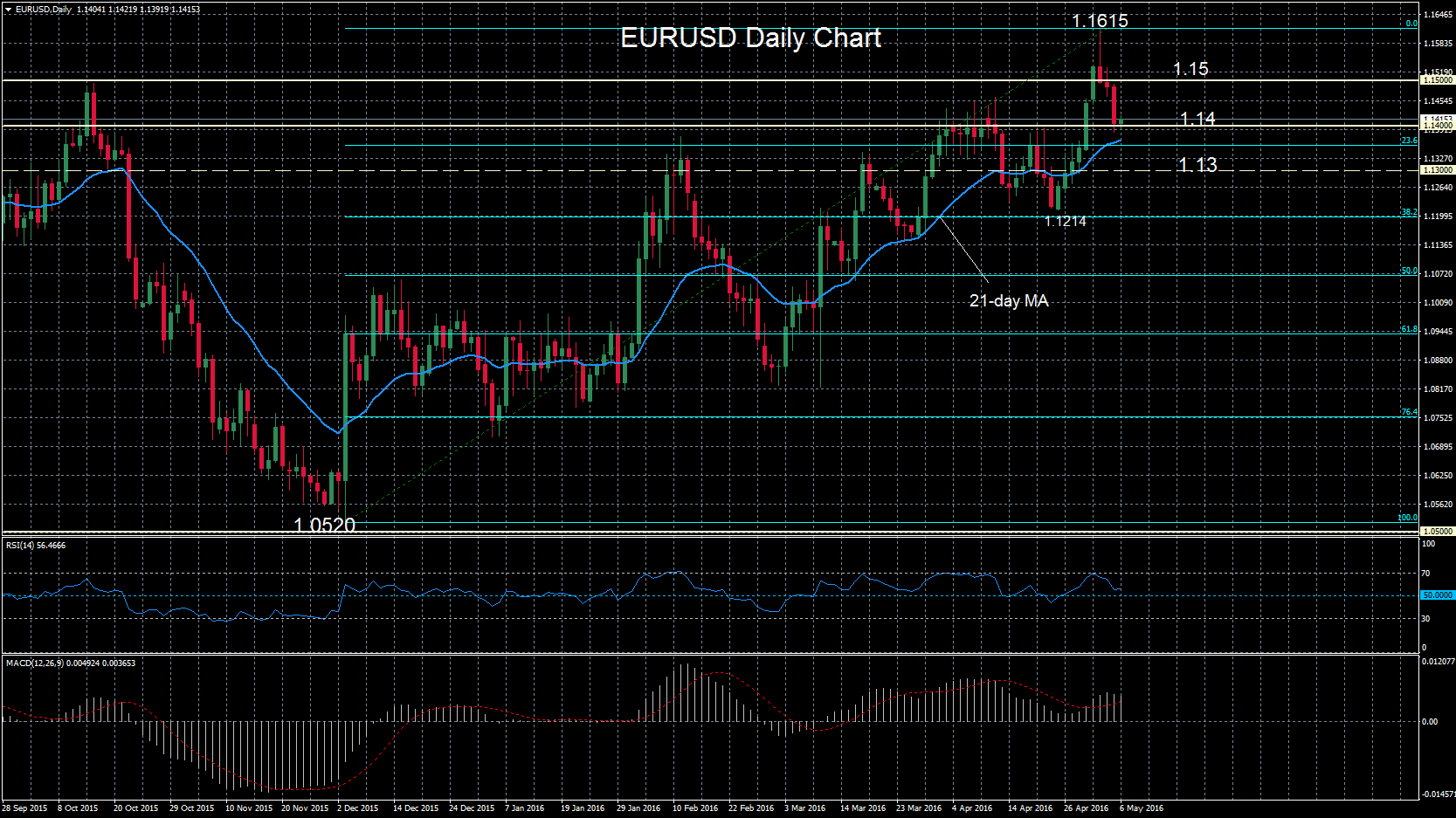

The overall technical picture for EURUSD remains bullish, as the pair staged a rally from 1.0520 to 1.1615 (December to May). The technical indicators – RSI and MACD are in bullish territory, supporting the bullish market structure.

But after hitting the high at 1.1615, prices reversed lower to find support around the 1.1400 area. Clearer signals are needed to see if this fall is a correction of the recent uptrend or if it is a reversal of the upside move. For now prices are above the 21-day moving average and the key 1.14 level. A drop below this and below the 23.6% Fibonacci could increase downside momentum to see a further decline to the key 1.13 level. The 23.6% Fibonacci comes in at 1.1355 and is the retracement of the upleg from 1.0520 1.1615.

To the upside, resistance at 1.1500 would need to be cleared to pave the way for a retest of the May 3 high of 1.1615 and above this we will see a continuation of the uptrend.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.